Text Solution

Verified by Experts

Topper's Solved these Questions

COMPANY ACCOUNTS- ACCOUNTING FOR SHARE CAPITAL

TS GREWAL|Exercise Example|1 VideosCOMPANY ACCOUNTS- ACCOUNTING FOR SHARE CAPITAL

TS GREWAL|Exercise 8.1|2 VideosCOMPANY ACCOUNTS REDEMPTION OF DEBENTURES

TS GREWAL|Exercise EXERCISE|24 VideosDISSOLUTION OF A PARTNERSHIP FIRM

TS GREWAL|Exercise Evaluation Questions : Questions with Missing Values|4 Videos

TS GREWAL-COMPANY ACCOUNTS- ACCOUNTING FOR SHARE CAPITAL-Evaluation Questions: Questions With Missing Values

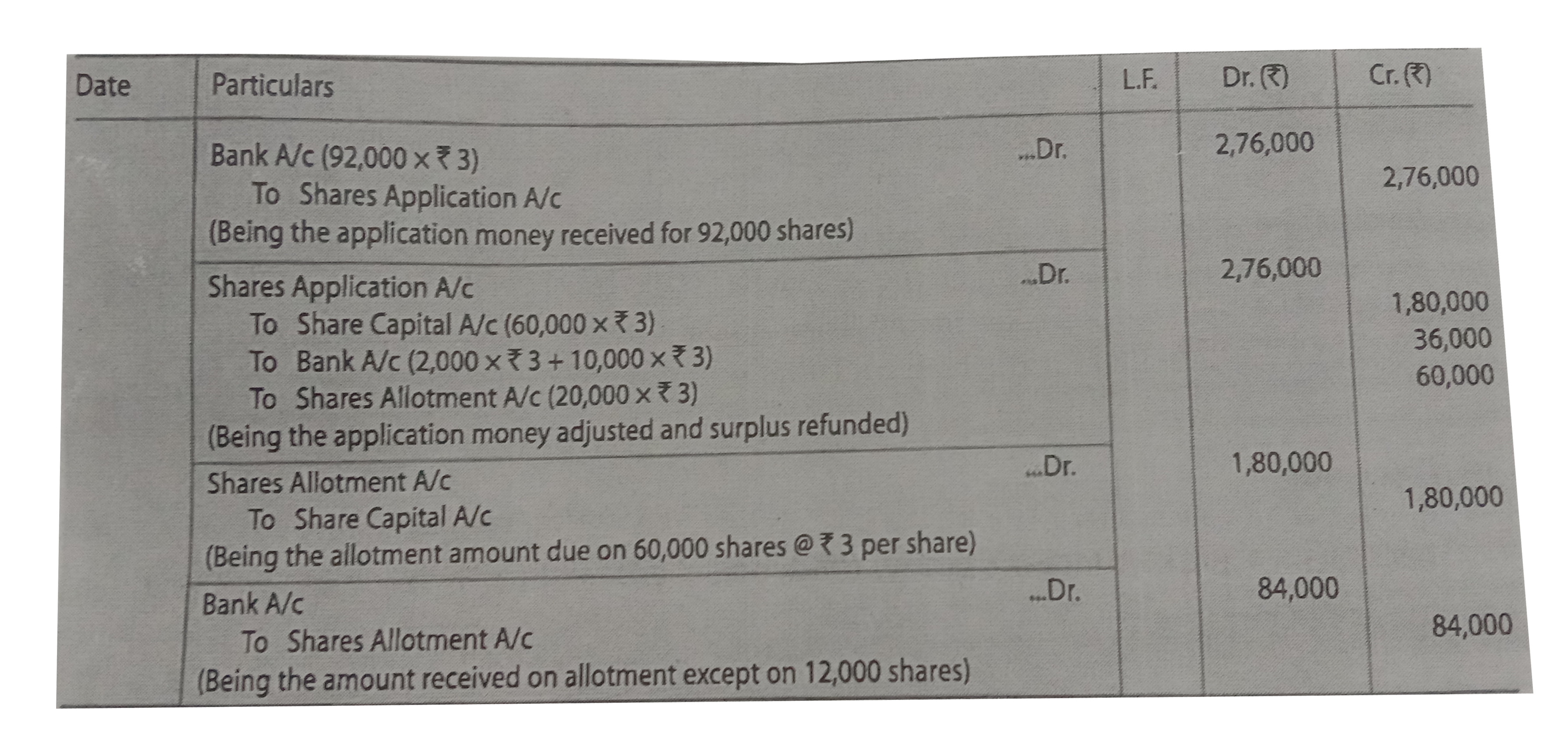

- (Shares Issued at Par, Oversubscribed-full allotment to some applican...

Text Solution

|

- (Business Purchase and Issue of Shares to Vendor). Complete the foll...

Text Solution

|

- (Business Purchase and Issue of Shares to Vendor). Complete the foll...

Text Solution

|

- (Forfeiture and Reissue of Shares). Complete the following Journal e...

Text Solution

|

- (Forfeiture and Reissue of Shares). Complete the following Journal e...

Text Solution

|

- Complete the following Journal entries:

Text Solution

|

- Complete the missing (?) figures in the following Extract of Balance S...

Text Solution

|