Journalise the following transactions:

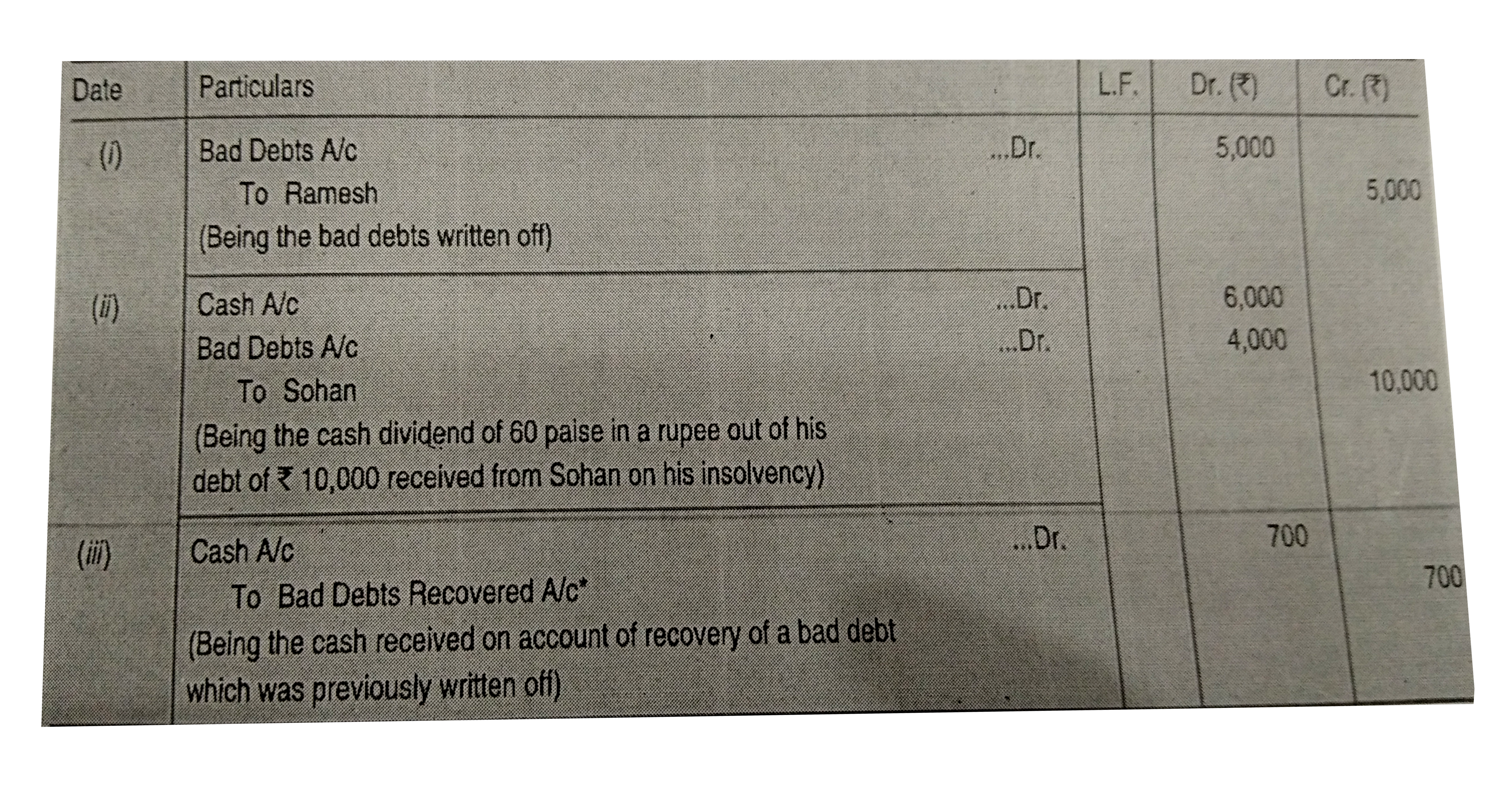

(i) Rs. 5,000 due from Ramesh are irrecoverable.

(ii) Sohan is declared insolvent. Received from his Official Receiver 60 paise in a rupee on a debt of Rs. 10,000.

(iii) Received cash for a bad debt written of last year Rs. 700.

Journalise the following transactions:

(i) Rs. 5,000 due from Ramesh are irrecoverable.

(ii) Sohan is declared insolvent. Received from his Official Receiver 60 paise in a rupee on a debt of Rs. 10,000.

(iii) Received cash for a bad debt written of last year Rs. 700.

(i) Rs. 5,000 due from Ramesh are irrecoverable.

(ii) Sohan is declared insolvent. Received from his Official Receiver 60 paise in a rupee on a debt of Rs. 10,000.

(iii) Received cash for a bad debt written of last year Rs. 700.

Text Solution

Verified by Experts

Topper's Solved these Questions

Similar Questions

Explore conceptually related problems

Journalise the following transactions: (i) Shyam became insolvent. A first and final compensation of 75 paise in a rupee was received from his Official Receiver. He owed us 10,000 (ii) Received cash for bad debts written off last year. 5,000 (iii) Rent due to landlord. 8,000 (iv) Salaries due to clerks. 10,000 (v) Placed an order with Rakesh Mohan for the supply of goods of the list price of Rs. 1,00,000. In this connection, Raman paid 10% of the list price as an advance by cheque.

Journalise the following transactions in the books of Ashok: (i) Received Rs. 11,700 from Hari Krishan in full settlement of his account for Rs. 12,000. (ii) Received Rs. 11,700 from Shyam on his account for Rs. 12,000. (iii) Received a first and final dividend of 70 paise in the rupee from the official receiver of Rajagopal who owed us Rs. 7,000. (iv) Paid Rs. 2,880 to A.K. Madal in full settlement of his account for Rs. 3,000. (v) Paid Rs. 2,880 to S.K. Gupta on his account for Rs. 3,000.

Journalise the following transactions in the books of Bhushan Agencies: (i) Received from Bharat cash Rs. 20,000, allowed him discount of Rs. 500. (ii) Received from Vikas Rs. 35,000 by cheque, allowed him discount of Rs. 750. (iii) Received from Amrit Rs. 38,000 in settlement of him dues of Rs. 40,000 in cash. (iv) Received from Amrit Rs. 50,000 by cheque on account against dues of Rs 60,000. (v) Paid cash Rs. 40,000 to Suresh, availed discount of 2% . (vi) Paid by cheque Rs. 25,000 to Mehar and settled her dues of Rs. 26,000. (vii) Paid Rs. 25,000 to Yogesh by cheque on account. (viii) Purchased goods costing Rs. 1,00,000 against cheque and availed discount of 3% . (ix) Purchased goods costing Rs. 60,000 from Akash & Co., paid 50% immediately availing 3% discount. (x) Sold goods of Rs. 30,000 against cheque allowing 2% discount. (xi) Sold goods of Rs. 60,000 to Vimal received 50% of due amount allowing 2% discount.

Journalise the following transactions in the books of Mohan, Delhi: (i) Raj of Alwar, Rajasthan who owed Mohan Rs. 25,000 became insolvent and received 60 paise in a ruee as full and final settlement. (ii) Mohan owes to his landlord Rs. 10,000 as rent. (iii) Charge depreciation of 10% on furniture costing Rs. 50,000. (iv) Salaries due to employees Rs. 20,000. (v) Sold to Sunil goods in cash of Rs. 10,000 less 10% trade discount plus CGST and SGST @ 6% each and received a net of Rs. 8,500. (vi) Provided interest on capital of Rs. 1,00,000 @ 10% per annum. (vii) Goods lost in theft Rs. 5,000, which were purchased paying IGST @ 12% from Alwar, Rajasthan.

Pass the rectifying entries for the following transactions: (i) An amount of Rs. 2,000 received from Mohan on 1st April, 2019 had been entered in the Cash Book as having been received on 31st March, 2019. (ii) The balance in the account of Rahim Rs. 1,000 had been written off as bad but no other account has been debited. (iii) An addition in the Return Inward Book had been cast Rs. 100 short. (iv) A cheque for Rs. 200 drawn for the Petty Cash Account has been posted in the account of Asif. (v) A discounted Bill of Exchange for Rs. 20,000 returned by the firm's bank had been credited to the Bank Account and debited to Bills Receivable Account. A cheque was received later from the customer for Rs. 20,000 and duly paid. [Hint: (v) Dr. Customer's A/c and Cr. Bills Receivable A/c by Rs. 20,000.]

Jouranlise the following transactions in the books of Harpreet Bros (a)1,000 due from Rohit are now bad debts. (b) Goods worth 2,000 were used by the proprietor. (c) Charge depreciation @ 10% p.a for two month on machine costing30,000. (d) Provide interest on capital of 1,50,000 at 6% p.a. for 9 months. (e) Rahul become insolvent, who owed is 2,000 a final dividend of 60 paise in a rupee is received from his estate.

Journalise the following entries: (i) Goods costing Rs. 500 given as charity. (ii) Sold goods to Mayank of Rs. 1,00,000, payable 25% by cheque at the time of sale and balance after 30 days of sale. (iii) Received Rs. 975 from Harikrishna in full settliment of his account of Rs. 1,000. (iv) Received a first and final dividend of 60 paise in a rupee from the Official Receiver of Rajan, who owed us Rs. 1,000. (v) Charge interest on Drawings Rs. 1,500. (vi) Sold goods costing Rs. 40,000 to Anil for cash at a profit of 25% on cost less 20% trade discount and paid cartage Rs. 100, which is not to be charged from customer.

Received Rs 4,900 from Garima in full settlement of Rs 5,000. Posting of Rs 100 will be made to the :

Record the following transactions in a Journal : (i) Withdrawn goods conting Rs. 5,000 for personal use. (ii) Goods costing Rs. 500 given as charity. (iii) A cheque for Rs. 5,000 received from Rajib was deposited into bank, returned dishonoured.