Text Solution

Verified by Experts

Topper's Solved these Questions

Similar Questions

Explore conceptually related problems

TS GREWAL-Admission of a Partner-EXERCISE

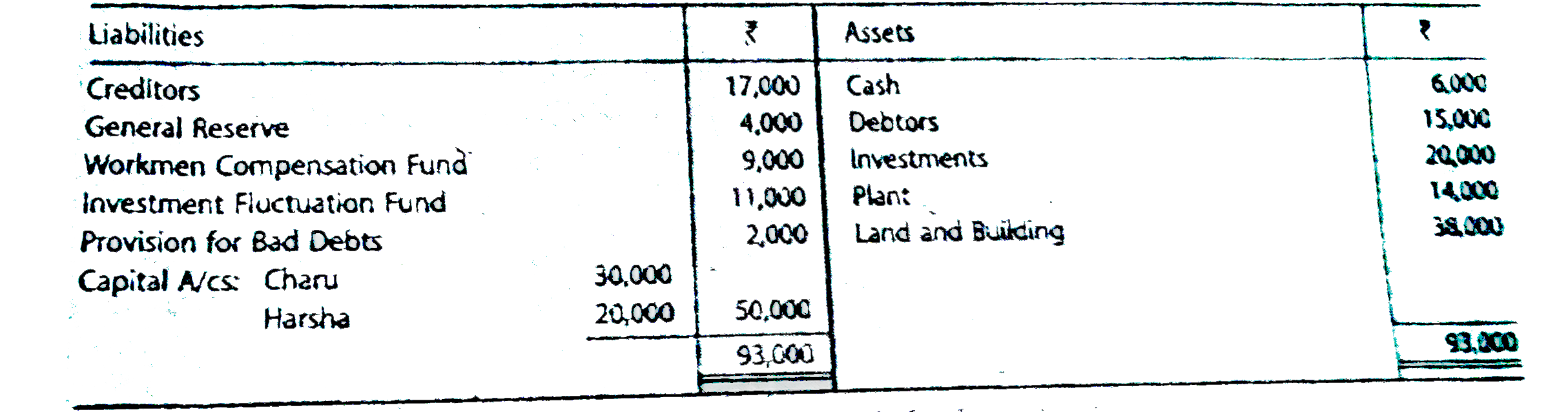

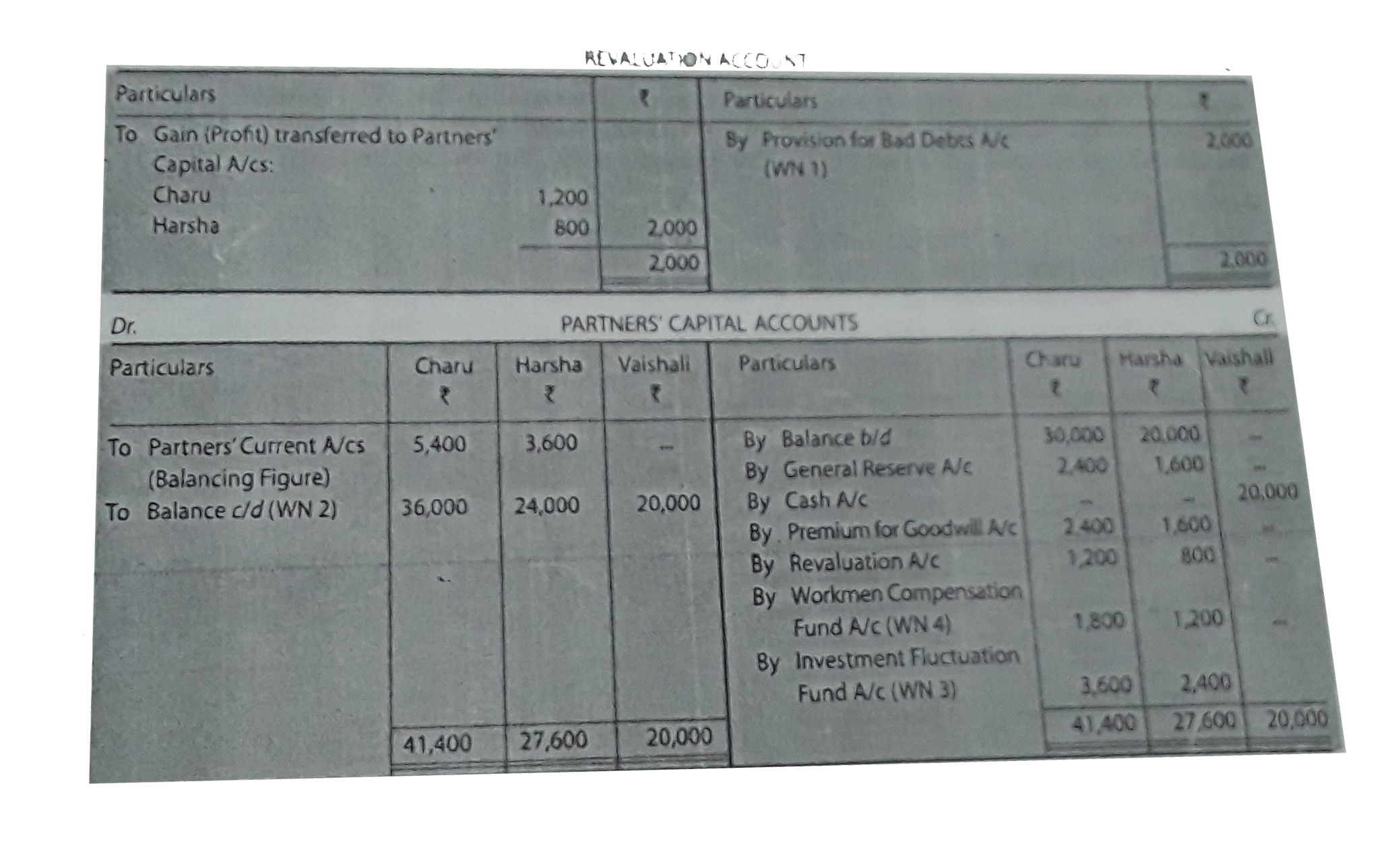

- Charu and Harsha were partners in a firm sharing profits in the ratio ...

Text Solution

|

- X, Y and Z are partners sharing profits and losses in the ratio of 5 :...

Text Solution

|

- Ravi and Mukesh are sharing profits in the ratio of 7 : 3. They admit...

Text Solution

|

- A and B are partners sharing and losses in the porportion of 7 : 5. Th...

Text Solution

|

- A, B and C were partners in a firm sharing profits in the ratio of 3 :...

Text Solution

|

- Bharati and Astha were partners sharing profits in the ratio of 3 : 2....

Text Solution

|

- X and Y are partners in a firm sharing profits and losses in the ratio...

Text Solution

|

- R and S are partners sharing profits in the ratio of 5 : 3. T joins th...

Text Solution

|

- Kabir and Farid are partners in a firm sharing profits and losses in t...

Text Solution

|

- Find New Profit-sharing Ratio: (i) R and T are partners in a firm sh...

Text Solution

|

- X and Y are partners sharing profits in the ratio of 3 : 2. They admit...

Text Solution

|

- Rakesh and Suresh are sharing profits in the ratio of 4 : 3. Zaheer jo...

Text Solution

|

- A and B are partners sharing profits in the ratio of 3 : 2. C is admi...

Text Solution

|

- A, B and C are partners sharing profits in the ratio of 4 : 3 : 2. D i...

Text Solution

|

- A, B, C and D are in partnership sharing profits and losses in the rat...

Text Solution

|

- X and Y are partners sharing profits and losses in the of 3 : 2. They ...

Text Solution

|

- A, B and C are partners sharing profits in the ratio of 2 : 2 : 1, D i...

Text Solution

|

- A and B are in partnership sharing profits and losses as 3 : 2. C is a...

Text Solution

|

- P and Q are partners sharing profits in the ratio of 3 : 2. They admit...

Text Solution

|

- A and B are partners sharing profits and losses in the ratio of 2 : 1....

Text Solution

|

- A and B are partners sharing profits and losses in the ratio of 2 : 5....

Text Solution

|