Text Solution

Verified by Experts

Topper's Solved these Questions

COMPANY ACCOUNTS REDEMPTION OF DEBENTURES

TS GREWAL|Exercise VERY SHORT ANSWER TYPE QUESTIONS|3 VideosCOMPANY ACCOUNTS REDEMPTION OF DEBENTURES

TS GREWAL|Exercise EXERCISE|24 VideosCOMPANY ACCOOUNT -ISSUE OF DEBENTURES

TS GREWAL|Exercise Evaluation Questions|4 VideosCOMPANY ACCOUNTS- ACCOUNTING FOR SHARE CAPITAL

TS GREWAL|Exercise Evaluation Questions: Questions With Missing Values|6 Videos

Similar Questions

Explore conceptually related problems

TS GREWAL-COMPANY ACCOUNTS REDEMPTION OF DEBENTURES-EXERCISE

- (Transfer of DRR to General Reserve on redemption of all the debenture...

Text Solution

|

- Star Ltd. Is a manufacturer of chemical fertilisers. Its annual turnov...

Text Solution

|

- Young India Ltd. Had issued following debentures : (a) 1,00,000 10% ...

Text Solution

|

- Dow Ltd. Issued Rs. 2,00,000, 8% Debentures of Rs. 10 each at a premiu...

Text Solution

|

- Nirbhai Chemicals Ltd. Issued RS. 10,00,000 , 6% Debentures of Rs. 50...

Text Solution

|

- Export-Import Bank of India (EXIM Bank) issued 20,000, 10% Debentures ...

Text Solution

|

- SRCC Ltd. has issued on 1st April, 2017, 20,000, 12% debentures of Rs....

Text Solution

|

- IFCl Ltd. (An All India Financial Institution) issued 10,00,000 9% Deb...

Text Solution

|

- On 31 st March, 2003, G Ltd. Had Rs. 8,00,000 9% Debentures due for re...

Text Solution

|

- {:("On 31 st March, 2018, W Ltd. had the following balances in its boo...

Text Solution

|

- Mansi Ltd. had 6,000, 10% Debentures of Rs. 100 each due for redemptio...

Text Solution

|

- India Textiles Corporation Ltd. has outstanding Rs. 50,00,000, 9% Deb...

Text Solution

|

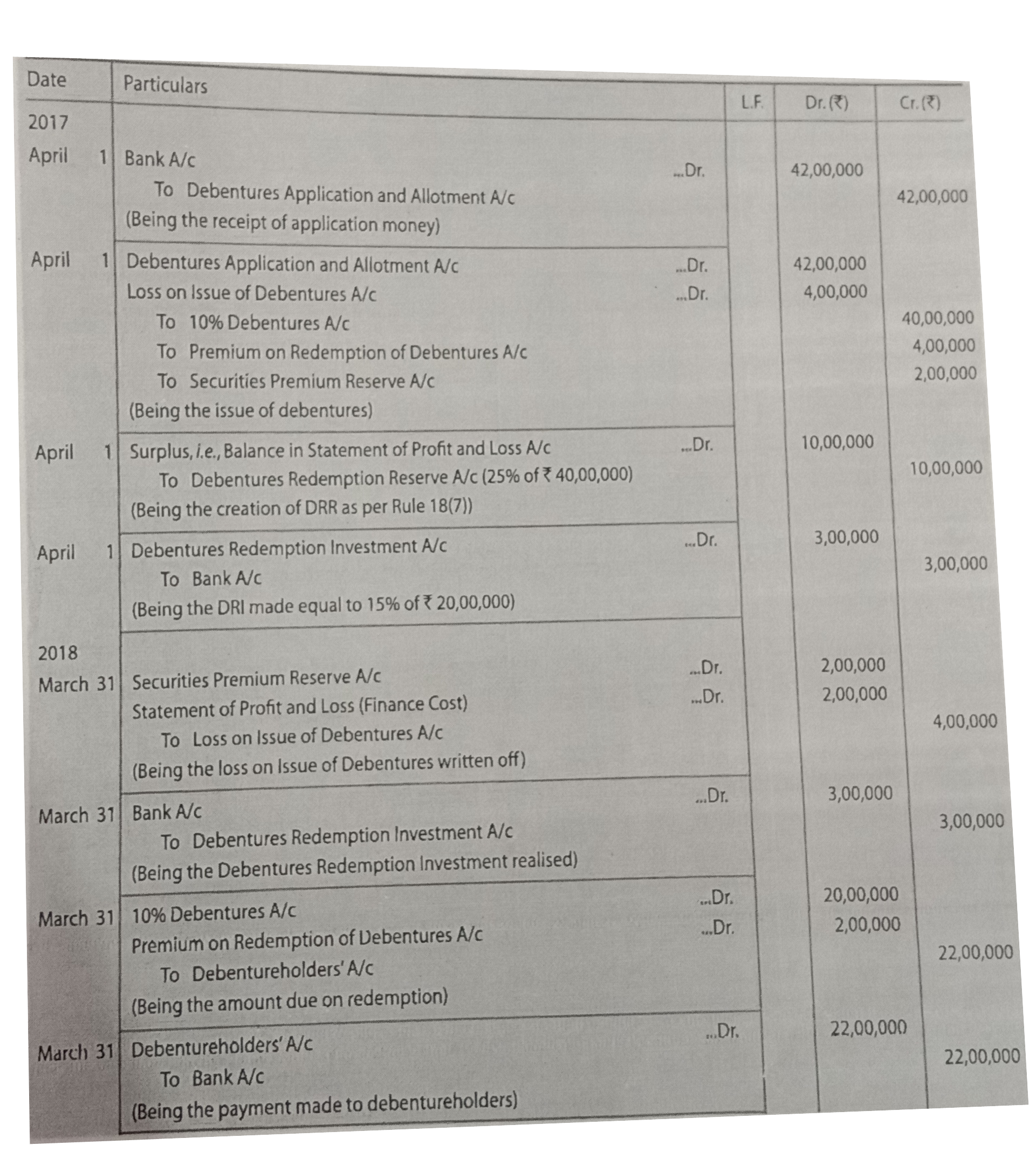

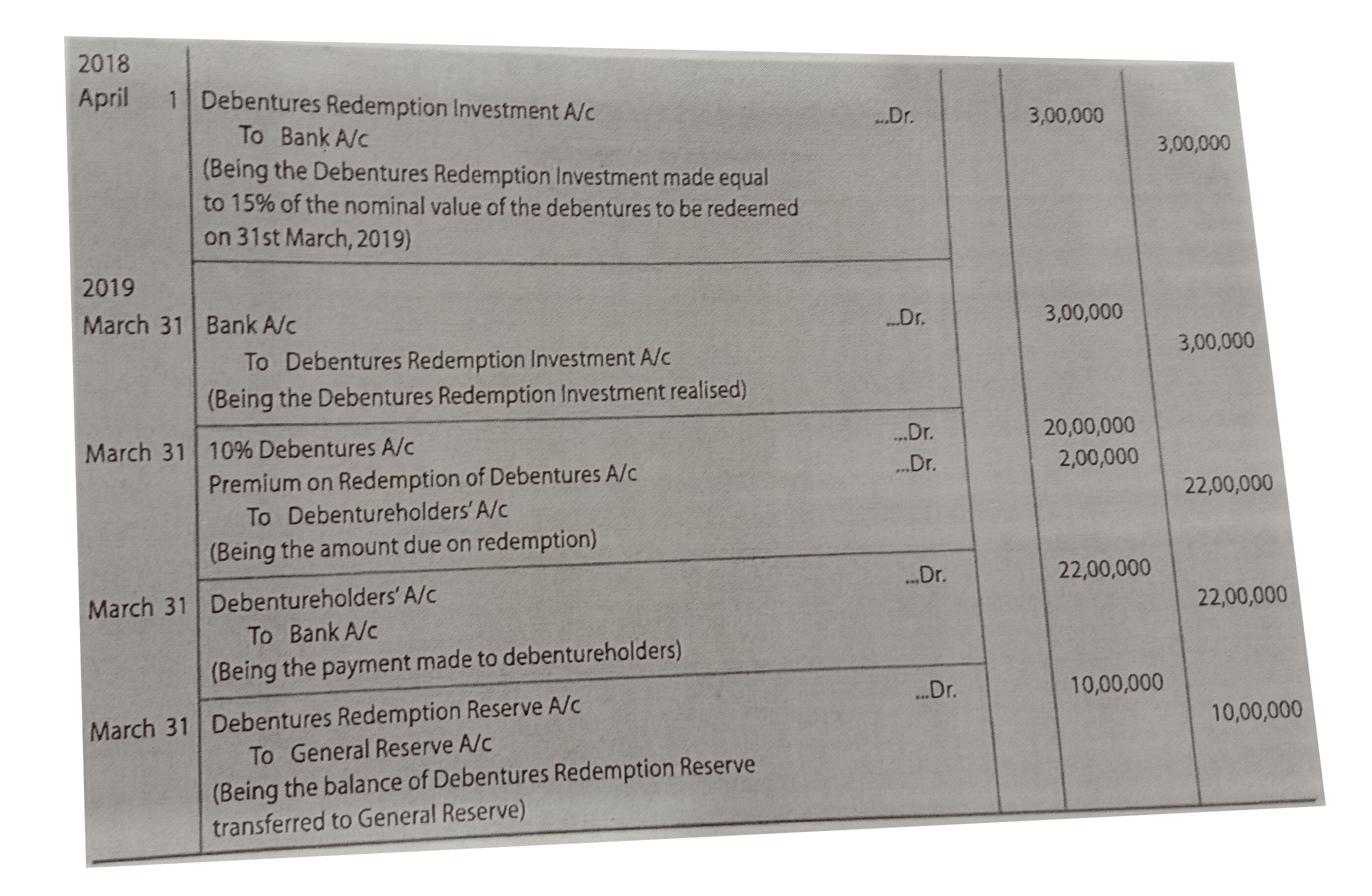

- Manish Ltd. Issued Rs. 40,00,000, 8% Debentures of Rs. 100 each on 1st...

Text Solution

|

- Godrej Ltd. has 20,000, 7% Debentures of Rs. 100 each due for redempt...

Text Solution

|

- Apolio Ltd. Issued 21,000, 8% Debentures of Rs. 100 each on 1st April,...

Text Solution

|

- On 1st April, 2016, following were the balances of Blue Bird Ltd. : ...

Text Solution

|

- Mahima Ltd. Issued Rs. 38,00,000, 9% Debentures of Rs. 100 each on 1s...

Text Solution

|

- On 1st April, 2013 the following balances appeared in books of Blue an...

Text Solution

|

- Rich Sugar Ltd. Issued Rs. 20 Lakh, 8% Debentures divided into debentu...

Text Solution

|

- Hp Ltd. has 1,00,000, 8% Debentures of Rs. 50 each due for redemption ...

Text Solution

|

- Venus Ltd. had 9,000, 9% Debentures of Rs. 100 each due for redemption...

Text Solution

|