Text Solution

Verified by Experts

The correct Answer is:

Topper's Solved these Questions

Similar Questions

Explore conceptually related problems

SANDEEP GARG-MEASUREMENT OF NATIONAL INCOME-Miscellaneous Practicals

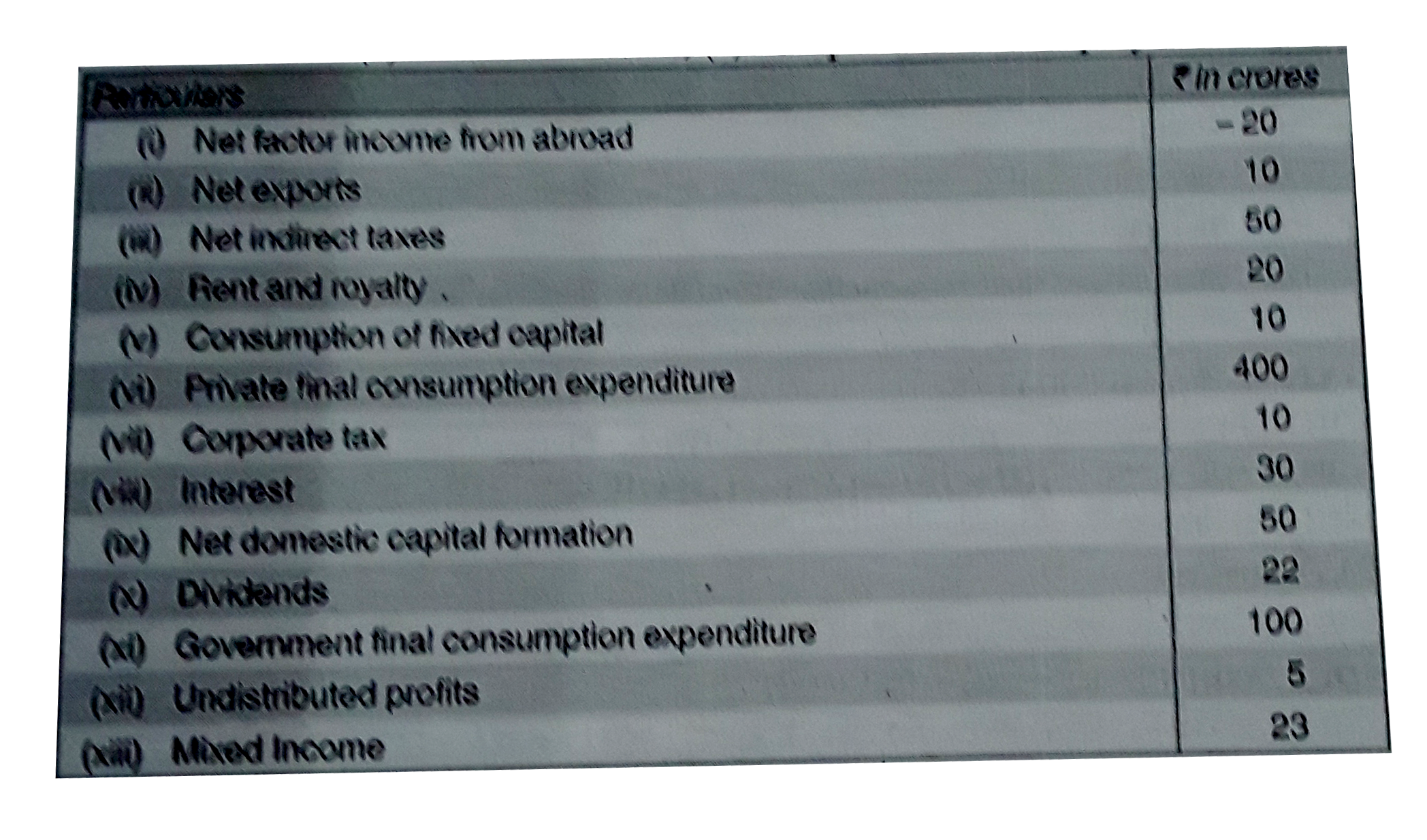

- Calculate : (a) Domestic Income, (b) Compensation of employees.

Text Solution

|

- From the following data relating to an economy, calculate (a) National...

Text Solution

|

- From the following information, calculate GNP(MP) by income and expend...

Text Solution

|

- Calculate Groos National Product at Market Price.

Text Solution

|

- Calculate Net Domestic Product at Factor Cost :

Text Solution

|

- Calculate Net Domestic Product at Market Price :

Text Solution

|

- Calculate Net National Product at Martket Price.

Text Solution

|

- From the following data, calculate net value added at factor cost.

Text Solution

|

- Calculate National Income.

Text Solution

|

- Calculate Net National Product at Factor Cost :

Text Solution

|

- Calculate gross value added at factor cost.

Text Solution

|

- From the following data, calculate Gross National Product at Market Pr...

Text Solution

|

- Calculate Net Domestic Product at Market Price.

Text Solution

|

- Calculate Groos National Product at Factor Cost.

Text Solution

|

- Calculate Net Domestic Product at Facotr Cost.

Text Solution

|

- Calculate National Income :

Text Solution

|

- Calculate Net Domestic Product at Factor Cost :

Text Solution

|