Text Solution

Verified by Experts

The correct Answer is:

Topper's Solved these Questions

ADJUSTMENTS IN PREPARATION OF FINANCIAL STATEMENTS

TS GREWAL|Exercise Illustration- 1|2 VideosADJUSTMENTS IN PREPARATION OF FINANCIAL STATEMENTS

TS GREWAL|Exercise Illustration- 2|2 VideosADJUSTMENTS IN PREPARATION OF FINANCIAL STATEMENTS

TS GREWAL|Exercise Short answer type questions|38 VideosACCOUNTS FROM INCOMPLETE RECORDS-SINGLE ENTRY SYSTEM

TS GREWAL|Exercise EVALUATION QUESTIONS WITH NISSING VALUES|1 VideosBANK RECONCILIATION STATEMENT

TS GREWAL|Exercise EVALUATION QUESTIONS : QUESTIONS WITH MISSING VALUES|8 Videos

Similar Questions

Explore conceptually related problems

TS GREWAL-ADJUSTMENTS IN PREPARATION OF FINANCIAL STATEMENTS -Practical Problems

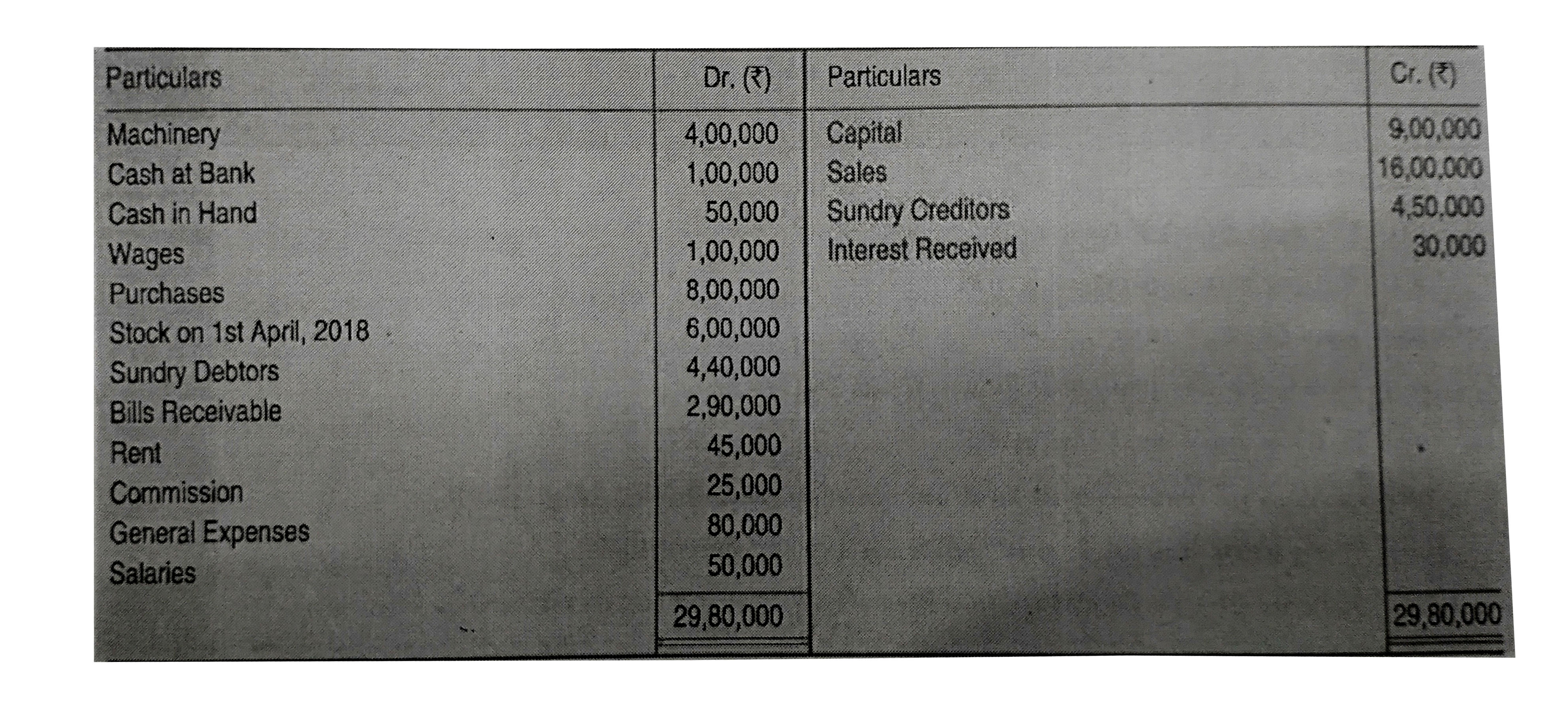

- Following are the balances extracted form the books of Manish on 31st ...

Text Solution

|

- Prepare Trading and Profit and Loss account and Balance sheet form the...

Text Solution

|

- Following Trial Balance has been extracted form the books of Prasad on...

Text Solution

|

- From the following Trial Balance of Shradha as on 31st March, 2019, pr...

Text Solution

|

- Trial balance of a business as at 31st March, 2019 is given below: ...

Text Solution

|

- Following are the balances extracted from the books Naraina on 31st Ma...

Text Solution

|

- Following balances are taken from the books of Niranjan. Prepare Tradi...

Text Solution

|

- From the following Trial Balance of Mahesh, prepare his Final Accounts...

Text Solution

|

- Following Balances were extracted from the books of Vijay on 31st Marc...

Text Solution

|

- Following are the balances extracted form the books of Manish on 31st ...

Text Solution

|

- Prepare Trading and Profit and Loss account and Balance sheet form the...

Text Solution

|

- Following Trial Balance has been extracted form the books of Prasad on...

Text Solution

|

- From the following Trial Balance of Shradha as on 31st March, 2019, pr...

Text Solution

|

- Trial balance of a business as at 31st March, 2019 is given below: ...

Text Solution

|

- Following are the balances extracted from the books Naraina on 31st Ma...

Text Solution

|

- Following balances are taken from the books of Niranjan. Prepare Tradi...

Text Solution

|

- From the following Trial Balance of Mahesh, prepare his Final Accounts...

Text Solution

|

- Following Balances were extracted from the books of Vijay on 31st Marc...

Text Solution

|