Text Solution

Verified by Experts

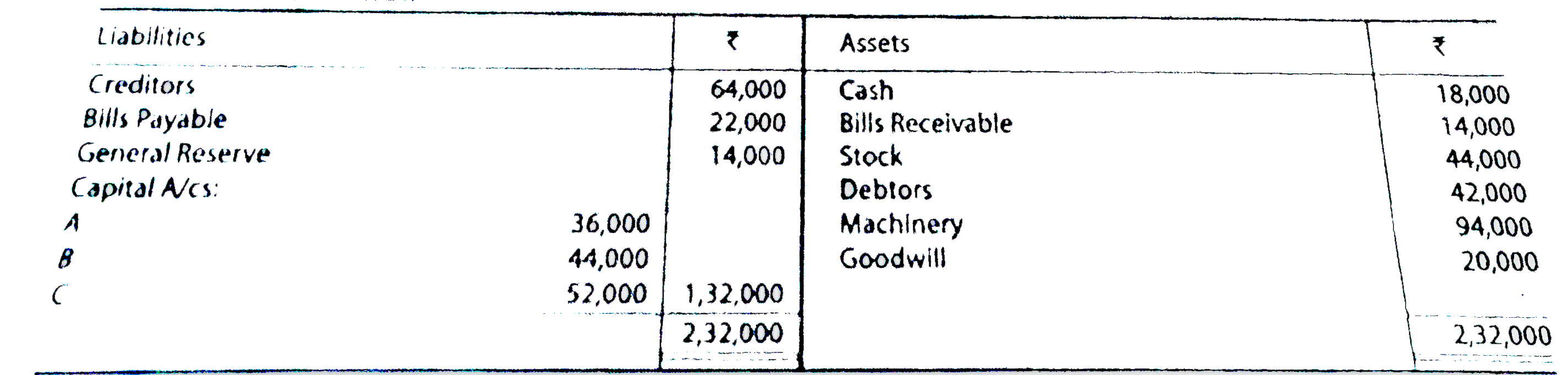

The correct Answer is:

Topper's Solved these Questions

Similar Questions

Explore conceptually related problems

TS GREWAL-Admission of a Partner-EXERCISE

- The Balance Sheet of X,Y and Z who share profits and losses in the rat...

Text Solution

|

- Shikhar and Rohit were partners in a firm sharing profits in the ratio...

Text Solution

|

- Raghu and Rishu are partners sharing profits in the ratio 3:2. Their B...

Text Solution

|

- Following is the Balance Sheet of Abha and Binay as at 31st March, 20...

Text Solution

|

- Sarthak and Vanshg are partners sharing profits in the ratio of 2:1 . ...

Text Solution

|

- A,B and C are partners sharing profits and losses in the ratio of 2:3:...

Text Solution

|

- A and B are partners in a firm sharing profits in the ratio of 3:2 The...

Text Solution

|

- L, M and N were partners in a firm sharing profits in the ratio of 3:2...

Text Solution

|

Text Solution

|

Text Solution

|

Text Solution

|

Text Solution

|

Text Solution

|

Text Solution

|

Text Solution

|

Text Solution

|

Text Solution

|

Text Solution

|

Text Solution

|

Text Solution

|