Text Solution

Verified by Experts

Topper's Solved these Questions

COMPANY ACCOOUNT -ISSUE OF DEBENTURES

TS GREWAL|Exercise Answers To Questions|4 VideosCOMPANY ACCOOUNT -ISSUE OF DEBENTURES

TS GREWAL|Exercise Questions(Very short Answer Type Questions)|11 VideosCOLLAGE OF OBJECTIVE TYPE/MULTIPLE CHOICE QUESTIONS (MCQS)

TS GREWAL|Exercise Multiple choice question|286 VideosCOMPANY ACCOUNTS REDEMPTION OF DEBENTURES

TS GREWAL|Exercise EXERCISE|24 Videos

Similar Questions

Explore conceptually related problems

TS GREWAL-COMPANY ACCOOUNT -ISSUE OF DEBENTURES-Evaluation Questions

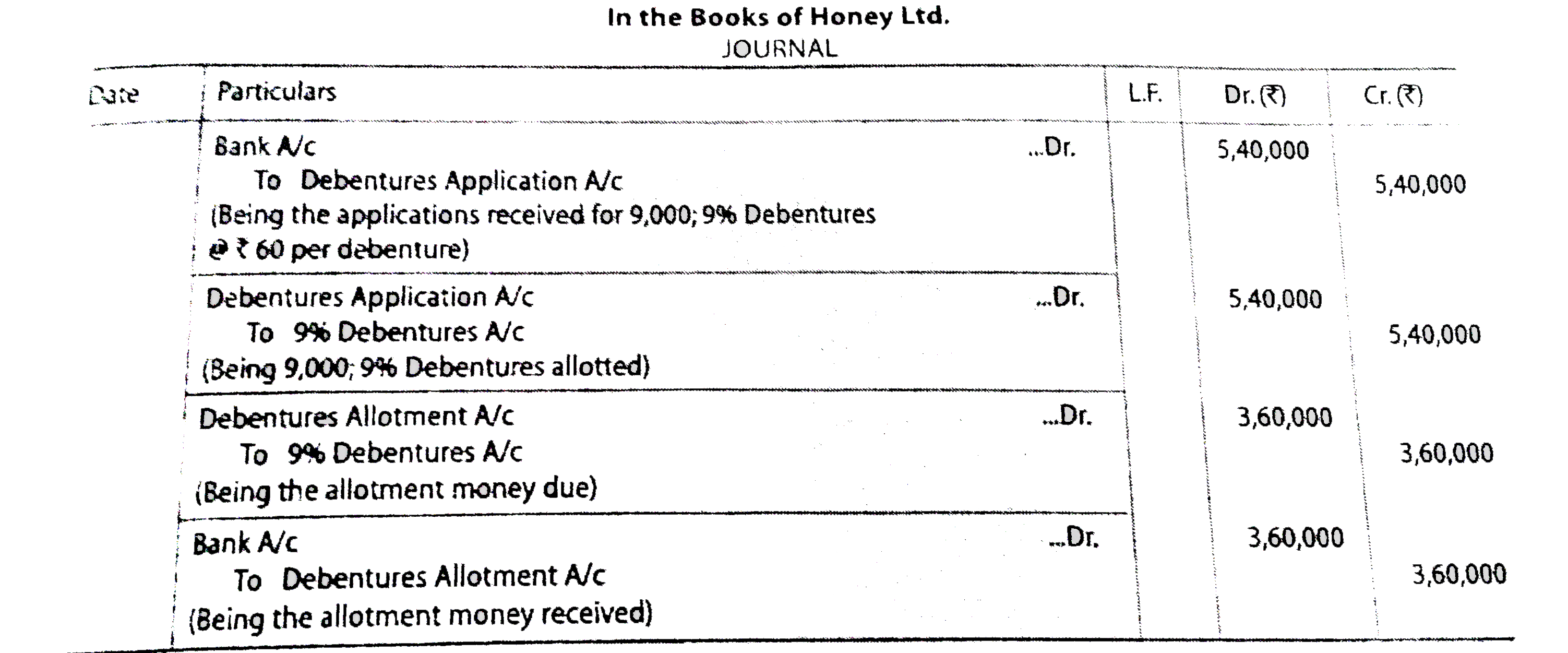

- Honey Ltd . Issued 10,000, 9% Debentures of ₹ 100 each for subscri...

Text Solution

|

- Fill the missing value in the following:

Text Solution

|

- A Ltd. Purchased machinery from Kiran Machines Ltd. And paid them by i...

Text Solution

|

- Complete the following Journal entries:

Text Solution

|

- Complete the following Journal entries:

Text Solution

|