Text Solution

Verified by Experts

The correct Answer is:

Topper's Solved these Questions

FINANCIAL STATEMENTS OF NOT-FOR-PROFIT ORGANISATIONS

TS GREWAL|Exercise Example|1 VideosFINANCIAL STATEMENTS OF NOT-FOR-PROFIT ORGANISATIONS

TS GREWAL|Exercise Questions|6 VideosFINANCIAL STATEMENT OF A COMPANY

TS GREWAL|Exercise EXERCISE|45 VideosGOODWILL: NATURE AND VALUATION

TS GREWAL|Exercise EVALUATION QUESTIONS: QUESTIONS WITH MISSING VALUES|2 Videos

TS GREWAL-FINANCIAL STATEMENTS OF NOT-FOR-PROFIT ORGANISATIONS-Exercise

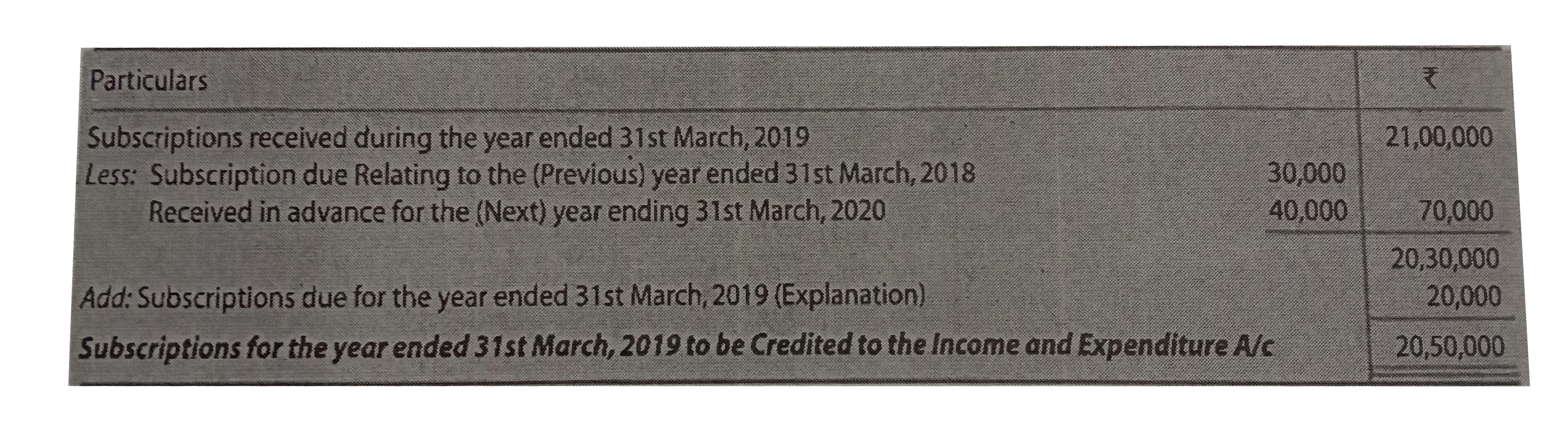

- In the year ended 31st March, 2019 subscriptions received were Rs. 21,...

Text Solution

|

- From the information given below prepare Receipts and Payments Account...

Text Solution

|

- Bengal Cricket Club was inaugurated on 1st April 2018. It had the foll...

Text Solution

|

- The following information were obtained from the books of Delthi Club...

Text Solution

|

- from the following information prepare Receipts and Payments Account ...

Text Solution

|

- From the following particulars of Evergreen Club prepare Receipts an...

Text Solution

|

- How are the following items shown in the accounts of a Not-for-Profit...

Text Solution

|

- How are the following dealt with in the accounts of a Not-for-Profit O...

Text Solution

|

- How are the following dealt with while preparing the final accounts o...

Text Solution

|

- From the following information of a club show the amounts of match exp...

Text Solution

|

- Show how are the following items dealt with while preparing the final ...

Text Solution

|

- How is Entrance Fees dealt with while preparing the final accounts for...

Text Solution

|

- In the ended 31st March 2019 subscriptions received by the jaipur Lit...

Text Solution

|

- Subscriptions received during the year ended 31st March 2019 are : ...

Text Solution

|

- In the year ended 31st March 2019 subscriptions received by kings Cl...

Text Solution

|

- From the following information calculate amount of subscriptions to b...

Text Solution

|

- Calculate amount of subscription which will be treated as income for ...

Text Solution

|

- From the following particulars calculate amount of subscription to be ...

Text Solution

|

- How are the following items of subscriptions shown in the Income and E...

Text Solution

|

- From the following information calculate amount of subscriptions outst...

Text Solution

|

- From the following information , prepare subscription Account for the ...

Text Solution

|