Text Solution

Verified by Experts

Topper's Solved these Questions

SPECIAL PURPOSE BOOKS II - OTHER BOOKS

TS GREWAL|Exercise Higher Order Thinking Skills (HOTS) Questions|6 VideosSPECIAL PURPOSE BOOKS II - OTHER BOOKS

TS GREWAL|Exercise Multiple Choice Questions (MCQ)|15 VideosSPECIAL PURPOSE BOOKS II - OTHER BOOKS

TS GREWAL|Exercise Illustration(With GST)|1 VideosSPECIAL PURPOSE BOOKS I-CASH BOOK

TS GREWAL|Exercise EVALUATION QUESTIONS: QUESTIONS WITH MISSING VALUES|2 VideosTHEORY BASE OF ACCOUNTING , ACCOUNTING STANDARDS AND INDIAN ACCOUNTING STANDARDS (IND - AS)

TS GREWAL|Exercise Very Short Answer Type Questions|32 Videos

Similar Questions

Explore conceptually related problems

TS GREWAL-SPECIAL PURPOSE BOOKS II - OTHER BOOKS-Illustration

- Enter the following transactions in Purchase Book of M/s. Bhaskar Brot...

Text Solution

|

- Record the following transactions of M/s. Kishore & Sons, Delhi in th...

Text Solution

|

- From the following transactions of M/s. Ridhima Sales, Kolkata , prep...

Text Solution

|

- Enter the following transactions in the Purchases Return Book of Shri ...

Text Solution

|

- Record the following in Purchases Return Book and post them in ledger ...

Text Solution

|

- Prepare Sales Return Book in the Books of Lal & Co. , Delhi from the f...

Text Solution

|

- Record the following transactions of Abhay & Co., Kolkata in the Retur...

Text Solution

|

- Record the following transactions of Harry Marketing, Amritsar into p...

Text Solution

|

- Following are the Ledger balances on 31st March, 2019: Building Rs. ...

Text Solution

|

- The Balance Sheet of Rajgopal as at 31st March, 2019 is as under: ...

Text Solution

|

- Enter the following in the books of Karan, Delhi to close his account...

Text Solution

|

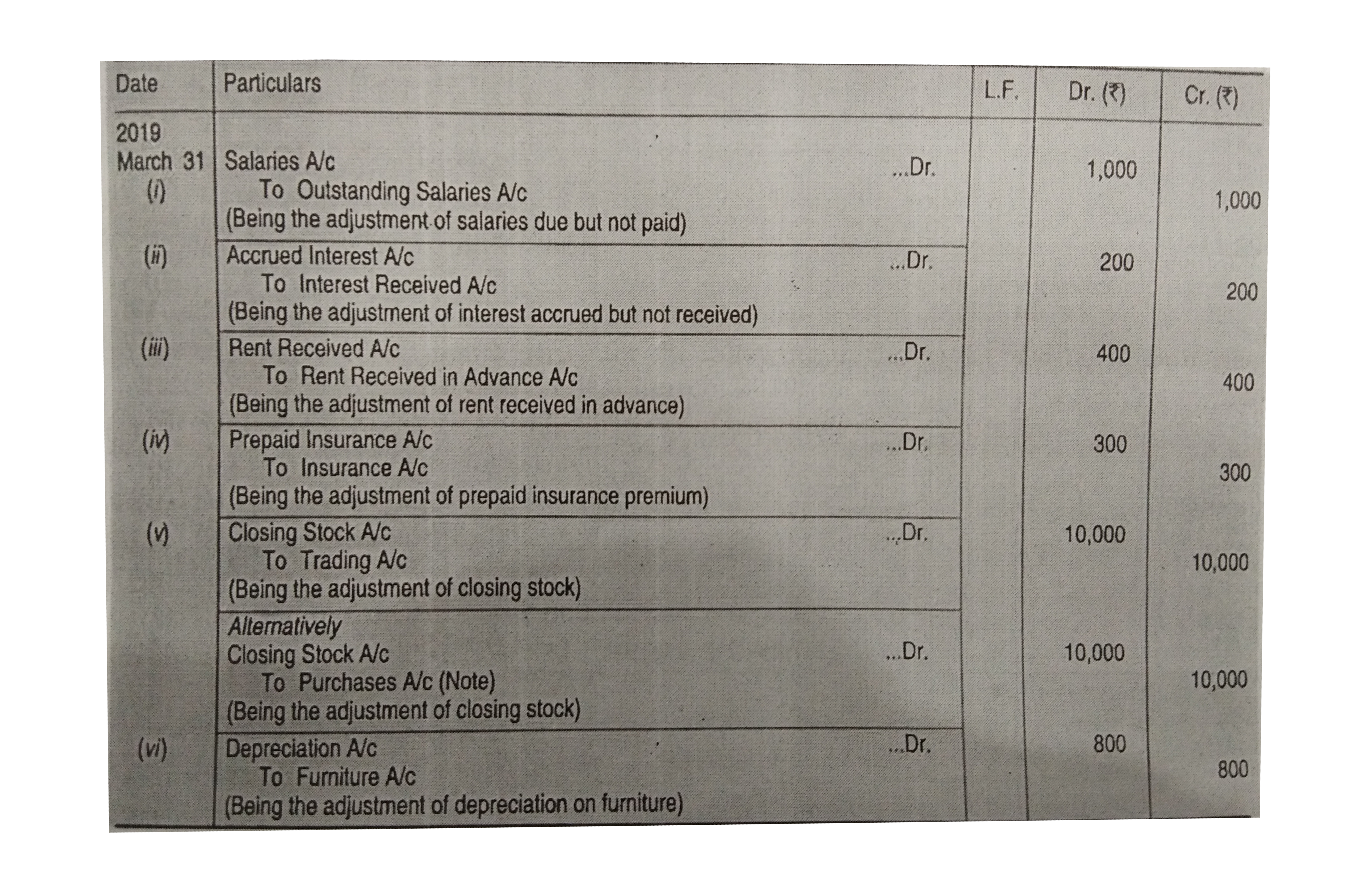

- Pass necessary adjustment entries for the following in the books of Sh...

Text Solution

|

- Enter the following transactions in the appropriate books of original...

Text Solution

|

- Shri Suresh Gupta purchased a running business on 1st April, 2019 at a...

Text Solution

|

- {:(2019,,,"Rs."),("April",1,"Raj started a business with ................

Text Solution

|