Recommended Questions

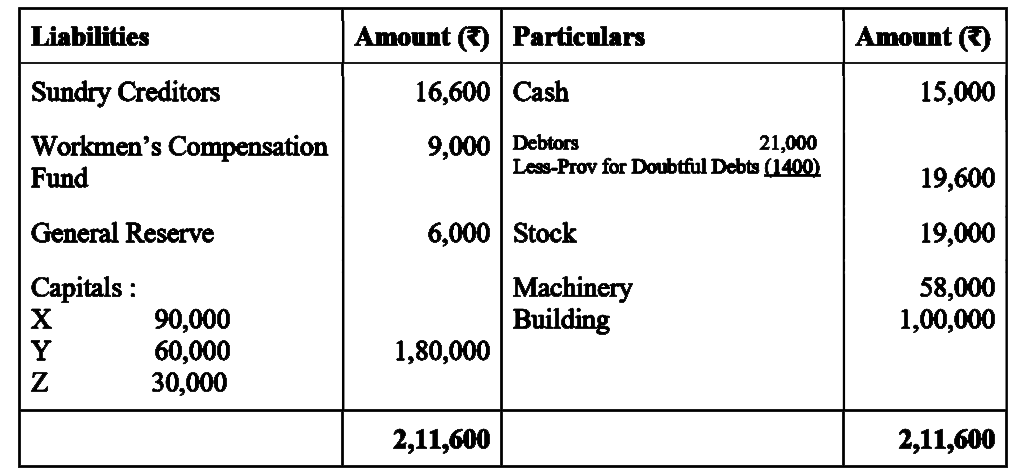

- X,Y and Z were in partnership sharing profits in proportion to their c...

Text Solution

|

- Aoverset(HNO(2))toC(2)H(5)OHoverset([O])toB में A तथा B को पहचान-कर उन...

Text Solution

|

- समस्याओ में रेखिक समीकरण युग्म बनाइए और उनके हल प्रतिस्थापन विधि द्...

Text Solution

|

- समस्याओ में रेखिक समीकरणों के युग्म बनाइए और उनके हल (यदि उनका ...

Text Solution

|

- k किस मान के लिए , निम्न रेखिक समीकरण के युग्म का कोई हल नहीं है ...

Text Solution

|

- हल कीजिए :x +y = 10 और x - y = 4

Text Solution

|

- a और b के मान ज्ञात कीजिए जिनके लिये निम्नलिखित समीकरण निकाय ...

Text Solution

|

- Cu//Zn सेल के विभव पर प्रभाव होगा ? यदि (a) SO(4)^(2-) को Cu^(2+) क...

Text Solution

|

- एक अभिक्रिया इस प्रकार से है - 2Ag^(+)+Cd to2Ag+Cd^(2+) अभिक्रिया ...

Text Solution

|