Topper's Solved these Questions

FINANCIAL PLANNING

CHETAN PUBLICATION|Exercise Problem Set -4B|10 VideosFINANCIAL PLANNING

CHETAN PUBLICATION|Exercise MCQs|21 VideosFINANCIAL PLANNING

CHETAN PUBLICATION|Exercise Practise Set -4.4|5 VideosCO-ORDINATE GEOMETRY

CHETAN PUBLICATION|Exercise ASSIGNMENT-5|11 VideosGEOMETRIC CONSTRUCTION

CHETAN PUBLICATION|Exercise ASSIGNMENT|13 Videos

Similar Questions

Explore conceptually related problems

CHETAN PUBLICATION-FINANCIAL PLANNING-Problem Set -4A

- A trader from Surat, Gujrat sold cotton clothes to a trader in Rajkot,...

Text Solution

|

- A ready -made garment shopkeeper gves 5% discount on the dress of Rs 1...

Text Solution

|

- A dealer supplied Walky-Talky set of Rs 84,000 (with GST) to police co...

Text Solution

|

- A dealer has given 10% discount on a showpiece of Rs 25,000. GST of 28...

Text Solution

|

- Smt. Malhotra purchased solar panels for the taxable value of Rs 85,00...

Text Solution

|

- A wholesaler purchased electric goods for the taxable amount of Rs 1,5...

Text Solution

|

- Anna Patil (Thane,Maharashtra) supplied vacuum cleaner to a shopkeeper...

Text Solution

|

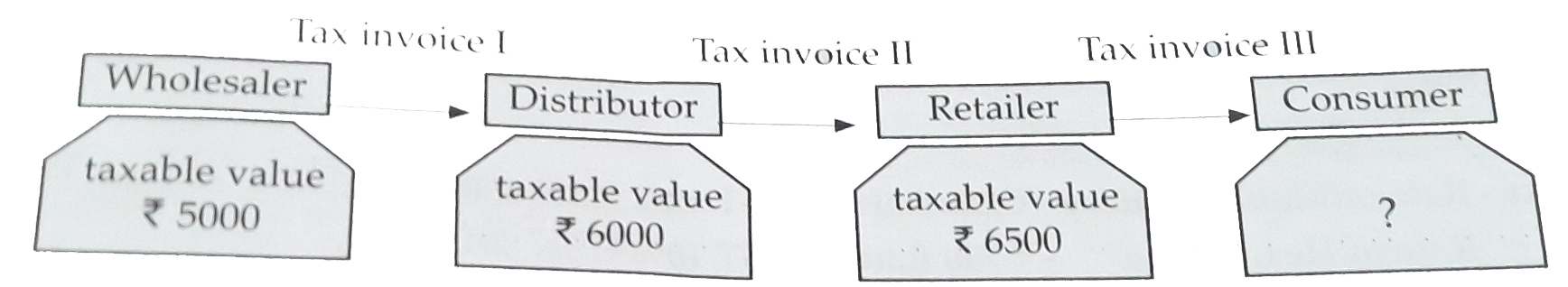

- For the given trading chain prepare the tax invoice I,II,III. GST at t...

Text Solution

|