Text Solution

Verified by Experts

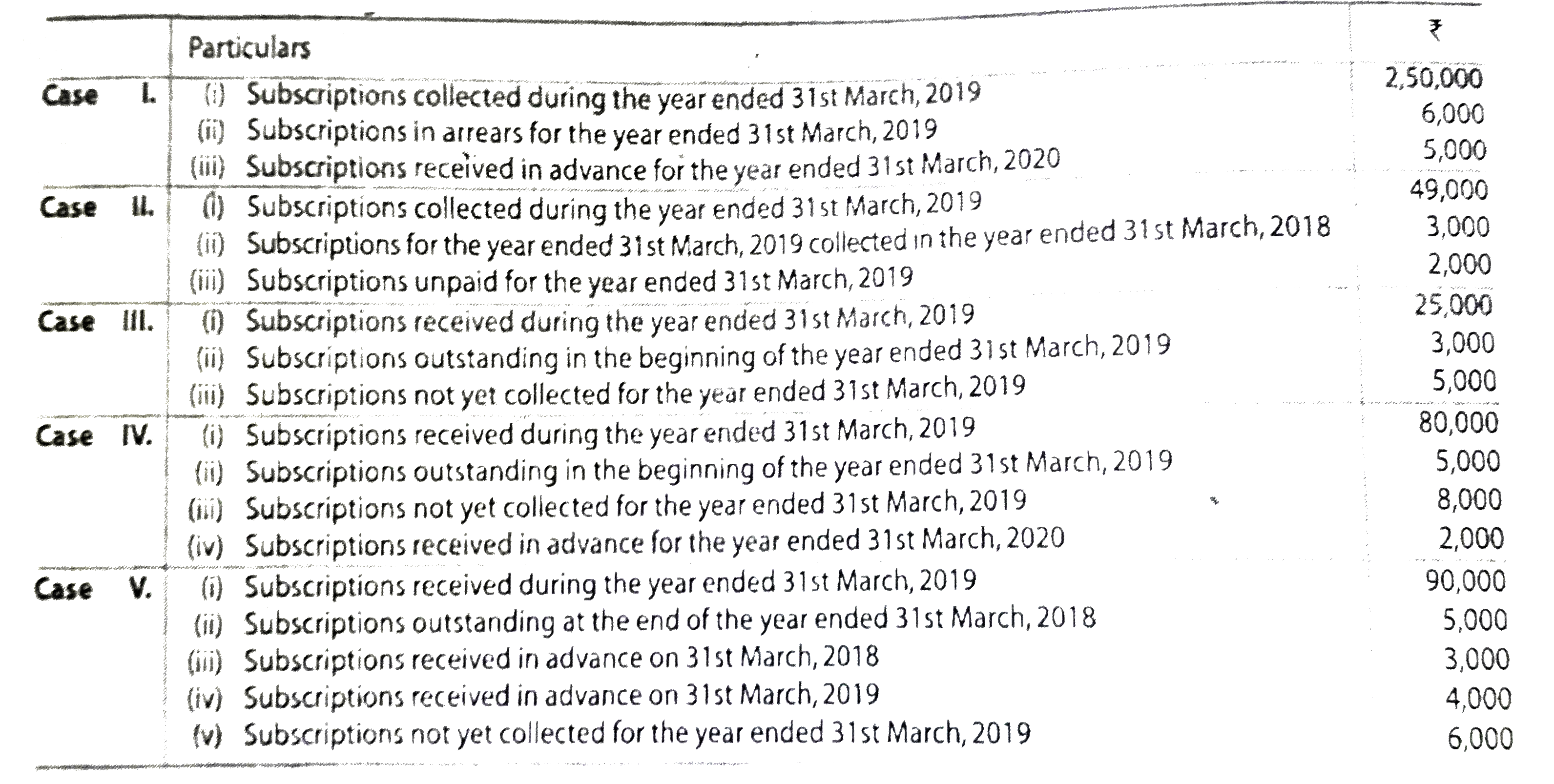

The correct Answer is:

Topper's Solved these Questions

Similar Questions

Explore conceptually related problems

TS GREWAL-FINANCIAL STATEMENTS OF NOT-FOR-PROFIT ORGANISATIONS-Exercise

- In the year ended 31st March 2019 subscriptions received by kings Cl...

Text Solution

|

- From the following information calculate amount of subscriptions to b...

Text Solution

|

- Calculate amount of subscription which will be treated as income for ...

Text Solution

|

- From the following particulars calculate amount of subscription to be ...

Text Solution

|

- How are the following items of subscriptions shown in the Income and E...

Text Solution

|

- From the following information calculate amount of subscriptions outst...

Text Solution

|

- From the following information , prepare subscription Account for the ...

Text Solution

|

- On the basis of the information given below, Calculate the amount of m...

Text Solution

|

- Calculate amount of mediciness consumed the year ended 131st March 201...

Text Solution

|

- Calcualte amount to be posted to the income and Expenditure Account f...

Text Solution

|

- On the basis of the following information calculate amount that will a...

Text Solution

|

- Calculate the amount that will be posted to the income and Expenditur...

Text Solution

|

- Calculate the amount of sports material to be transferred to income a...

Text Solution

|

- How are the following dealt with while preparing the final accounts f...

Text Solution

|

- How are the following dealt with while preparing the final accounts fo...

Text Solution

|

- Hor are the following dealt with while preparing the final accounts o...

Text Solution

|

- From the following information of a Not-for-Profit Organisation show t...

Text Solution

|

- The book value of furniture on 1st April 2018 is Rs 60,000. Half of th...

Text Solution

|

- Delhi Youth Club has furniture at a value of Rs. 2,20,000 in its book ...

Text Solution

|

- In the year ended 31st march 2019 Salaries paid amounted to Rs. 2.04,...

Text Solution

|