Text Solution

Verified by Experts

Topper's Solved these Questions

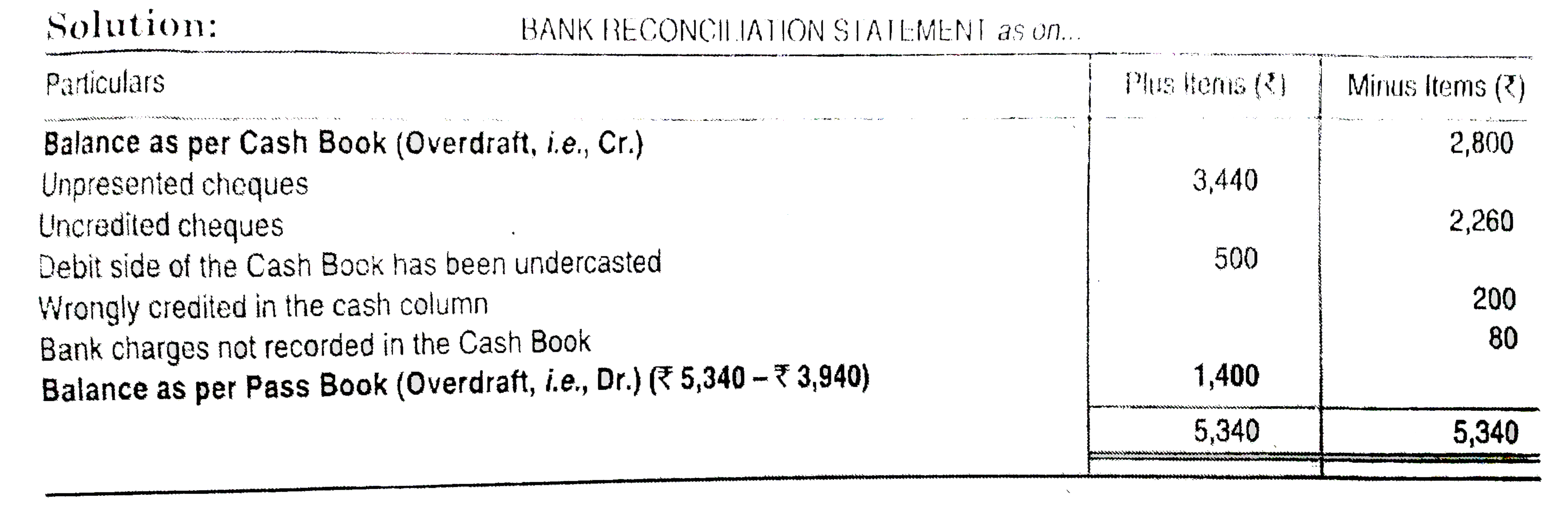

BANK RECONCILIATION STATEMENT

TS GREWAL|Exercise HIGHER ORDER THINKING SKILLS (HOTS) QUESTIONS|6 VideosBANK RECONCILIATION STATEMENT

TS GREWAL|Exercise MULTIPLE CHOICE QUESTIONS (MCQS)|16 VideosADJUSTMENTS IN PREPARATION OF FINANCIAL STATEMENTS

TS GREWAL|Exercise Illustration- 6|2 VideosBASES OF ACCOUNTING

TS GREWAL|Exercise Short Answer Type Questions|4 Videos

Similar Questions

Explore conceptually related problems

TS GREWAL-BANK RECONCILIATION STATEMENT -EVALUATION QUESTIONS : QUESTIONS WITH MISSING VALUES

- Following information is of Roshan who requires you to reconcile his C...

Text Solution

|

- In the following Bank Reconciliation Statement, determine the mission ...

Text Solution

|

- In the following Bank Reconciliation Statement, determine the mission ...

Text Solution

|

- In the following Bank Reconciliation Statement, determine the mission ...

Text Solution

|

- Complete the following Bank Reconciliation Statement

Text Solution

|

- In the following Bank Reconciliation Statement, determine the mission ...

Text Solution

|

- In the following Bank Reconciliation Statement, determine the mission ...

Text Solution

|

- In the following Bank Reconciliation Statement, determine the mission ...

Text Solution

|

- Complete the following Bank Reconciliation Statement

Text Solution

|