Text Solution

Verified by Experts

Topper's Solved these Questions

Similar Questions

Explore conceptually related problems

NCERT-FINANCIAL STATEMENTS - II-TEST YOUR UNDERSTANDING

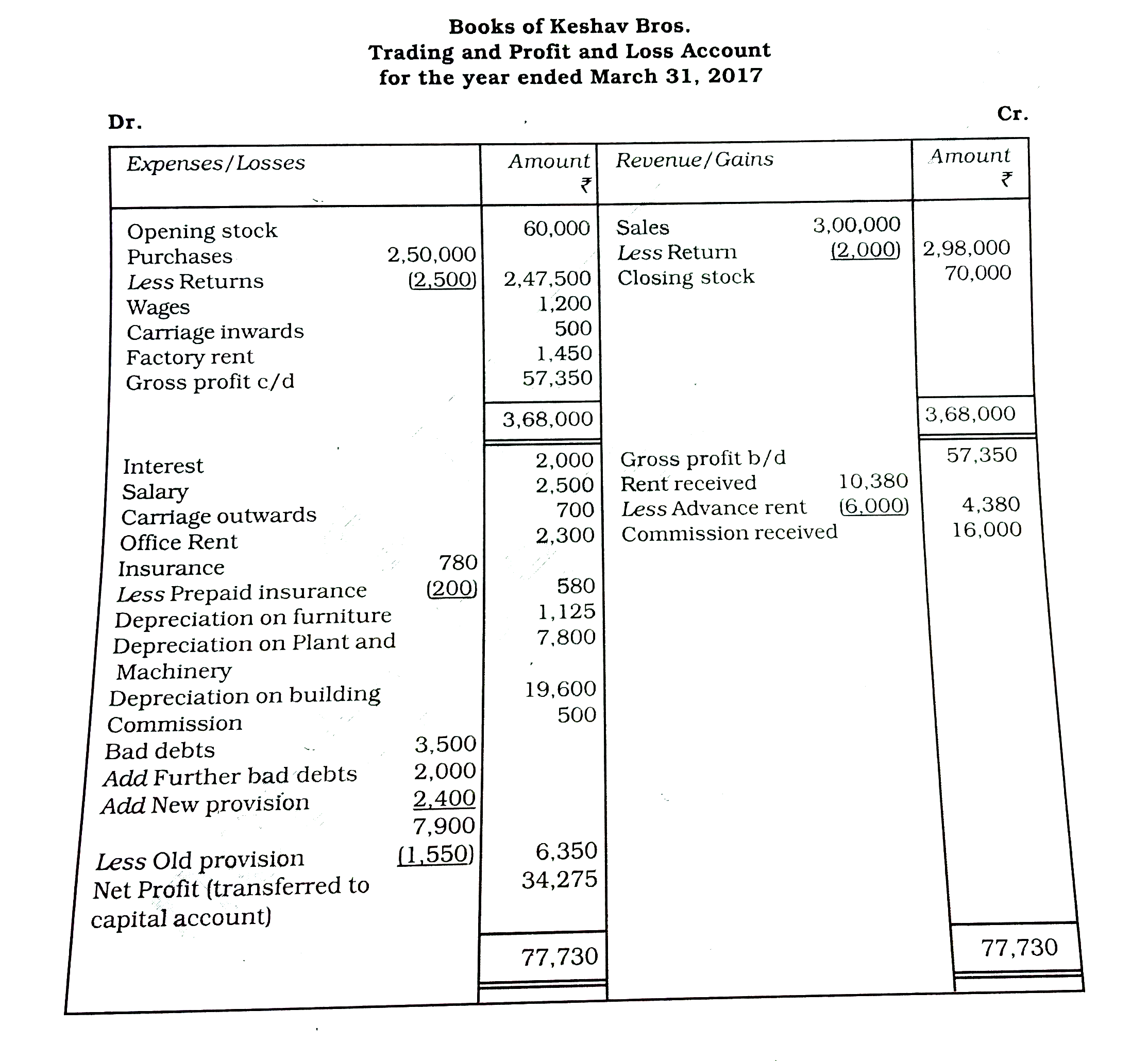

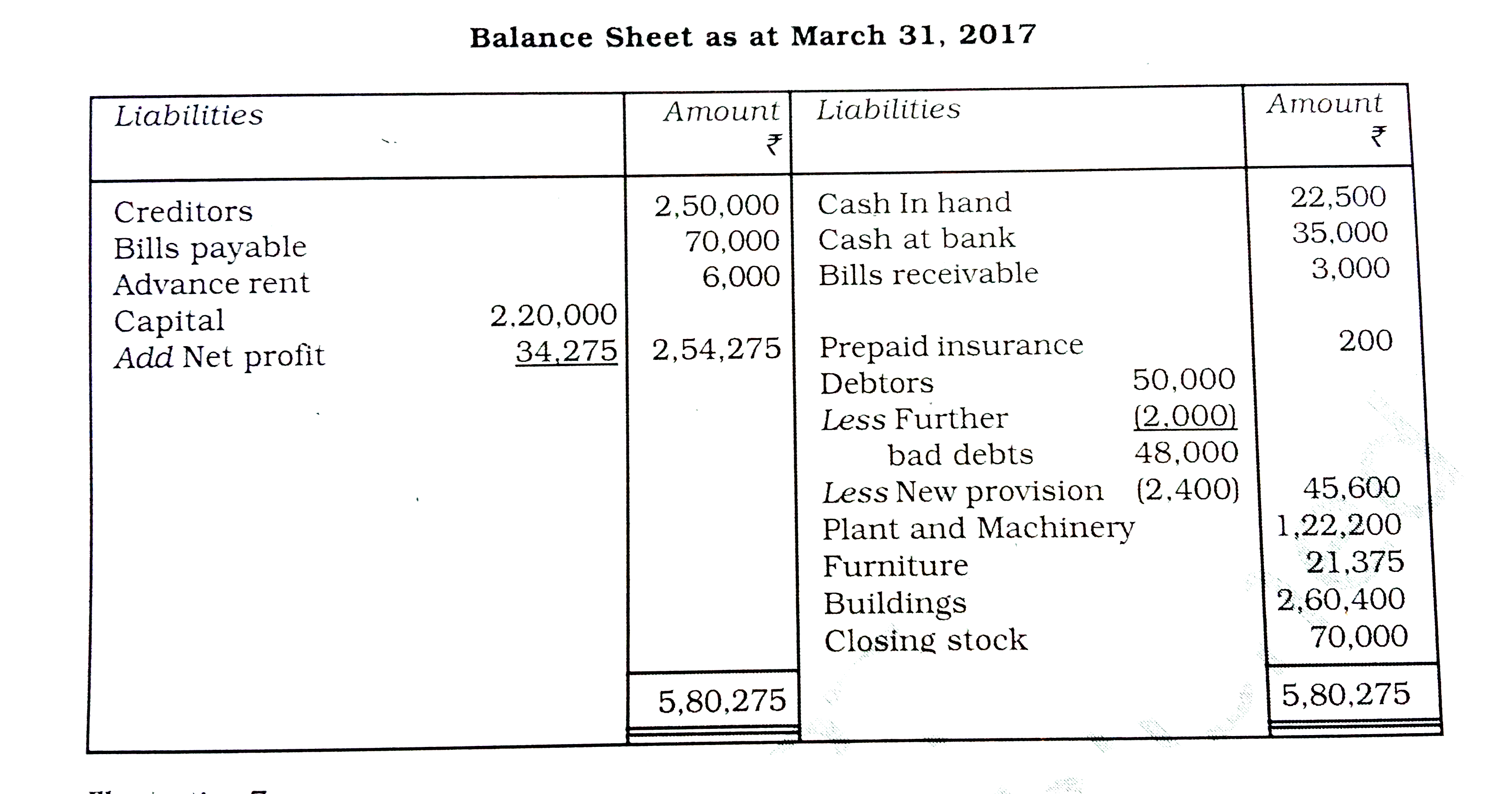

- From the following balances of M/s Keshav Bros. You are required to pr...

Text Solution

|

- Rahul’s trial balance provide you the following information : It...

Text Solution

|

- If the rent of one month is still to be paid the adjustment entry will...

Text Solution

|

- If the rent received in advance Rs. 2,000. The adjustment entry will b...

Text Solution

|

- If the opening capital is Rs. 50,000 as on April 01, 2016 and addition...

Text Solution

|

- If the insurance premium paid Rs. 1,000 and pre-paid insurance Rs. 300...

Text Solution

|