Text Solution

Verified by Experts

Topper's Solved these Questions

Similar Questions

Explore conceptually related problems

NCERT-ISSUE AND REDEMPTION OF DEBENTURES-Illustration

- ABC Lemited issured Rs 10,000 12% debentures of Rs 100 each payable Rs...

Text Solution

|

- T.V Components Ltd., issued 10,000, 12% debentures of Rs each at a dis...

Text Solution

|

- The debentures were fully subscribed and all money was duly received R...

Text Solution

|

- A Limited issued 5000, 10% debentures of Rs 100 each at a premium of R...

Text Solution

|

- X Limited Issued 10,000 , 12% debentures of Rs 100 each payable Rs 40 ...

Text Solution

|

- Aashirward Company Limited purchased assets of the book value of Rs 2,...

Text Solution

|

- Rai company purchased assets of the book value of Rs 2,20,000 from ano...

Text Solution

|

- National Packaging company pruchased assets of the value of Rs 1,90,00...

Text Solution

|

- G.S Rai company pruchased assets of the book value of Rs 99,000 from a...

Text Solution

|

- Romi Ltd acquired assets of Rs 20 lakh and took over creidtors of Rs 2...

Text Solution

|

- Blue prints Ltd., purchased building wirth Rs 150,000 machinery worth ...

Text Solution

|

- A Limited took over the assets of Rs 300000 and liabilities lof Rs 100...

Text Solution

|

- Suvidha Ltd purchased machinery worth Rs 198000 from suppliers Ltd.The...

Text Solution

|

- A company took loan of Rs 1000000 from Punjab National Bank and issued...

Text Solution

|

- Give Journal entries for the following: 1. Issued of Rs 100,000 , 9%...

Text Solution

|

- You are required to pass the journal entries relating to the issue of ...

Text Solution

|

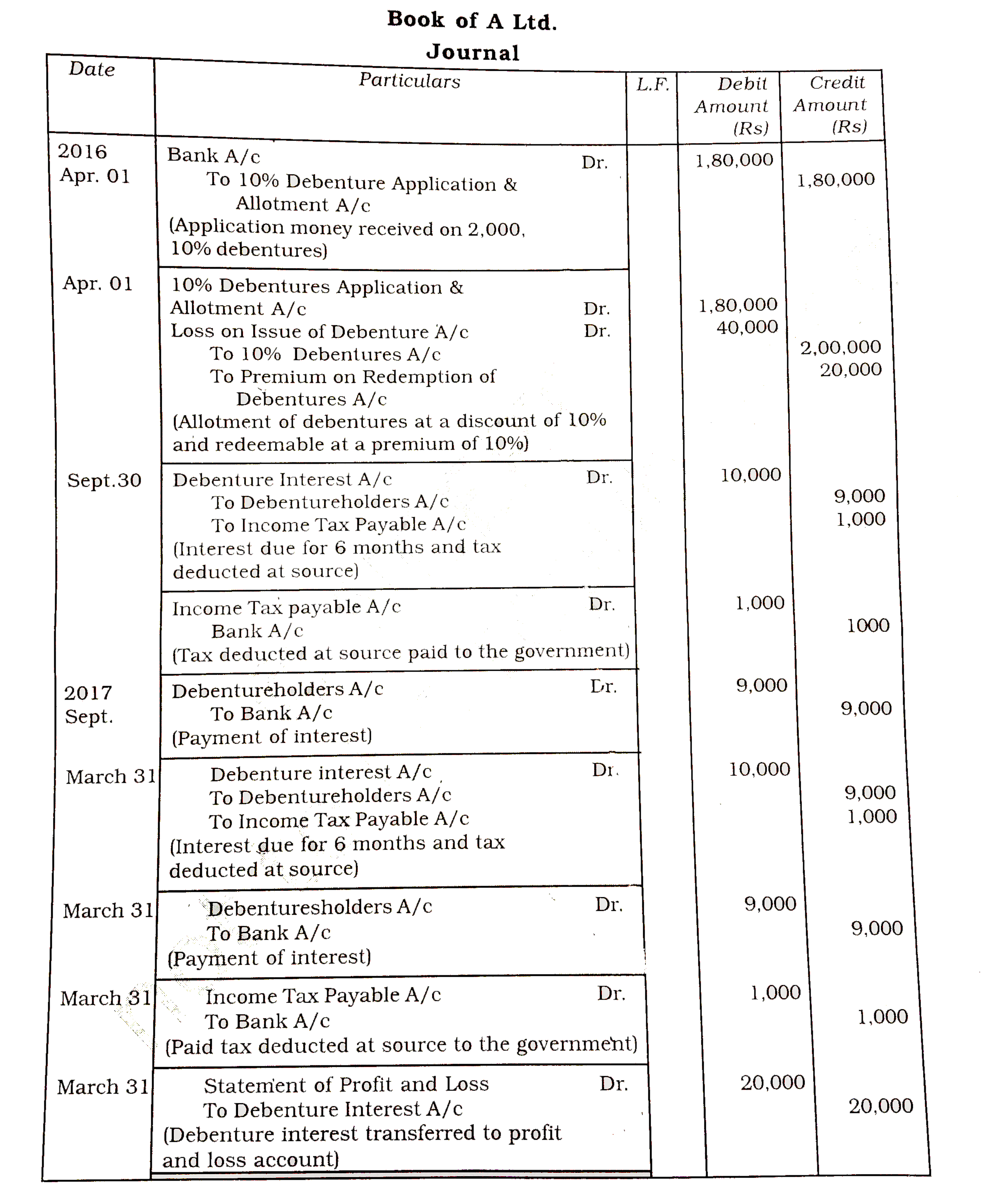

- A Ltd issued 2000 , 10% debentures of Rs 100 each on April 01,2016 at ...

Text Solution

|

- A Ltd. Company has issued Rs 100,000, 9% debentures at a discount of 6...

Text Solution

|