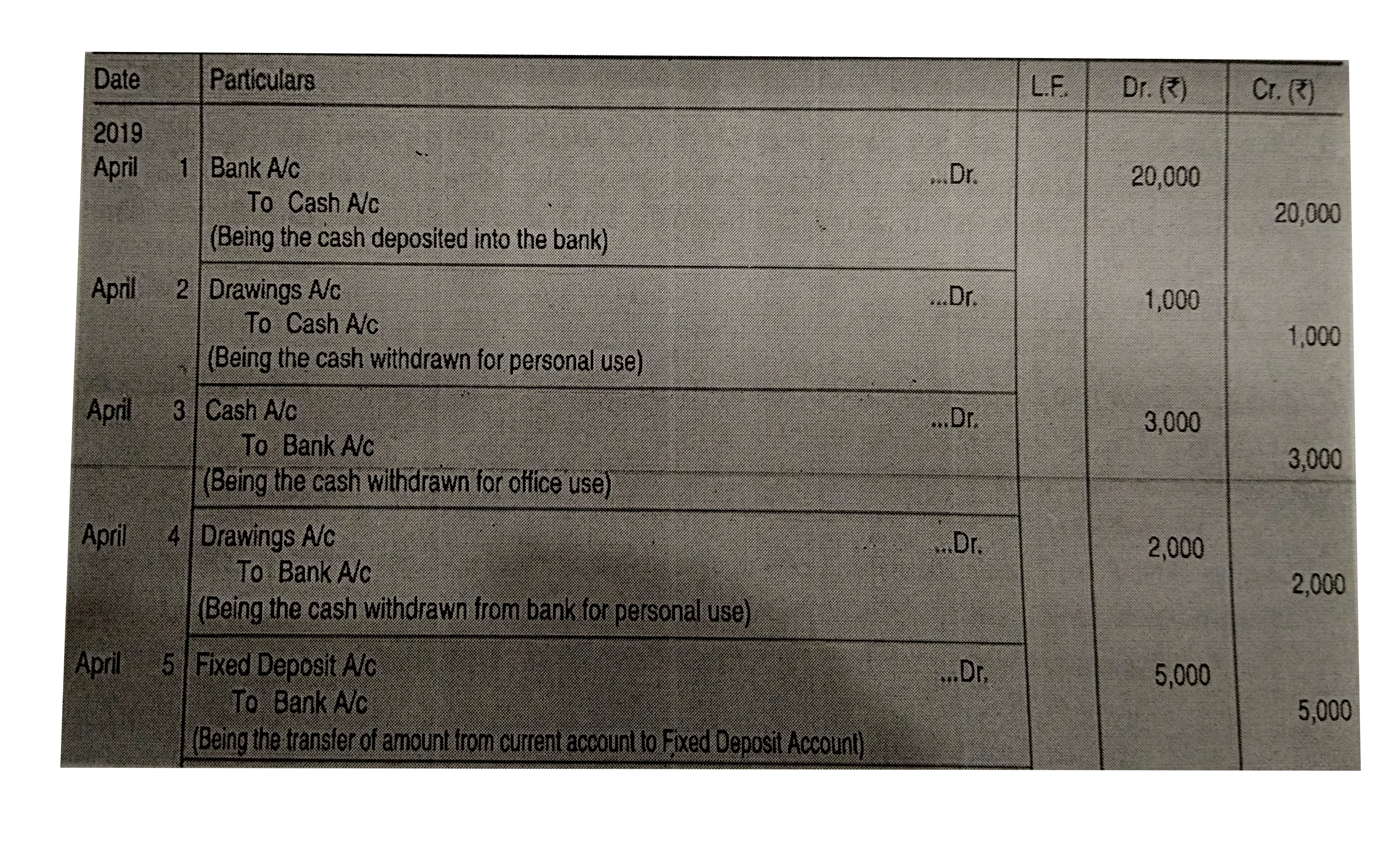

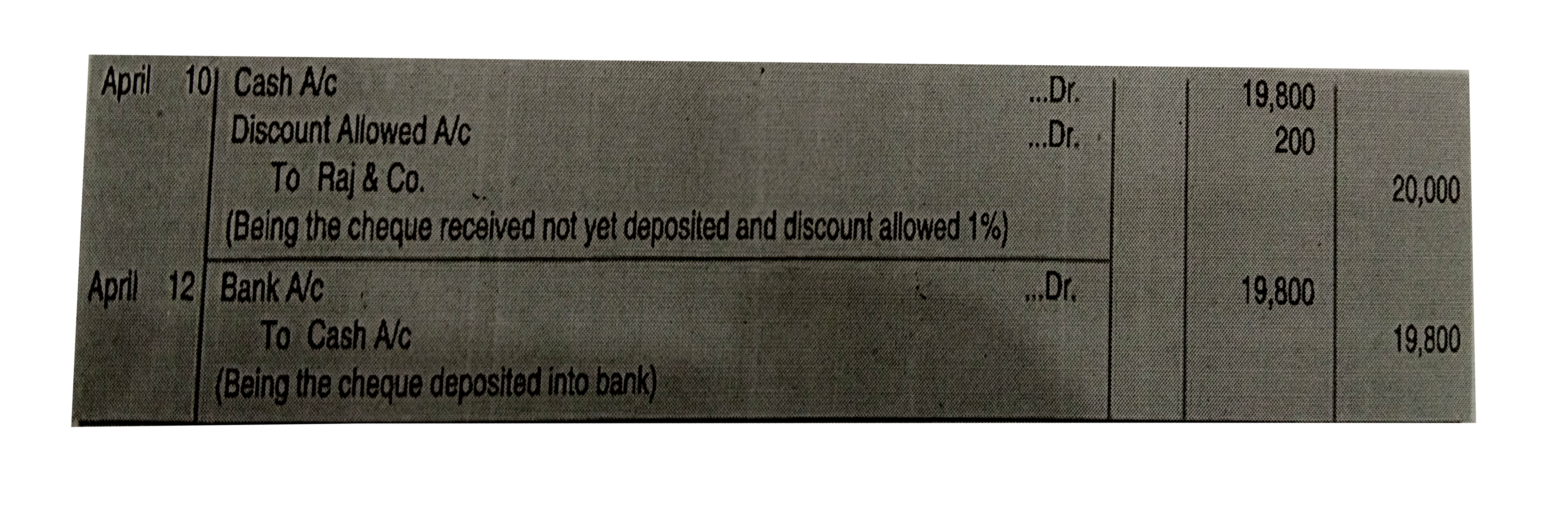

Journalise the following transactions :

`{:(2019,,,"Rs."),("April",1,"Paid into bank for opening a current account","20,000"),("April",2,"Withdrawn for personal expenses","1,000"),("April",3,"Withdrawn from bank","3,000"),("April",4,"Withdrawn from bank of personal use","2,000"),("April",5,"Placed on fixed deposit account at bank by transfer from current account","5,000"),("April",10,"Received a cheque from Raj & Co. to whom goods were sold for Rs. 20,000",),(,,"last year, Allowed him " 1% "discount.",),("April",12,"Raj & Co.'s cheque deposited into bank.",):}`

Journalise the following transactions :

`{:(2019,,,"Rs."),("April",1,"Paid into bank for opening a current account","20,000"),("April",2,"Withdrawn for personal expenses","1,000"),("April",3,"Withdrawn from bank","3,000"),("April",4,"Withdrawn from bank of personal use","2,000"),("April",5,"Placed on fixed deposit account at bank by transfer from current account","5,000"),("April",10,"Received a cheque from Raj & Co. to whom goods were sold for Rs. 20,000",),(,,"last year, Allowed him " 1% "discount.",),("April",12,"Raj & Co.'s cheque deposited into bank.",):}`

`{:(2019,,,"Rs."),("April",1,"Paid into bank for opening a current account","20,000"),("April",2,"Withdrawn for personal expenses","1,000"),("April",3,"Withdrawn from bank","3,000"),("April",4,"Withdrawn from bank of personal use","2,000"),("April",5,"Placed on fixed deposit account at bank by transfer from current account","5,000"),("April",10,"Received a cheque from Raj & Co. to whom goods were sold for Rs. 20,000",),(,,"last year, Allowed him " 1% "discount.",),("April",12,"Raj & Co.'s cheque deposited into bank.",):}`

Text Solution

Verified by Experts

Topper's Solved these Questions

Similar Questions

Explore conceptually related problems

Prepare Two-column Cash Book of Tarun, Kanpur form the following transactions: 2019 {:("April",1,"Cash in Hand Rs. 1,200, Overdraft"),("April",3,"Capital introduced Rs.20,000 out of which Rs. 16,000 is by cheque and is deposited in the bank."),("April",4, "Purchased goods from Shyam Traders, Lucknow for Rs. 3,000 plus CGST and SGST @6% each and they allowed trade discoung Rs. 200. The amount was paid by cheque."),("April",4,"Goods purchased for cash Rs.4,000 plus CGST and SGST @6% each."),("April",5, "Sold goods to Mohan on credit Rs.5,000 plus CGST and SGSR @6% each"),("April",6,"Received cheque from Rakesh Rs.2,450 after allowing him discount Rs.50."),("April",10,"Cheque received from Rakesh deposited into bank."),("April",11,"Settled the account of Tej printers Rs.750 by paying cash Rs.680."),("April",12,"Cash received from Mohan Rs.4,750 in full settlement of his account of Rs.5,000."),("April",16,"Received Rs.1,000 from Param, whose account of Rs.2,000 was written off as bad bebts earlier."),("April",17,"Received from Muril on behalf of Monohar Rs.200."),("April",19,"Received a cheque for Rs.800 from Mukesh, which was endrosed to Nitin."),("April",20,"Sold old furmiture for Rs.700 plus CGST and SGST @6% each, payment received in cash."),("April",25,"Withdrawn from band Rs.3,000."),("April",28,"Surendra who owed Rs.400 became bankrupt and paid 60 paise in a repee."),("April",30,"Interest debited by bank Rs.375."),("April",30,"Deposited with bank the balance after retaining Rs.2,000 office."):}

{:(2019,,,"Rs."),("April",1,"Raj started a business with .............................","6,00,000"),("April",4,"Furniture purchased from Modern Furniture for Rs. 50,000 plus CGST and SGST @ 6% each",),("April",5,"Purchased goods for Rs. 1,00,000 plus CGST and SGST @ 6% each in cash",),("April",8,"Purchased goods from K.G. Khosla & Co., Faridabad, Haryana for Rs. 1,50,000, trade discount 20%,",),(,,"plus IGST @ 12%",),("April",9,"Opened a bank account by depositing ..................................","1,50,000"),("April",10,"Sold goods of Rs. 2,00,000 and charged CGST and SGST @ 6% each",),("April",10,"Purchased stationery from R.S. Mart for Rs. 5,000 plus CGST and SGST @ 6% each",),("April",11,"Sold goods to Sanjay Kumar, Delhi of Rs. 1,00,000, charged IGST @ 12%",),("April",14,"Goods returned by Sanjay Kumar, Delhi of sale value Rs. 20,000",),("April",15,"Payment to K.G. Khosla & Co. by cheque ................","50,000"),("April",20,"Goods purchased from Shiv Dayal & Co, Delhi for Rs. 1,00,000 plus IGST @ 12%",),("April",25,"Goods returned to Shiv Dayal & Co., Delhi ...................","10,000"),("April",28,"Paid electricity bill ............................","1,000"),("April",29,"Cash sales Rs. 90,000 plus CGST and SGST @ 6% each",),("April",30,"Withdrew from bank for personal use ......................","10,000"):}

From the following information prepare Bank Reconciliation Statement as on 31st March,2019 {:(,,Rs.),((i), "Bank overdraft as per Pass Book.","36,000"),((ii),"Cheques issued but not presented for payment.","19,1700"),((iii),"Cheques deposited with bank but not collected. ","25,000"),((iv),"Cheques entered in Cash Book but not banked.","9,000"),((v),"Directly deposited to bank by a customer.","11,000"):}

Prepare Bank Reconcialiation Statement as on 31st March 2019 from the following particulars: {:(,,Rs.),((i), "Bank balance as per Pass Book.","10,000"),((ii),"Cheque deposited into the Bank ,but no entry was passed in Cash Book.","500"),((iii),"Cheque received and entered in Cash Book but not sent to bank.","1,200"),((iv),"Credit side of the Cash Book bank column cas short.","200"),((v),"Insurance premium paid directly by the bank under the standing advice.","600"),((vi),"Bank charges entered twice in the Cash Book.","20"),((vii),"Cheque issued but not presented to the bank payment.","500"),((viii),"Cheque received entered twice in the Cash Book.","1,000"),((ix),"Bill disounted dishonoured not recorded in the Cash Book.","5,000"),((x),"Bank wrongly allowed interest of Rs,500, which was reversed by it on 5th April, 2019",""):}

Show the effect of the following transactions on Assets, Liabilities and Capital through accounting equation : {:(,,," "Rs.),((a),"Started business with cash",,"1,20,000"),((b),"Rent received",,"10,000"),((c),"Invested in shares",,"50,000"),((d),"Received diviend",,"5,000"),((e),"Purchased goods on credit from Ragani",,"35,000"),((f),"Paid cash for household expenses",,"7,000"),((g),"sold goods for cash (costing Rs.10,000)",,"14,000"),((h),"Cahs paid to Ragani",,"35,000"),((i),"Deposited into bank",,"20,000"):}

1st April 2019 Assets and Liability of the Young Club are as follows : Assert : {:(,,"Rs"),("Land and Building",,"2,00,000"),("Furniture",,"65,000"),("Cash in Hand",,"25,000"),("Subscriptions Receivable",,"30,000"):} Liabilites : {:("Bank Overdraft",,"20,000"),("Outstanding Salaries",,"5,000"):} Detemine Capital Fund as on 1st April 2019