Text Solution

Verified by Experts

Topper's Solved these Questions

DEPRECIATION , PROVISIONS AND RESERVES

NCERT|Exercise TEST YOUR UNDERSTANDING -I|10 VideosDEPRECIATION , PROVISIONS AND RESERVES

NCERT|Exercise TEST YOUR UNDERSTANDING -II|3 VideosCASH FLOW STATEMENT

NCERT|Exercise Numerical Questions|12 VideosFINANCIAL STATEMENTS - I

NCERT|Exercise TEST YOUR UNDERSTANDING-II|4 Videos

NCERT-DEPRECIATION , PROVISIONS AND RESERVES -NUMERICAL PROBLEMS

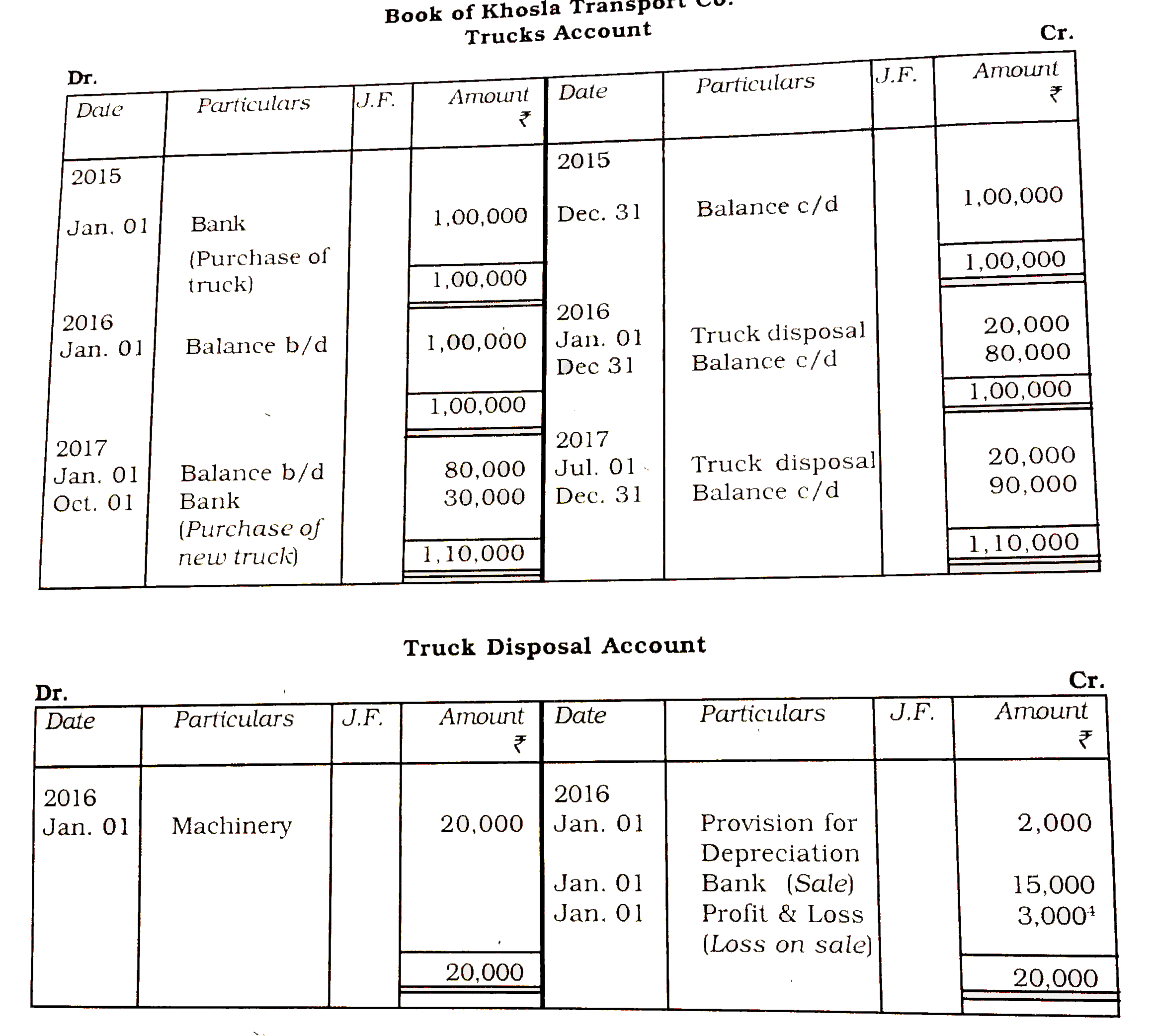

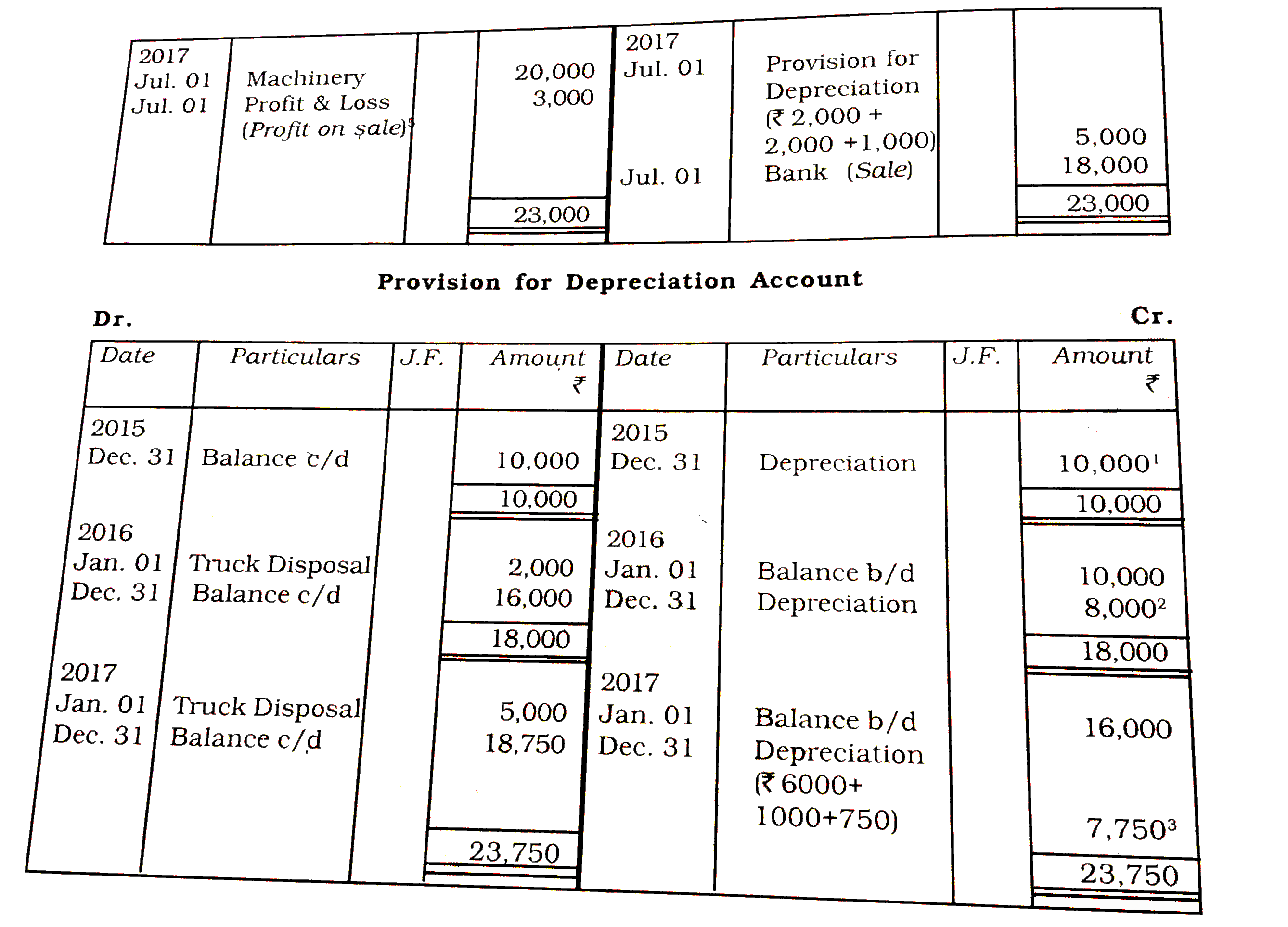

- On January 01, 2015, Khosla Transport Co. purchased five trucks for Rs...

Text Solution

|

- On April 01, 2010, Bajrang Marbles purchased a Machine for Rs. 1,80,...

Text Solution

|

- On July 01, 2010, Ashok Ltd. Purchased a Machine for Rs. 1,80,000 and ...

Text Solution

|

- Reliance Ltd. Purchased a second hand machine for Rs. 56,000 on Octobe...

Text Solution

|

- Berlia Ltd. Purchased a second hand machine for Rs. 56,000 on July 01,...

Text Solution

|

- Ganga Ltd. purchased a machinery on January 01, 2014 for Rs. 5,50,000...

Text Solution

|

- Azad Ltd. purchased furniture on October 01, 2014 for Rs. 4,50,000. On...

Text Solution

|

- M/s Lokesh Fabrics purchased a Textile Machine on April 01, 2011 for R...

Text Solution

|

- The following balances appear in the books of Crystal Ltd, on Jan 01, ...

Text Solution

|

- Excel Computers has a debit balance of Rs. 50,000 (original cost Rs. ...

Text Solution

|

- Carriage Transport Company purchased 5 trucks at the cost of Rs. 2,00...

Text Solution

|

- Saraswati Ltd. purchased a machinery costing Rs. 10,00,000 on January ...

Text Solution

|

- On July 01, 2011 Ashwani purchased a machine for Rs. 2,00,000 on cre...

Text Solution

|

- On October 01, 2010, a Truck was purchased for Rs. 8,00,000 by Laxmi ...

Text Solution

|

- Kapil Ltd. purchased a machinery on July 01, 2011 for Rs. 3,50,000. I...

Text Solution

|

- On January 01, 2011, Satkar Transport Ltd., purchased 3 buses for Rs. ...

Text Solution

|

- On October 01, 2011 Juneja Transport Company purchased 2 Trucks for Rs...

Text Solution

|

- A Noida based Construction Company owns 5 cranes and the value of this...

Text Solution

|

- Shri Krishan Manufacturing Company purchased 10 machines for Rs. 75,0...

Text Solution

|

- On January 01, 2014, a Limited Company purchased machinery for Rs. 20,...

Text Solution

|

- A Plant was purchased on 1st July, 2015 at a cost of Rs. 3,00,000 and...

Text Solution

|