Text Solution

Verified by Experts

The correct Answer is:

Topper's Solved these Questions

FINANCIAL PLANNING

NAVNEET PUBLICATION - MAHARASHTRA BOARD|Exercise ASSIGNEMENT 4.4|4 VideosFINANCIAL PLANNING

NAVNEET PUBLICATION - MAHARASHTRA BOARD|Exercise ASSIGNMENT 4.2|4 VideosCOORDINATE GEOMETRY

NAVNEET PUBLICATION - MAHARASHTRA BOARD|Exercise Assignment 6.5|13 VideosGEOMETRIC CONSTRUCTIONS

NAVNEET PUBLICATION - MAHARASHTRA BOARD|Exercise CHALLENGING QUESTION|4 Videos

Similar Questions

Explore conceptually related problems

NAVNEET PUBLICATION - MAHARASHTRA BOARD-FINANCIAL PLANNING -ASSIGNMENT 4.3

- The rate of CGST on an articleis14% . Find the payable GST on an artic...

Text Solution

|

- The value of an airconditioner with GST is Rupees 54,400. If the rate ...

Text Solution

|

- Shekher bought a washing machine having printed price Rupees 25,000.2...

Text Solution

|

- Asim invested Rupees 13,750 to buy shares of FV Rupees 100 at a premiu...

Text Solution

|

- What amount is received by selling 150 shares of FV Rupees 100 at a p...

Text Solution

|

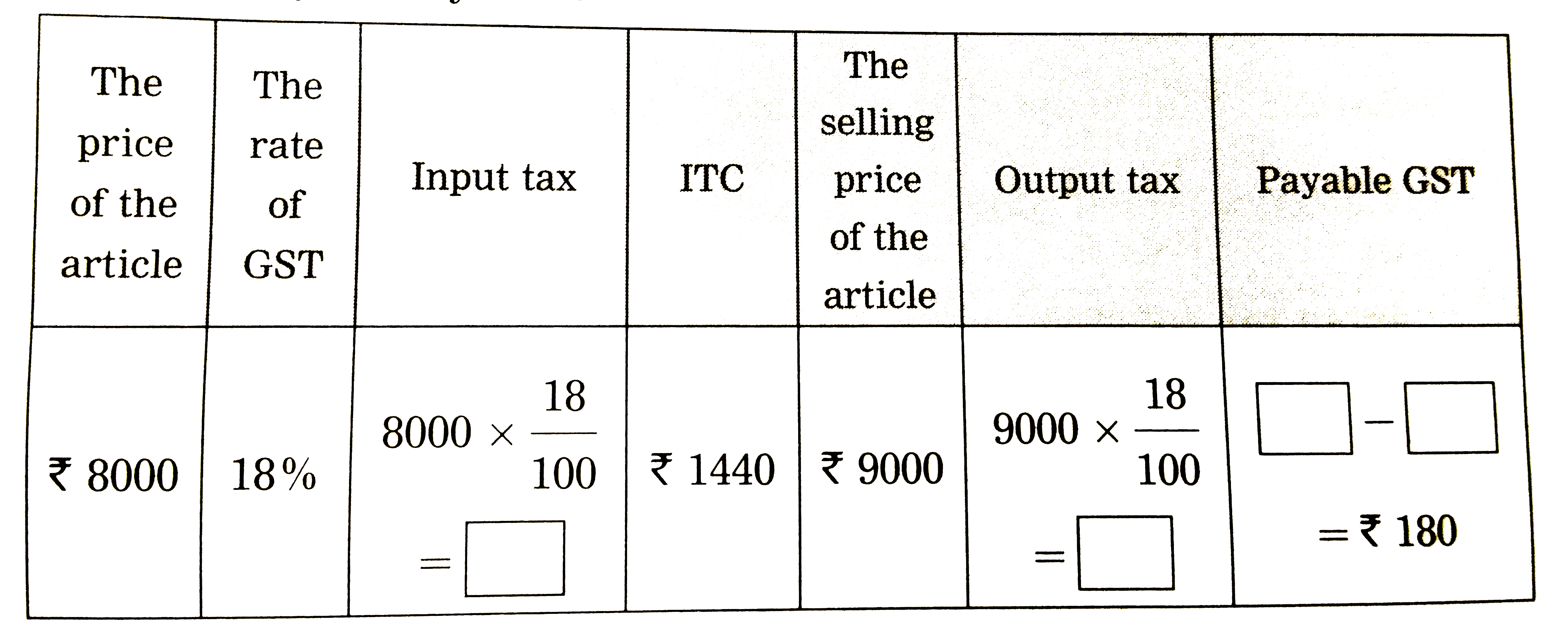

- A shopkeeper paid 18% GST on articles worth Rupees 8000. He soldthe sa...

Text Solution

|

- 20 shares are sold for the market value Rupees 800. Brokerage is paid ...

Text Solution

|

- Complete the following table by writing suitable numbers and words.

Text Solution

|