Text Solution

Verified by Experts

The correct Answer is:

Topper's Solved these Questions

FINANCIAL STATEMENTS OF SOLE PROPRIETORSHIP

TS GREWAL|Exercise Illustration|50 VideosFINANCIAL STATEMENTS OF SOLE PROPRIETORSHIP

TS GREWAL|Exercise short answer type question|26 VideosDEPRECIATION

TS GREWAL|Exercise EVALUATION QUESTIONS: QUESTIONS WITH MISSING VALUES|3 VideosINTRODUCTION TO ACCOUNTING

TS GREWAL|Exercise Short Answer Type Questions|19 Videos

Similar Questions

Explore conceptually related problems

TS GREWAL-FINANCIAL STATEMENTS OF SOLE PROPRIETORSHIP-Practical Problems

- Following balances appear in the Trial Balance of a firm as on 31st Ma...

Text Solution

|

- From the following information, prepare Trading Account for the year e...

Text Solution

|

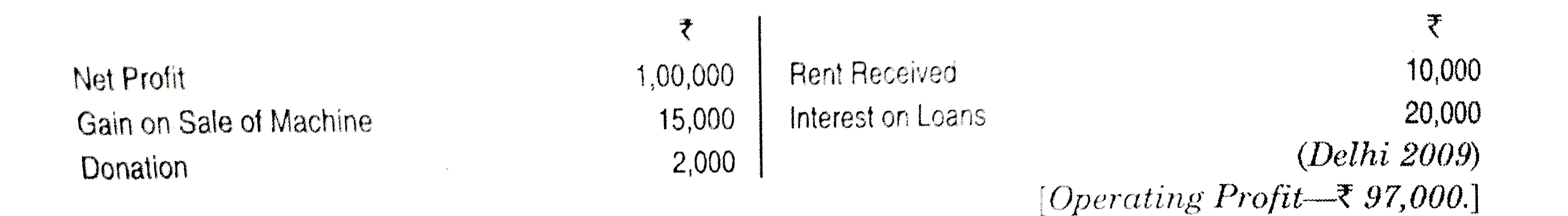

- From the following figures, calculate Operating Profit

Text Solution

|

- From the following, prepare Profit and Loss Account of Sohan Lal as it...

Text Solution

|

- From the following information, prepare Profit and Loss Account for th...

Text Solution

|

- From the following particulars, prepare Balance Sheet as at 31st March...

Text Solution

|

- From the following information, prepare Balance Sheet of a trader as a...

Text Solution

|

- From the Balance Sheet given below, calculate: (i) Fixed Assets (ii)...

Text Solution

|

- Prepare Trading and Profit and Loss Account and Balance Sheet of Jagat...

Text Solution

|

- From the following balances, prepare Trading and Profit and Loss Accou...

Text Solution

|

- The following are the balances as on 31st March, 2019 extracted from t...

Text Solution

|

- From the following balances of Anand, prepare Trading Account, Profit ...

Text Solution

|

- From the following balances, prepare Final Accounts of M/s Raja & Sons...

Text Solution

|

- From the following balances, prepare Final Accounts of M/s Mangal & So...

Text Solution

|

- From the following balances prepare Trading and Profit and Loss Accoun...

Text Solution

|

- From the following balances taken from the books of Hari & Co., prepar...

Text Solution

|

- From the following balances, as on 31st March, 2019, prepare Trading a...

Text Solution

|

- Trial Balance of Chatter Sen on 31st March, 2019 revealed the followin...

Text Solution

|

- Following Trial Balance is extracted from the books of a merchant on 3...

Text Solution

|

- The following balances were extracted from the books of Harish Chandra...

Text Solution

|