Text Solution

Verified by Experts

The correct Answer is:

Topper's Solved these Questions

ACCOUNTS FROM INCOMPLETE RECORDS

NCERT|Exercise Test Your Understanding- I|4 VideosACCOUNTS FROM INCOMPLETE RECORDS

NCERT|Exercise Test Your Understanding-II|1 VideosACCOUNTS FROM INCOMPLETE RECORDS

NCERT|Exercise Summar with reference to Learning Objectives.|3 VideosAPPLICATIONS OF COMPUTERS IN ACCOUNTING

NCERT|Exercise Questions for Practice(Long Answers)|4 Videos

Similar Questions

Explore conceptually related problems

NCERT-ACCOUNTS FROM INCOMPLETE RECORDS-Numerical questions

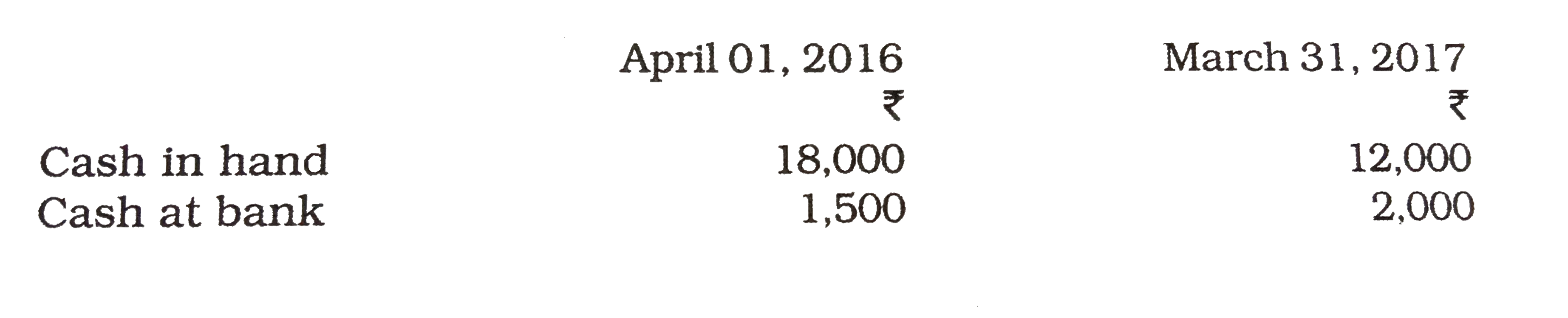

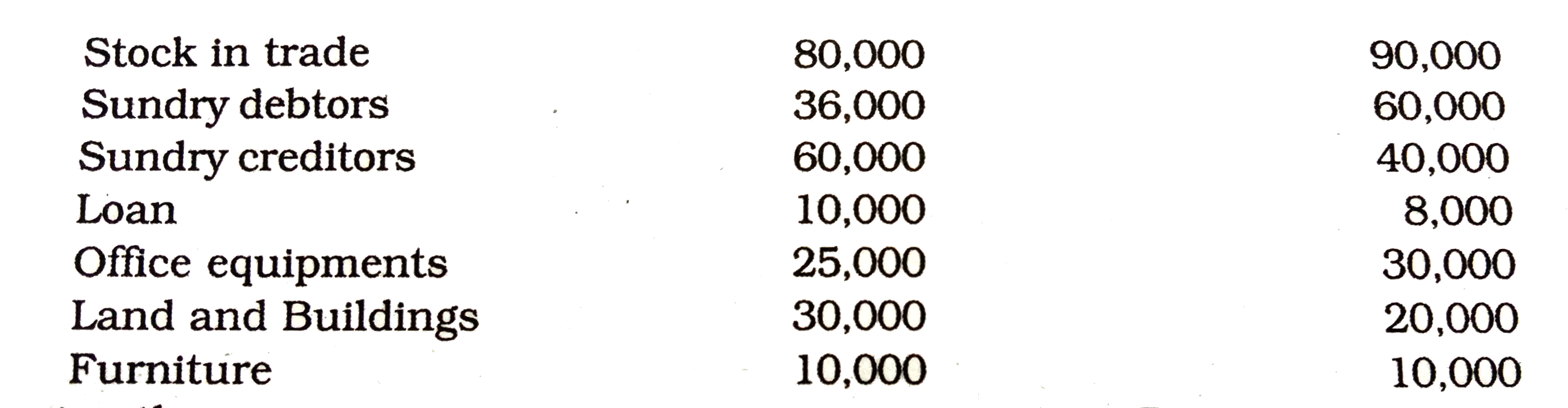

- Mr. Arnav does not keep proper records of his business he provided fol...

Text Solution

|

- Mr. Akshat keeps his books on incomplete records following information...

Text Solution

|

- Gopal does not keep proper books of account. Following information is ...

Text Solution

|

- Mr. Muneesh maintains his books of accounts from incomplete records. H...

Text Solution

|

- Mr. Girdhari Lal does not keep full double entry records. His balance ...

Text Solution

|

- Mr. Ashok does not keep his books properly. Following information is a...

Text Solution

|

- Krishna Kulkarni has not kept proper books of accounts prepare the sta...

Text Solution

|

- M/s Saniya Sports Equipment does not keep proper records. From the fol...

Text Solution

|

- From the following information calculate the amount to be paid to cred...

Text Solution

|

- Find out the credit purchases from the following:

Text Solution

|

- From the following information calculate total purchases.

Text Solution

|

- The following information is given Calculate credit purchases dur...

Text Solution

|

- From the following, calculate the amount of bills accepted during the ...

Text Solution

|

- Find out the amount of bills matured during the year on the basis of i...

Text Solution

|

- Prepare the bills payable account from the following and find out miss...

Text Solution

|

- Calculate the amount of bills receivable during the year.

Text Solution

|

- Calculate the amount of bills receivable dishonoured from the followin...

Text Solution

|

- From the details given below, find out the credit sales and total sale...

Text Solution

|

- From the following information, prepare the bills receivable account a...

Text Solution

|

- Prepare the suitable accounts and find out the missing figure if any.

Text Solution

|