Text Solution

Verified by Experts

Topper's Solved these Questions

NATIONAL INCOME AND RELATED AGGREGATES : SOME BASIC CONCEPTS

RADHA BHUGANA|Exercise Let Us Recapitulate|37 VideosNATIONAL INCOME AND RELATED AGGREGATES : SOME BASIC CONCEPTS

RADHA BHUGANA|Exercise MCQs|10 VideosMONEY

RADHA BHUGANA|Exercise Guidelines To NCRT Questions|2 VideosSAMPLE QUESTION PAPER

RADHA BHUGANA|Exercise Section B|1 Videos

Similar Questions

Explore conceptually related problems

RADHA BHUGANA-NATIONAL INCOME AND RELATED AGGREGATES : SOME BASIC CONCEPTS-LONG ANSWER TYPE QUESTION

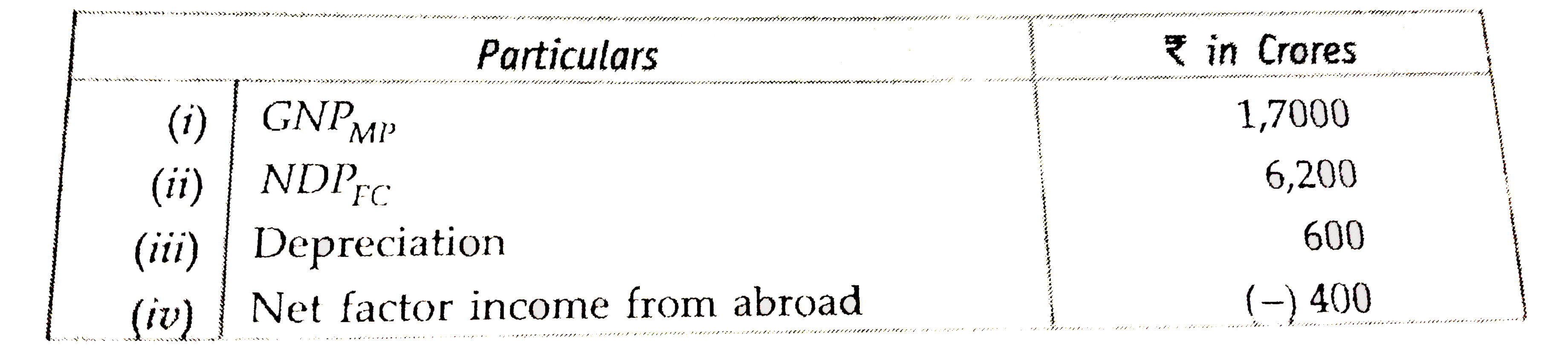

- Calculate Net Indirect Tax :

Text Solution

|

- Discuss the concept of factor income and transfer income with the help...

Text Solution

|

- Briefly discuss the concept of normal residents.

Text Solution

|

- Define domestic territory.

Text Solution

|

- Distinguish between market price and factor cost.

Text Solution

|

- Define gross investment.

Text Solution

|

- Differentiate between consumer goods and capital goods.

Text Solution

|