Text Solution

Verified by Experts

NCERT-ACCOUNTING FOR NOT-FOT PROFIT ORGANISATION-All Questions

- From the trial balance and other information given below for a school,...

Text Solution

|

- Prepare Income and Expenditure Account of Entertainment Club for the y...

Text Solution

|

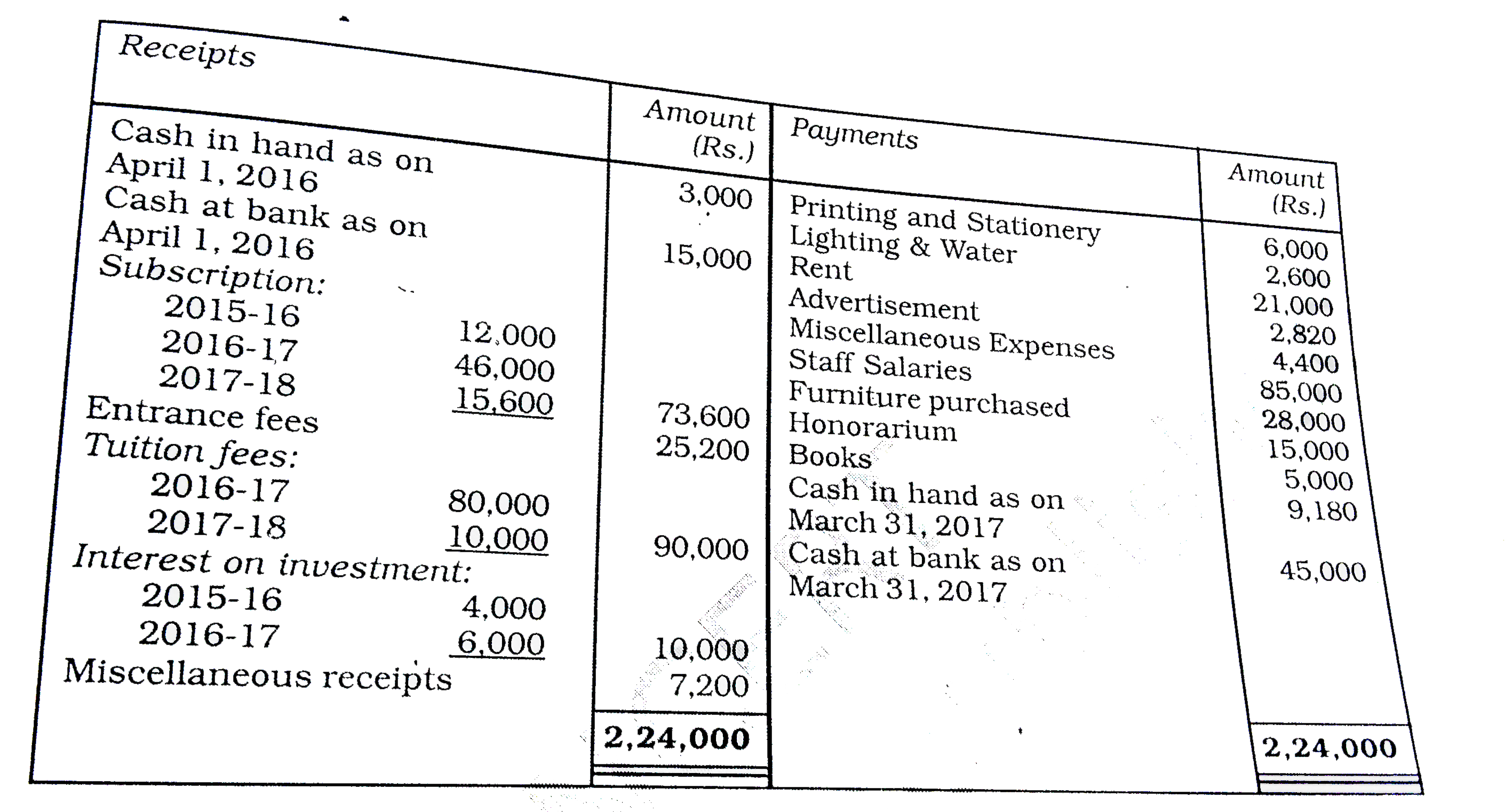

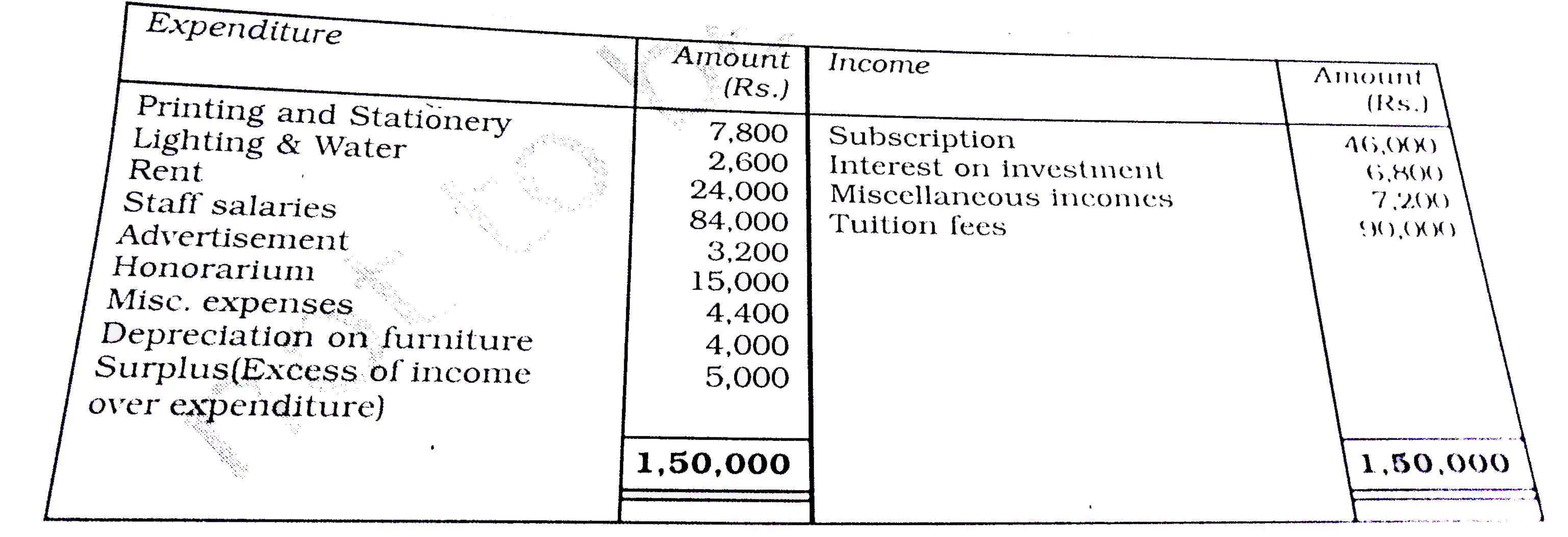

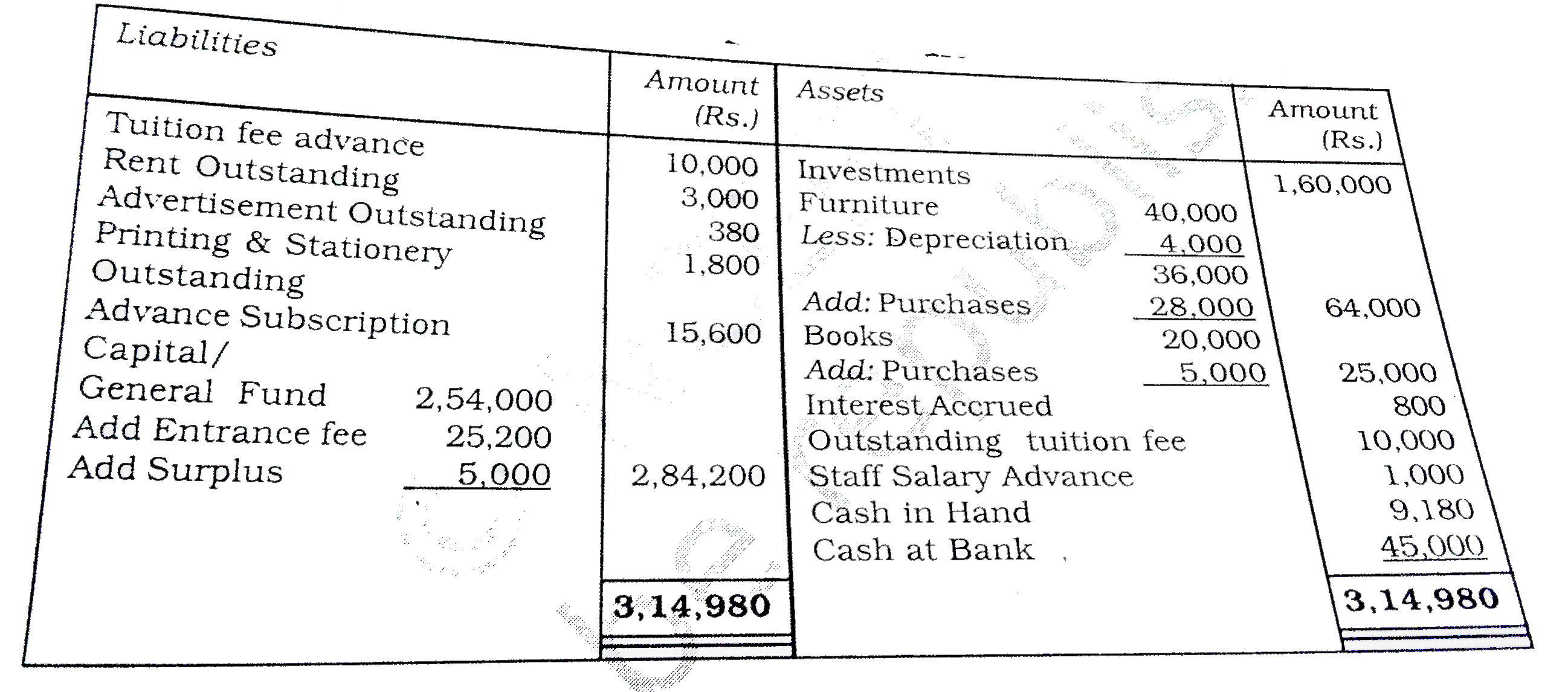

- Shiv-e-Narain Education Trust provides the information in regard to Re...

Text Solution

|

- State with reasons whether the following statements are TRUE or FALSE:...

Text Solution

|

- State with reasons whether the following statements are TRUE or FALSE:...

Text Solution

|

- State with reasons whether the following statements are TRUE or FALSE:...

Text Solution

|

- State with reasons whether the following statements are TRUE or FALSE:...

Text Solution

|

- State with reasons whether the following statements are TRUE or FALSE:...

Text Solution

|

- State with reasons whether the following statements are TRUE or FALSE:...

Text Solution

|

- State with reasons whether the following statements are TRUE or FALSE:...

Text Solution

|

- State with reasons whether the following statements are TRUE or FALSE:...

Text Solution

|

- State with reasons whether the following statements are TRUE or FALSE:...

Text Solution

|

- State with reasons whether the following statements are TRUE or FALSE:...

Text Solution

|

- How would you treat the following items in the case of a ‘not-for-prof...

Text Solution

|

- How would you treat the following items in the case of a ‘not-for-prof...

Text Solution

|

- How would you treat the following items in the case of a ‘not-for-prof...

Text Solution

|

- How would you treat the following items in the case of a ‘not-for-prof...

Text Solution

|

- State the meaning of ‘Not- for- Profit’ Organisations.

Text Solution

|

- State the meaning of Receipt and Payment Account.

Text Solution

|

- State the meaning of Income and Expenditure Account.

Text Solution

|