Topper's Solved these Questions

ACCOUNTING FOR BILLS OF EXCHANGE

TS GREWAL|Exercise Qusetions with missing Values.|2 VideosACCOUNTING FOR BILLS OF EXCHANGE

TS GREWAL|Exercise Short Answer Type Questions|5 VideosACCOUNTING EQUATION

TS GREWAL|Exercise EVALUATION QUESTIONS|6 VideosACCOUNTING PROCEDURES - RULES OF DEBIT AND CREDIT

TS GREWAL|Exercise Practical Problems|12 Videos

Similar Questions

Explore conceptually related problems

TS GREWAL-ACCOUNTING FOR BILLS OF EXCHANGE-Practical Problems

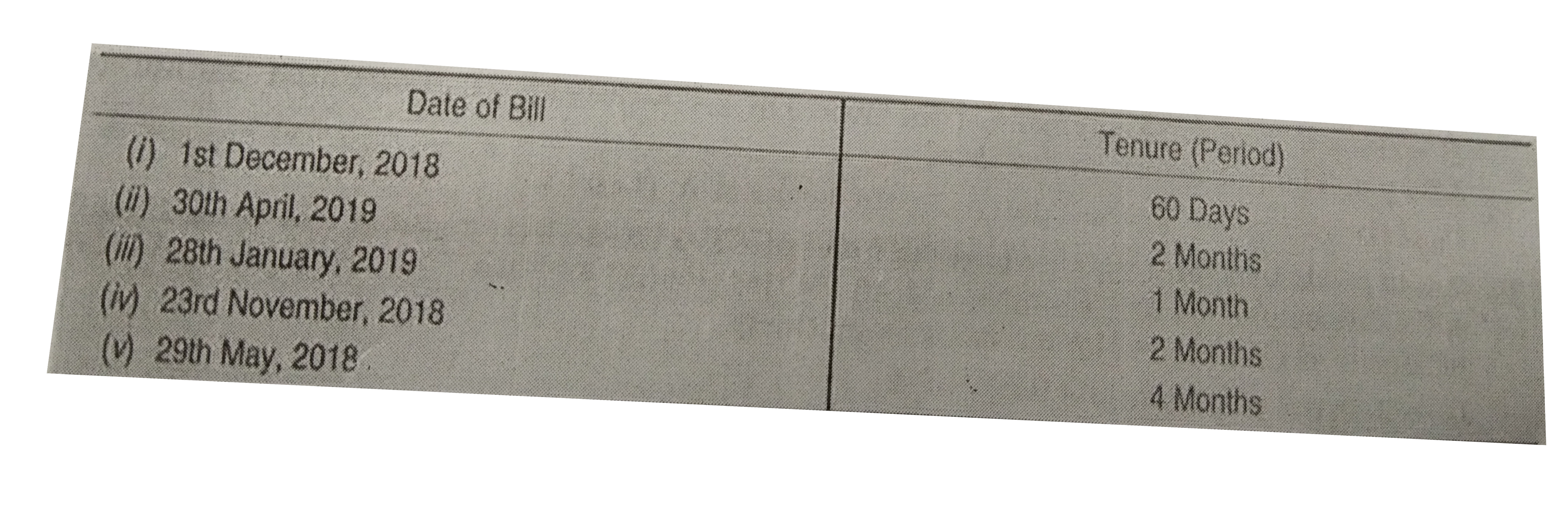

- Calculate the due dates of the bills in the following cases. (i)...

Text Solution

|

- On 10th March, 2019. A drawns on B a bill at 3 months for ₹ 20,000 whi...

Text Solution

|

- On 1st January 2019 , A sold goods to B for ₹ 5,000 plus IGST @ 18% A...

Text Solution

|

- Vinod sold goods to Darbara Singh for ₹ 1,000 on 1st January 2019. He ...

Text Solution

|

- On 1st January , 2019 X sold goods of ₹ 20,000 to Y and drew a bill o...

Text Solution

|

- Dinesh received from Shridhar an acceptance for ₹ 3,000 on 1st Septem...

Text Solution

|

- A sells goods of ₹ 10,000 on 1st March, 2019 to B on credit. B accepts...

Text Solution

|

- A drew a bill of ₹ 1,000 on B of 3 months which was duly accepted by...

Text Solution

|

- A owed B ₹ 8,000 . He gave a bill for the same on 1st August , 2018 pa...

Text Solution

|

- A sold goods to B for ₹ 20,000 plus CGST and SGST @ 9% each on credit ...

Text Solution

|

- Mohan singh draws a bill on Jagat for ₹ 1,000 payable 2 month s after...

Text Solution

|

- X draws on Y a bill for ₹ 4,000 which was duly accepted by Y,Y meets t...

Text Solution

|

- Ram draws a bill ₹ 2,000 on Shyam on 15th September , 2018 for 3 mont...

Text Solution

|

- On 20th Marchm 2019, Naresh sold goods, to Kailash to the value of ₹ 1...

Text Solution

|

- On 1st march , 2019 Naresh sold goods to Y for ₹ 25,000 and immediatel...

Text Solution

|

- On 1st , 2019 A drew a bill for ₹ 5,000 on B payable after 3 month...

Text Solution

|

- On 15th June , 2019 Mohan sold goods to Sohan valued at ₹ 2,000. He dr...

Text Solution

|

- On 1st March , 2019 R accepted a Bill of Exchange of ₹ 20,000 from S ...

Text Solution

|

- On 1st January , 2019 A drew a bill on B for ₹ 10,000 payable after 3...

Text Solution

|

- Y owes X ₹ 4,000 on 1st January 2019 Y accepts a 3 months bill for ₹ 3...

Text Solution

|