Interest on capital will be as 18,960 (12% of Rs. 1,58,000) for Josh and Rs. 960 for Krish calculated as follows:

`60,000xx12/100+ Rs.16,000xx12/100xx6/12=Rs.7,200+Rs.960 `

`=Rs. 8_(,)160.`

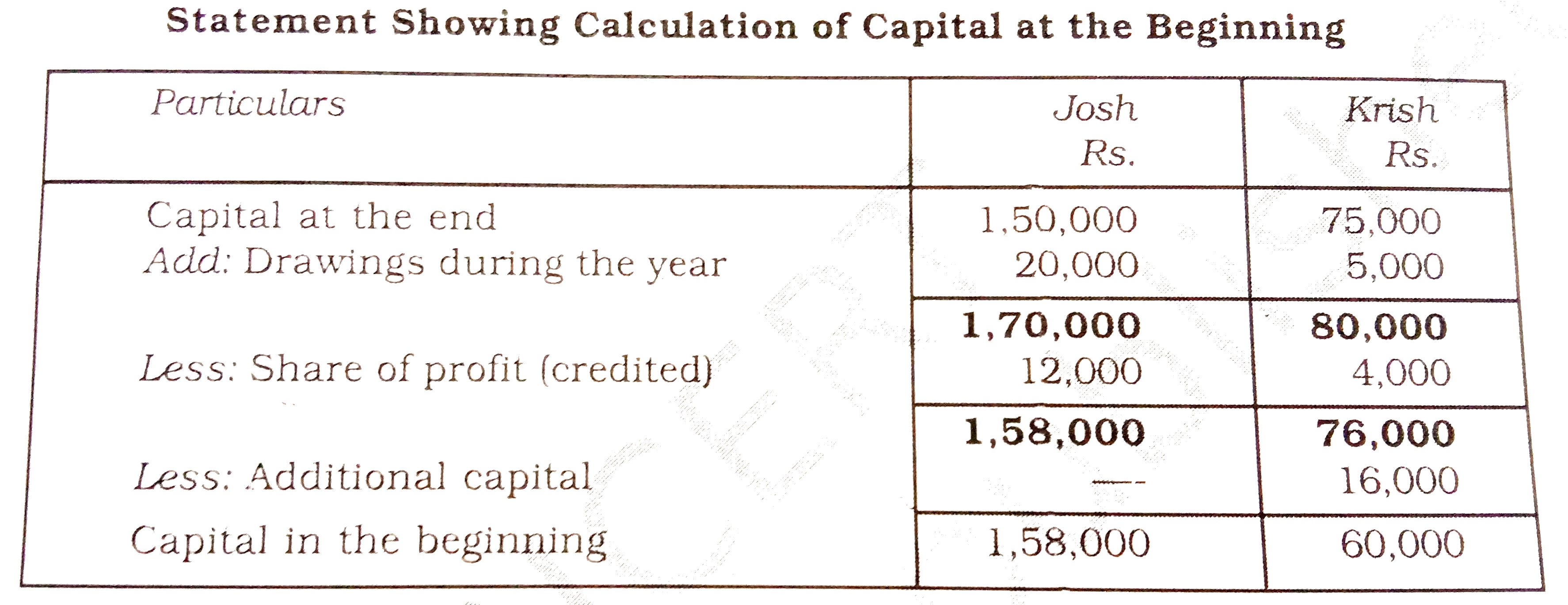

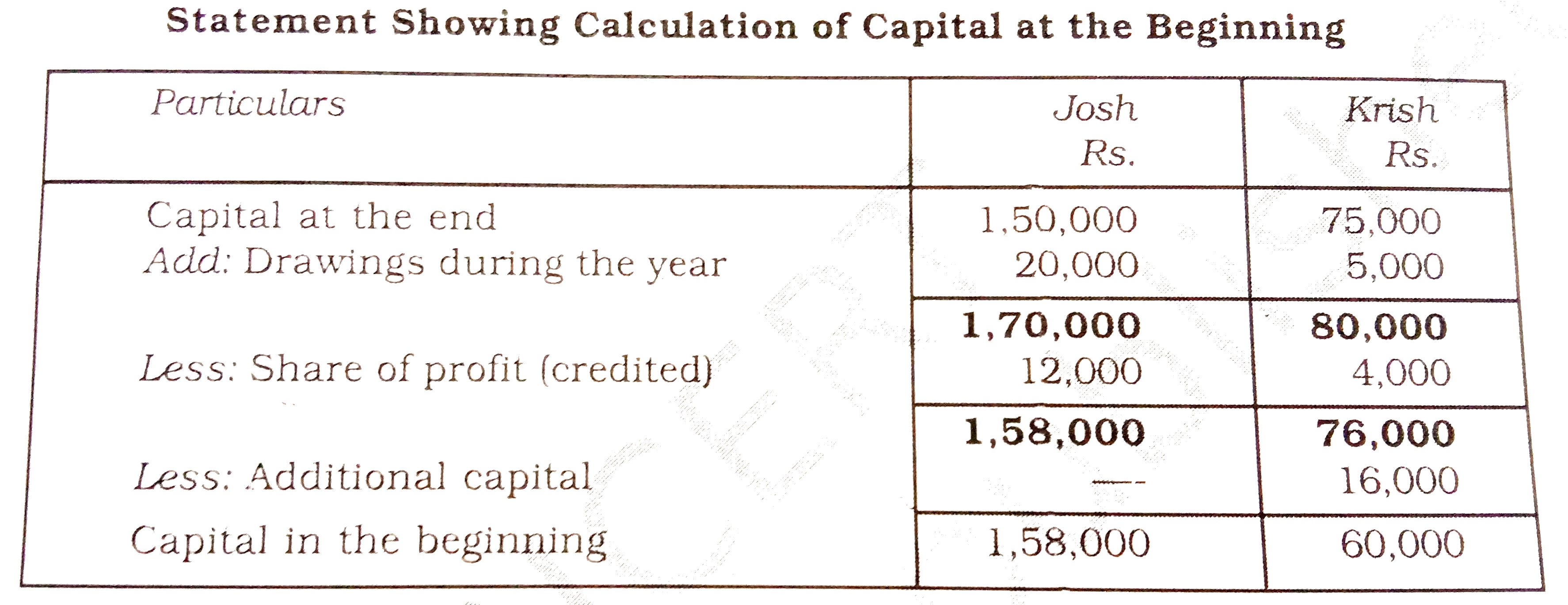

Sometimes opening capitals of partners may not be given. In such a situation before calculation of interest on capital the opening capitals will have to be worked out with the help of partners’ closing capitals by marking necessary adjustments for the additions and withdrawal of capital, drawings, share of profit or loss, if already shown in the capital accounts the partners.

As clarified earlier, the interest on capital is allowed only when the firm has earned profit during the accounting year. Hence, no interest will be allowed during the year the firm has incurred net loss and if in a year, the profit of the firm is less than the amount due to the partners as interest on capital, the payment of interest will be restricted to the amount of profits. In that case, the profit will be effectively distributed in the ratio of interest on capital of each partner.