Text Solution

Verified by Experts

Topper's Solved these Questions

Similar Questions

Explore conceptually related problems

NCERT-CASH FLOW STATEMENT -Numerical Questions

- Anand Ltd., arrived at a net income of Rs 5,00,000 for the year ended ...

Text Solution

|

- From the information given below you are required to calculate the cas...

Text Solution

|

- For each of the following transactions, calculate the resulting cash f...

Text Solution

|

- The following is the Profit and Loss Account of Yamuna Limited: ...

Text Solution

|

- Compute cash from operations from the following figures: (i) Profit ...

Text Solution

|

- From the following particulars of Bharat Gas Limited, calculate Cash F...

Text Solution

|

- From the following Balance Sheet of Mohan Ltd., prepare cash flow Stat...

Text Solution

|

- From the following Balance Sheets of Tiger Super Steel Ltd., prepare C...

Text Solution

|

- From the following information, prepare cash flow statement: ...

Text Solution

|

- From the following Balance Sheet of Yogeta Ltd., prepare cash flow sta...

Text Solution

|

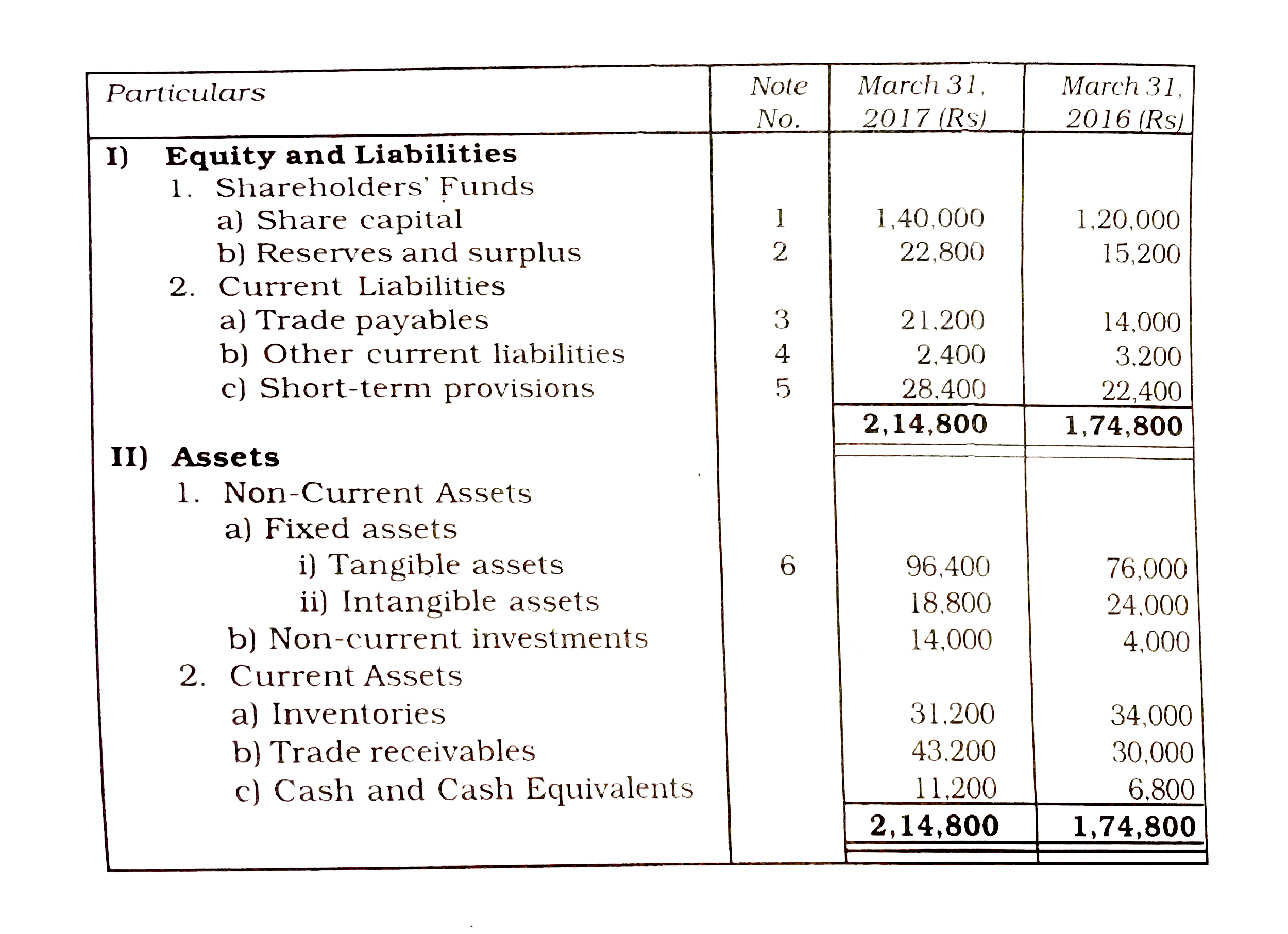

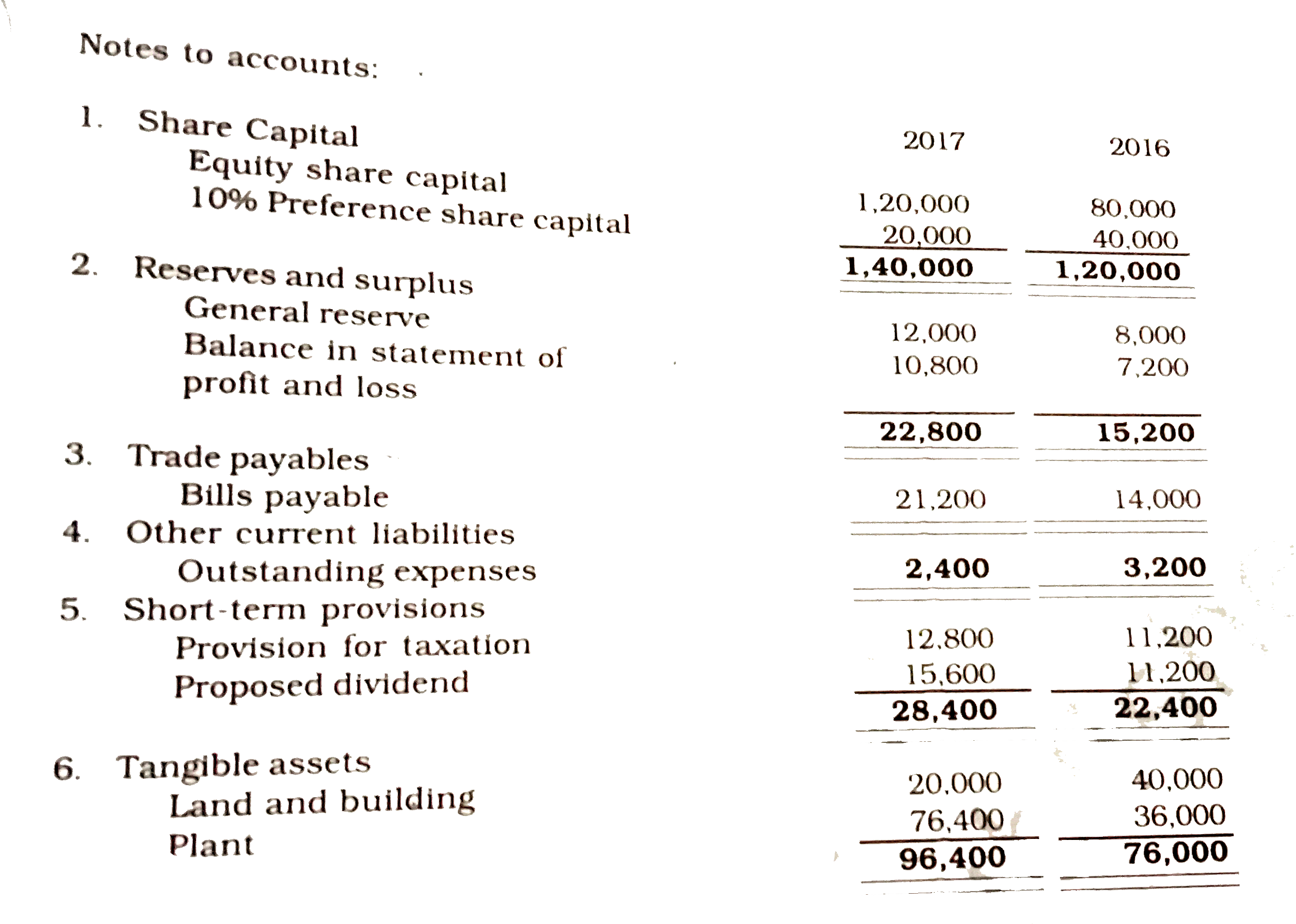

- Following is the Financial Statement of Garima Ltd., prepare cash flow...

Text Solution

|

- From the following Balance Sheet of Computer India Ltd., prepare cash ...

Text Solution

|