Text Solution

Verified by Experts

The correct Answer is:

Topper's Solved these Questions

NATIONAL INCOME AND RELATED AGGREGATES

SANDEEP GARG|Exercise HOTS (Higher Order Thinking Skills Questions)|2 VideosNATIONAL INCOME AND RELATED AGGREGATES

SANDEEP GARG|Exercise True and False|3 VideosNATIONAL INCOME AND RELATED AGGREGATES

SANDEEP GARG|Exercise Unsolved Practicals|11 VideosMONEY

SANDEEP GARG|Exercise Example|1 VideosREVISION SECTION SCANNER

SANDEEP GARG|Exercise CBSE Examination Paper -(2018-19) CLASS-XII|12 Videos

Similar Questions

Explore conceptually related problems

SANDEEP GARG-NATIONAL INCOME AND RELATED AGGREGATES -Example

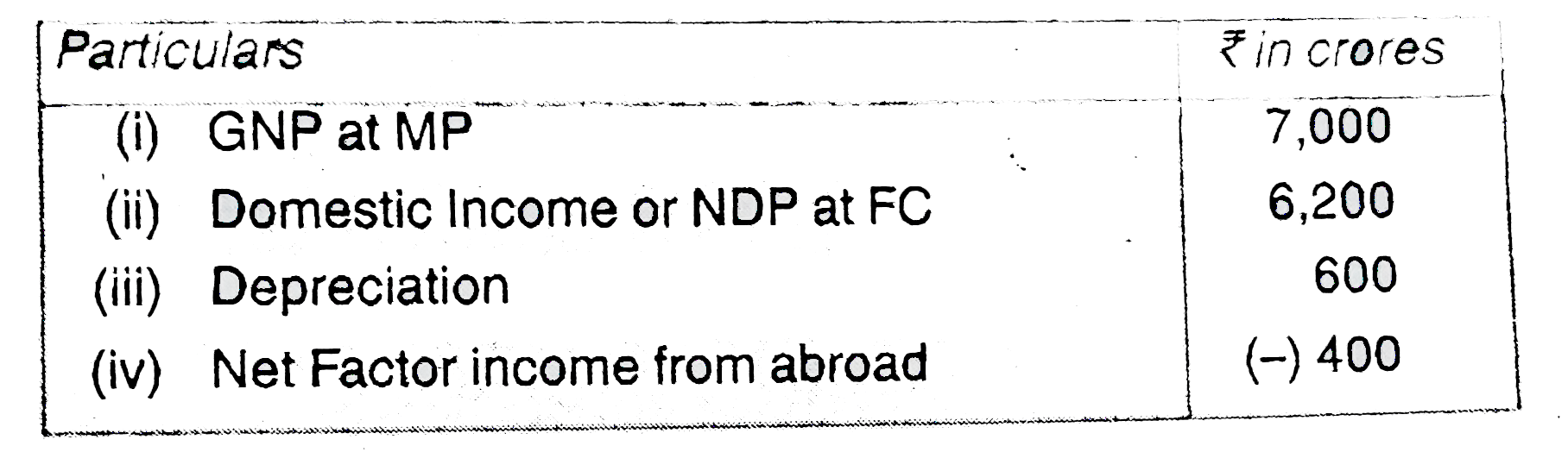

- Calculate Domestic Income or NDP at FC.

Text Solution

|

- Calculate National income or NNP at FC .

Text Solution

|

- Calculate GNP at FC.

Text Solution

|

- Calculate GNP at MP.

Text Solution

|

- Calculate Consumption of Fixed Capital .

Text Solution

|

- Calculate Net Indirect Tax.

Text Solution

|

- Calculate Subsidies.

Text Solution

|

- Calculate Factor Income to abroad .

Text Solution

|

- The net domestic product at market price of an economy is ₹ 4, 500 cr...

Text Solution

|

- Calculate (a) Depreciation , (b) Subsidies , (c) NDP at FC.

Text Solution

|