Text Solution

Verified by Experts

The correct Answer is:

Topper's Solved these Questions

SPECIAL PURPOSE BOOKS II - OTHER BOOKS

TS GREWAL|Exercise Evaluation Questions: Questions with Missing Values|1 VideosSPECIAL PURPOSE BOOKS I-CASH BOOK

TS GREWAL|Exercise EVALUATION QUESTIONS: QUESTIONS WITH MISSING VALUES|2 VideosTHEORY BASE OF ACCOUNTING , ACCOUNTING STANDARDS AND INDIAN ACCOUNTING STANDARDS (IND - AS)

TS GREWAL|Exercise Very Short Answer Type Questions|32 Videos

Similar Questions

Explore conceptually related problems

TS GREWAL-SPECIAL PURPOSE BOOKS II - OTHER BOOKS-Practical Problems

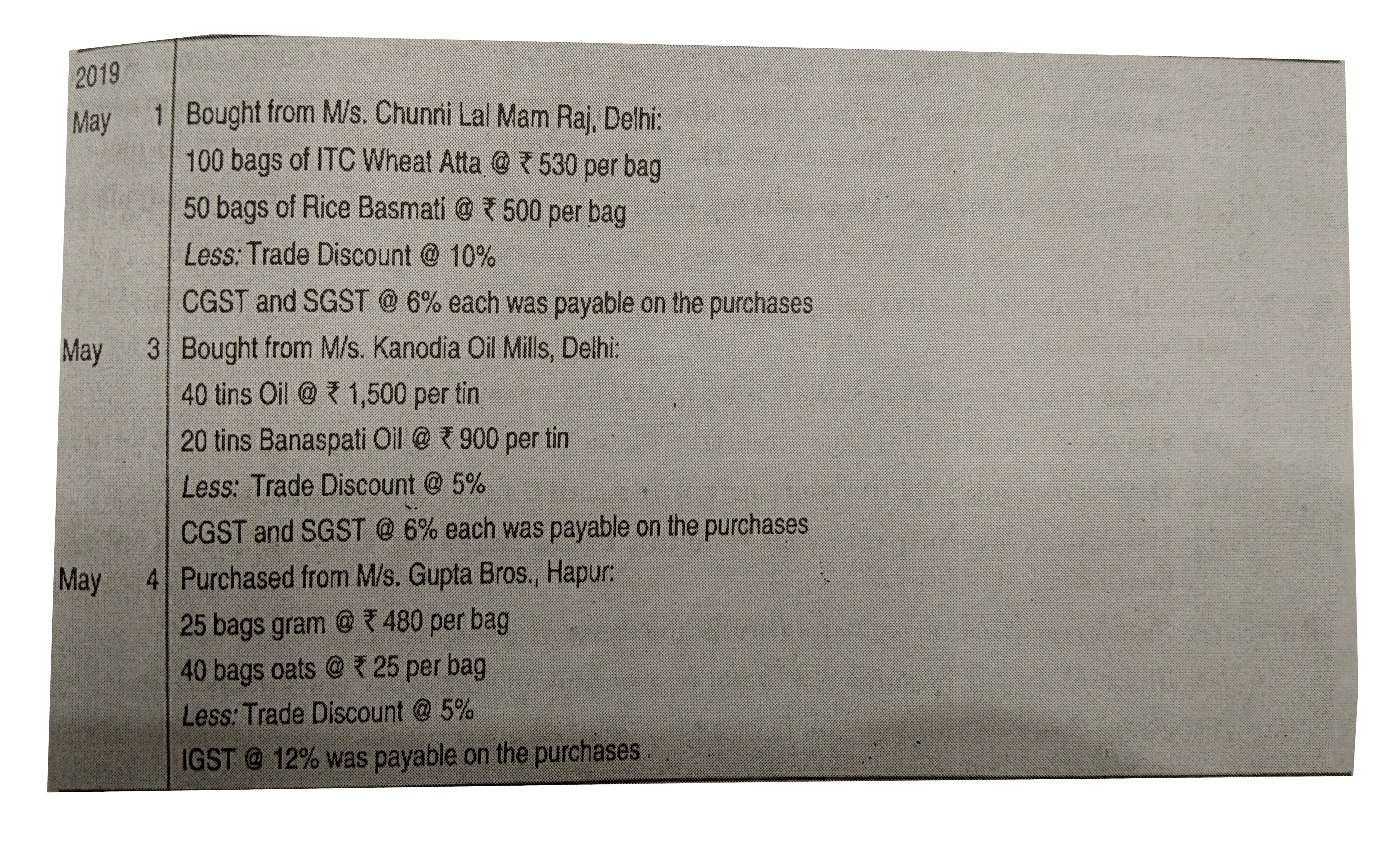

- Record the following transactions in the Purchases Book of Subhash Gen...

Text Solution

|

- Verma Bros., Kolkata carry on business as wholesale cloth dealer. Fr...

Text Solution

|

- From the following transactions of Kamal, Guwahati, prepare Purchases ...

Text Solution

|

- The following purchases were made by Karam, Kolkata, during the month ...

Text Solution

|

- Prepare Sales Book from the following transactions of Hema Traders, Ko...

Text Solution

|

- From the following particulars, prepare Sales Book of M/s. Gyan Prasad...

Text Solution

|

- From the following particulars, prepare Sales Book of Gupta & Co., Kol...

Text Solution

|

- Prepare Purchases and Sales Books from the following transactions of R...

Text Solution

|

- Prepare purchases Return Book of Aruna Stores, Kolkata from the follow...

Text Solution

|

- Record the following transactions in the Purchases Return Book of Kaml...

Text Solution

|

- Prepare Sales Return Book of Shiv Shankar, Delhi from the following tr...

Text Solution

|

- Enter the following transactions in the Sales Return Book of Raj Compu...

Text Solution

|

- Prepare Returns Inward and Returns Outward Books of Manoj, Mumbai from...

Text Solution

|

- (Closing Entries). Give the necessary entries in the Journal Proper o...

Text Solution

|

- (Transfer Entries). Give the Journal entries for the following: (i) ...

Text Solution

|

- (Adjustment Entries). From the following information available on 31st...

Text Solution

|

- Enter the following transactions in proper Subsidiary Books of Ram, Lu...

Text Solution

|

- Write up Purchases and Sales Books from the following transactions of ...

Text Solution

|

- Record the following Transactions of Prabhat Electric Co., Delhi in t...

Text Solution

|

- R. Chetan, Kolkata has the following balances in his books on 1st Marc...

Text Solution

|