Profit before interest and tax = Rs. 1,50,000 + Debenture interest + Tax

= Rs. 1,50,000 + Rs. 40,000 + Rs. 50,000

= Rs.2,40,000

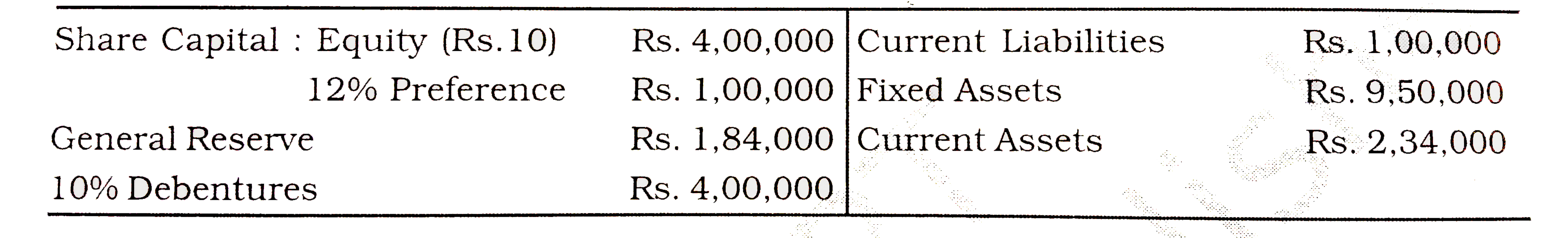

Capital Employed = Equity Share Capital + Preference Share Capital + Reserves + Debentures

= Rs. 4,00,000 + Rs. 1,00,000 + Rs. 1,84,000 + Rs. 4,00,000 = Rs. 10,84,000

Return on Investment = Profit before Interest and Tax/ Capital Employed `xx100`

= Rs. 2,40,000/Rs. `10,84,000xx100`

= `22.14%`

Shareholders’ Fund = Equity Share Capital + Preference Share Capital + General Reserve

= Rs. 4,00,000 + Rs. 1,00,000 + Rs. 1,84,000

= Rs. 6,84,000

Return on Shareholders’ Funds = Profit after tax/shareholders’ Funds `xx` 100

= Rs. 1,50,000/Rs. 6,84,000 `xx` 100

`= 21.93%`

EPS = Profit available for Equity Shareholders/ Number of Equity Shares

= Rs. 1,38,000/ 40,000 = Rs. 3.45

Preference Share Dividend = Rate of Dividend `xx` Prefence Share Capital

= `12%` of Rs. 1,00,000

= Rs. 12,000

Profit available to equity = Profit after Tax – Preference dividend on

Shareholders preference shares

where, Dividend on Prefrence = Rate of Dividend `xx` Preference Share Capital

shares = `12%` of Rs. 1,00,000

= Rs.12,000

= Rs. 1,50,000 – Rs. 12,000 = Rs. 1,38,000

P/E Ratio = Market price of a share/ Earnings per share

= 34/3.45

= 9.86 Times

Book Value per share = Equity Shareholders’ fund/No. of equity shares

where, Dividend on Prefrence = Rate of Dividend `xx` Preference Share Capital

shares = `12%` of Rs. 1,00,000

= Rs.12,000

= Rs. 1,50,000 – Rs. 12,000 = Rs. 1,38,000

P/E Ratio = Market price of a share/ Earnings per share

= 34/3.45

= 9.86 Times

Book Value per share = Equity Shareholders’ fund/No. of equity shares

`"where, Number of Equity Shares" =("Equity share capital")/("Face value per share")`

`=(Rs. 4,00,000)/(Rs.10)`

= 40,000 shares

Hence, Book value per share = Rs. 5,84,000/40,000 shares = Rs. 14.60

It may be noted that various ratios are related with each other. Sometimes, the combined information regarding two or more ratios is given and missing figures may need to be calculated. In such a situation, the formula of the ratio will help in working out the missing figures (See Illsuatration 23 and 24).