Text Solution

Verified by Experts

Topper's Solved these Questions

DISSOLUTION OF A PARTNERSHIP FIRM

TS GREWAL|Exercise Questions|8 VideosDISSOLUTION OF A PARTNERSHIP FIRM

TS GREWAL|Exercise Questions (Select the Correct Alternative)|7 VideosCOMPANY ACCOUNTS- ACCOUNTING FOR SHARE CAPITAL

TS GREWAL|Exercise Evaluation Questions: Questions With Missing Values|6 VideosFINANCIAL STATEMENT ANALYSIS

TS GREWAL|Exercise Short Answer Type Questions|16 Videos

Similar Questions

Explore conceptually related problems

TS GREWAL-DISSOLUTION OF A PARTNERSHIP FIRM-Evaluation Questions : Questions with Missing Values

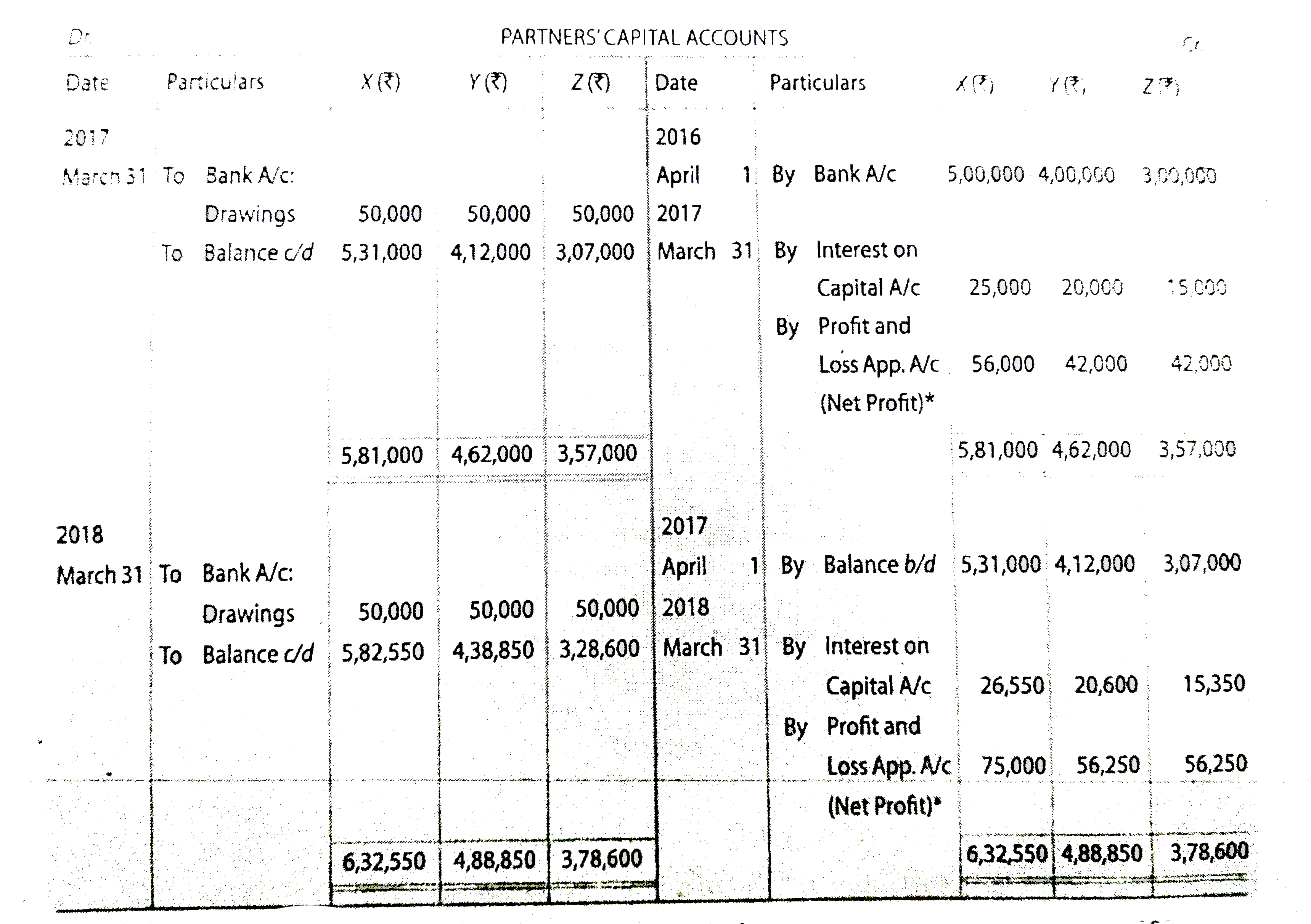

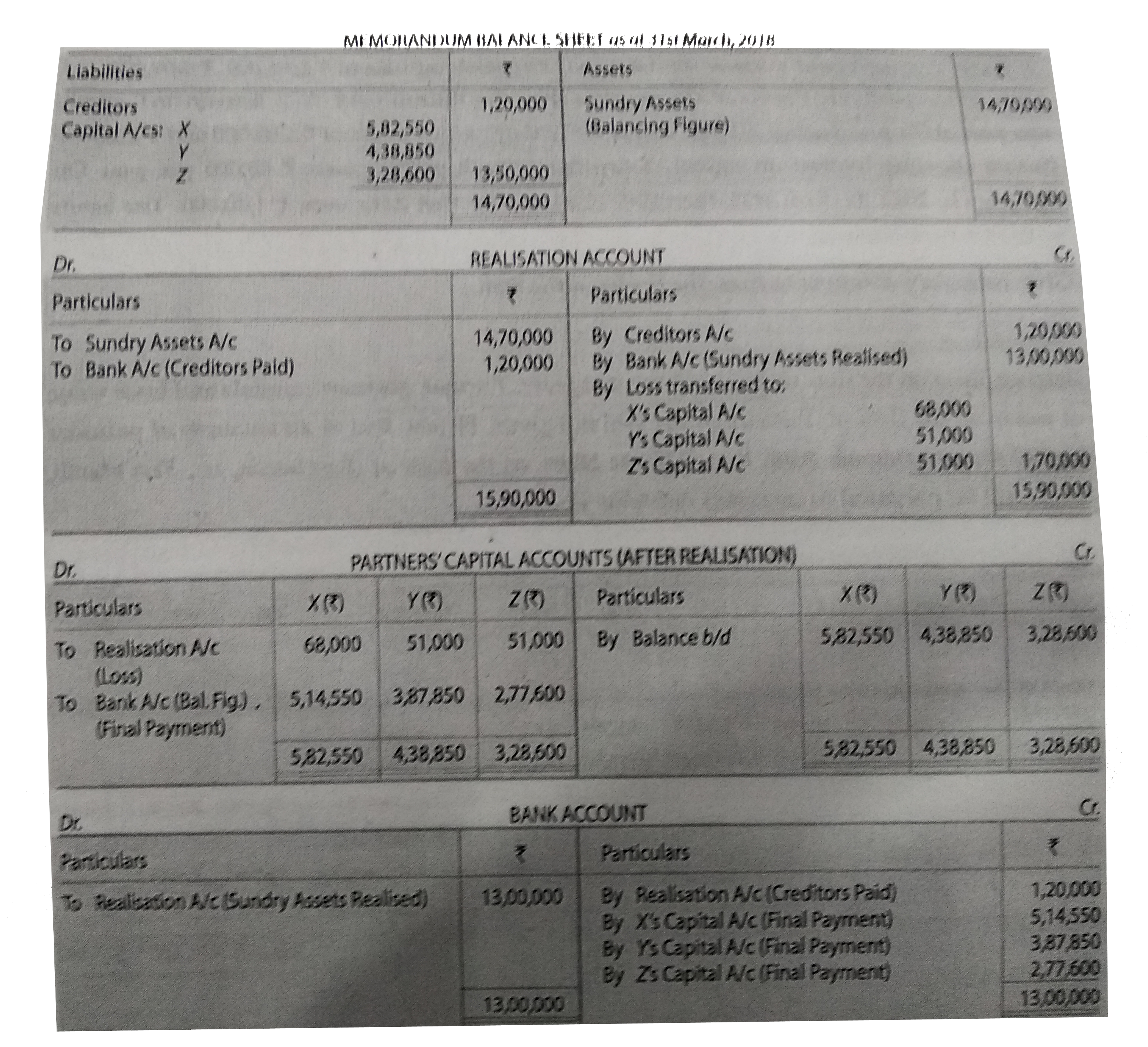

- X , Y and Z commenced business on 1st April , 2016 with capitals of ₹ ...

Text Solution

|

- (Dissolution of firm ). Ashish and Neha were partners in a firm sharin...

Text Solution

|

- Bora , Singh and Ibrahim were partners in a firm sharing profits in th...

Text Solution

|

- A , B and C are partners sharing profits and losses in the ratio of 2...

Text Solution

|

- X and Y were partners in a firm sharing profits and losses in the rati...

Text Solution

|