Topper's Solved these Questions

Similar Questions

Explore conceptually related problems

TS GREWAL-JOURNAL-Practical problems

- Journalise the following transactions of Rakesh Agencies, Delhi (Propr...

Text Solution

|

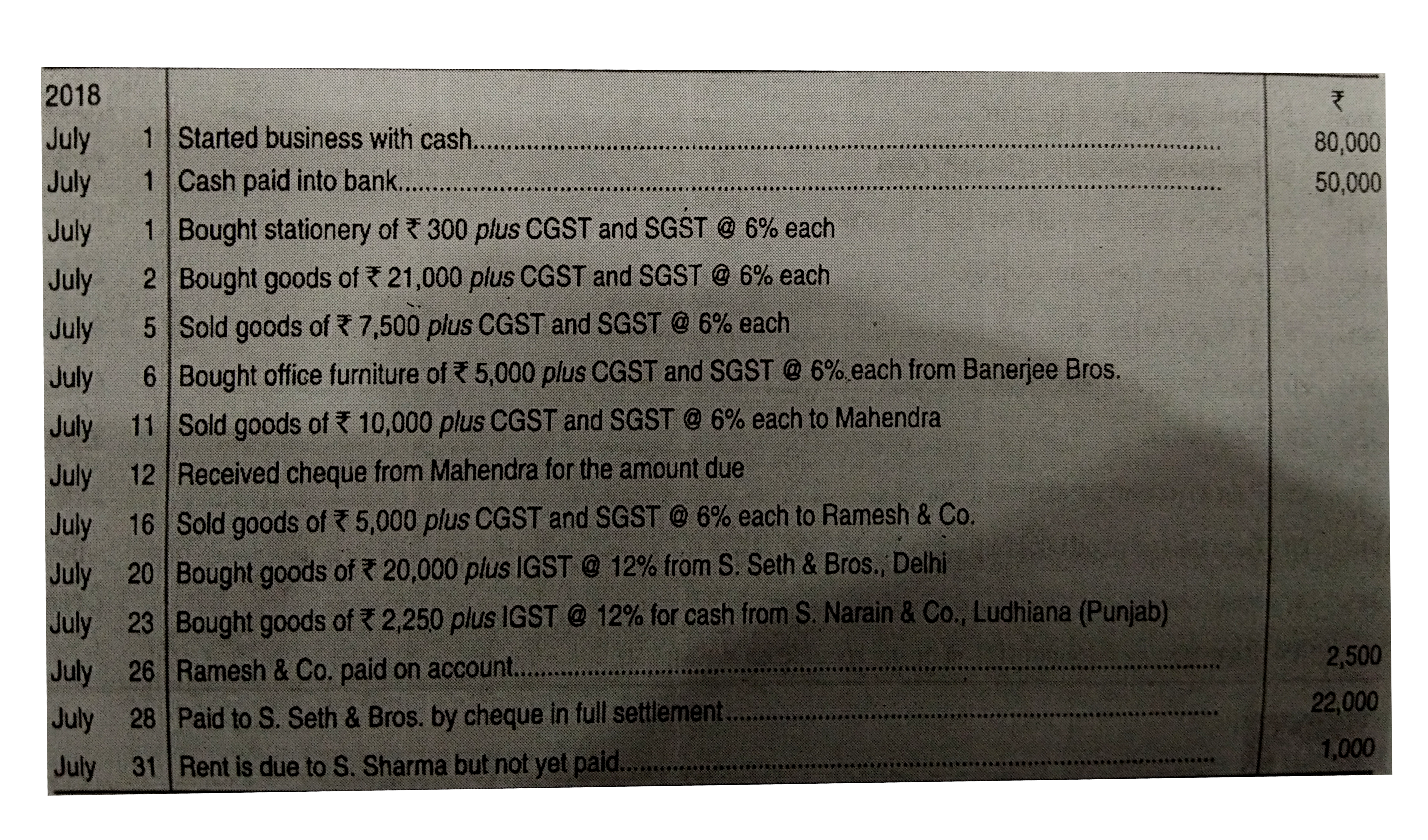

- Journalise the following transactions of Satish, Noida (UP):

Text Solution

|

- With Goods and Services Tax (GST) Following are the transactions of...

Text Solution

|

- Record the following transactions in the Journal of Ashoka Furniture T...

Text Solution

|

- M/s Auto Aid, Delhi purchased 500 pieces of car horns @ Rs. 200 each l...

Text Solution

|

- M/s Vaish Traders, Delhi purchased 500 Parker Pens @ Rs. 200 each less...

Text Solution

|

- M/s Auto Help, Delhi purchased 500 pieces of motor cycle horns at Rs. ...

Text Solution

|

- Name the accounts to be credited along with the amount for payment to ...

Text Solution

|

- Pass Journal entry for sale of goods by Rahul, Delhi to Anish, Delhi ...

Text Solution

|

- Pass Journal entry for purchase of goods by Amrit, Delhi from Ayur Pro...

Text Solution

|

- Pass Journal entry for purchase of goods by Amrit, Delhi form Add Gel ...

Text Solution

|

- Mittal Cycles purchased 100 cycles from from Hero Cycles, Ludhiana (Pa...

Text Solution

|

- Oswal Woollen Mills, Amritsar (Punjab) sold shawls to Gupta Shawls, Ja...

Text Solution

|

- Journalise the following transactions in the books of Ashok: (i) Rec...

Text Solution

|

- Enter the following transactions in the Journal of Suresh, Delhi who t...

Text Solution

|

- Journalise the following transactions:

Text Solution

|

- Journalise the following in the books of Amit, Saini, Gurugram (Harua...

Text Solution

|

- Journalise the following transactions in the books of Mohan, Delhi: ...

Text Solution

|

- Pass Journal entries in the books of Puneet, Delhi for the following: ...

Text Solution

|

- D. Chadha, Delhi commenced business on 1st January, 2019. His transac...

Text Solution

|