Text Solution

Verified by Experts

The correct Answer is:

Similar Questions

Explore conceptually related problems

Recommended Questions

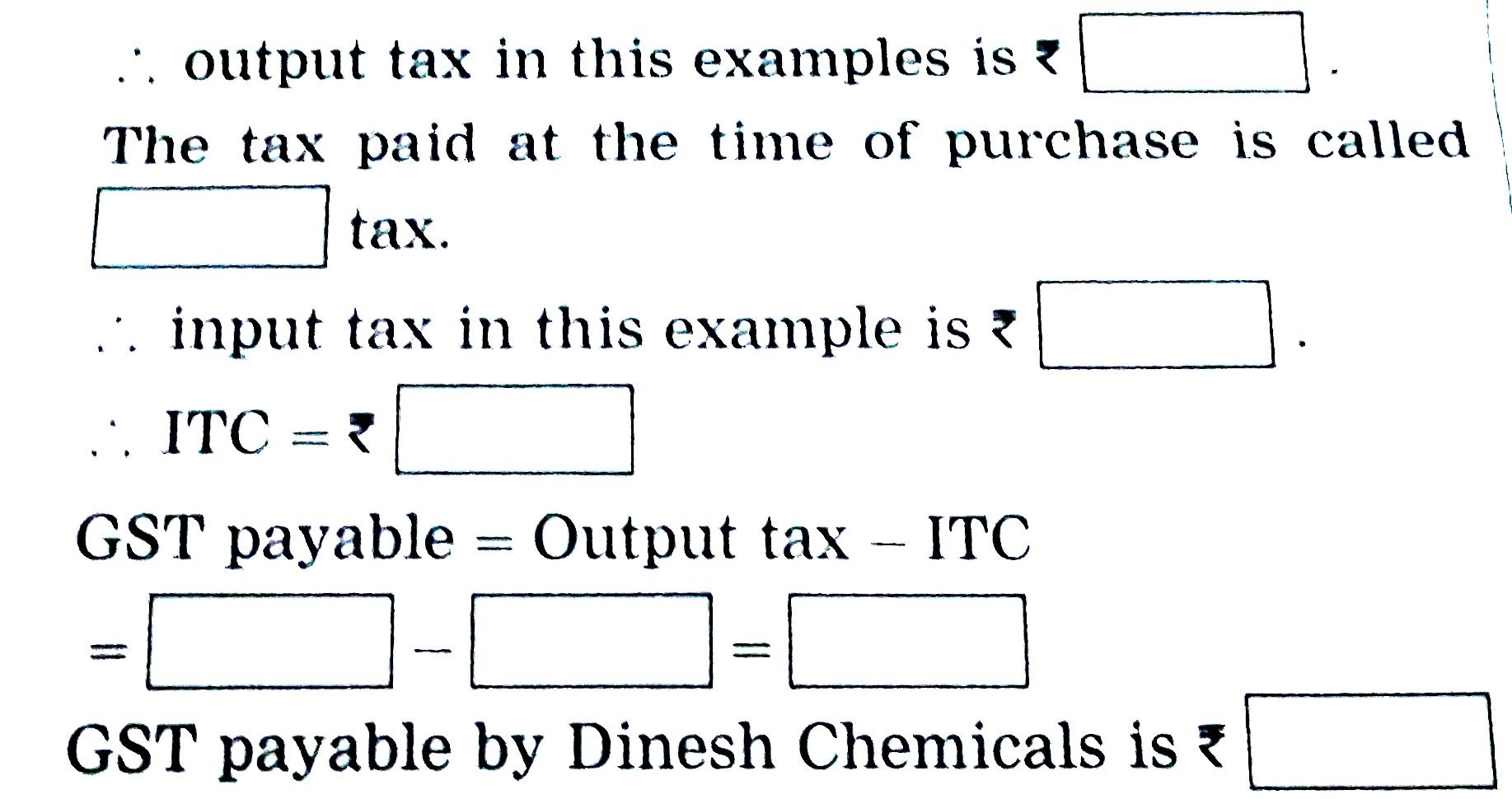

- Dinesh chemicals paid Rs 180500 GST for purchase of some chemicals and...

Text Solution

|

- Determine the point of symmetry of a regular hexagon. <img src="htt...

Text Solution

|

- Match the following Column A to Column B

Text Solution

|

- Match the following Column A to Column B

Text Solution

|

- Match the following Column A to Column B

Text Solution

|

- The inequation represented by the graph given below is : <img src="htt...

Text Solution

|

- The inequation that best describes the graph given below is <img src=...

Text Solution

|

- The inequation that best describes the following graph is <img src="h...

Text Solution

|

- In the chemical reactions, ltimg src="https://d10lpgp6xz60nq.cloudfr...

Text Solution

|