Text Solution

Verified by Experts

Topper's Solved these Questions

DISSOLUTION OF A PARTNERSHIP FIRM

TS GREWAL|Exercise Preparation of Memorandum Balance Sheet|12 VideosDISSOLUTION OF A PARTNERSHIP FIRM

TS GREWAL|Exercise Evaluation Questions : Questions with Missing Values|4 VideosDISSOLUTION OF A PARTNERSHIP FIRM

TS GREWAL|Exercise Realisation Account|2 VideosCOMPANY ACCOUNTS- ACCOUNTING FOR SHARE CAPITAL

TS GREWAL|Exercise Evaluation Questions: Questions With Missing Values|6 VideosFINANCIAL STATEMENT ANALYSIS

TS GREWAL|Exercise Short Answer Type Questions|16 Videos

Similar Questions

Explore conceptually related problems

TS GREWAL-DISSOLUTION OF A PARTNERSHIP FIRM-Realisation Account , Partner s Capital Accounts and Bank/Cash Account

- Bale and Yale are equal partners of a firm . They decide to dissolve t...

Text Solution

|

- Shilpa , Meena and Nanda decided to dissolve their partnership on 31st...

Text Solution

|

- A and B are partners in a firm sharing profits and losses in the ratio...

Text Solution

|

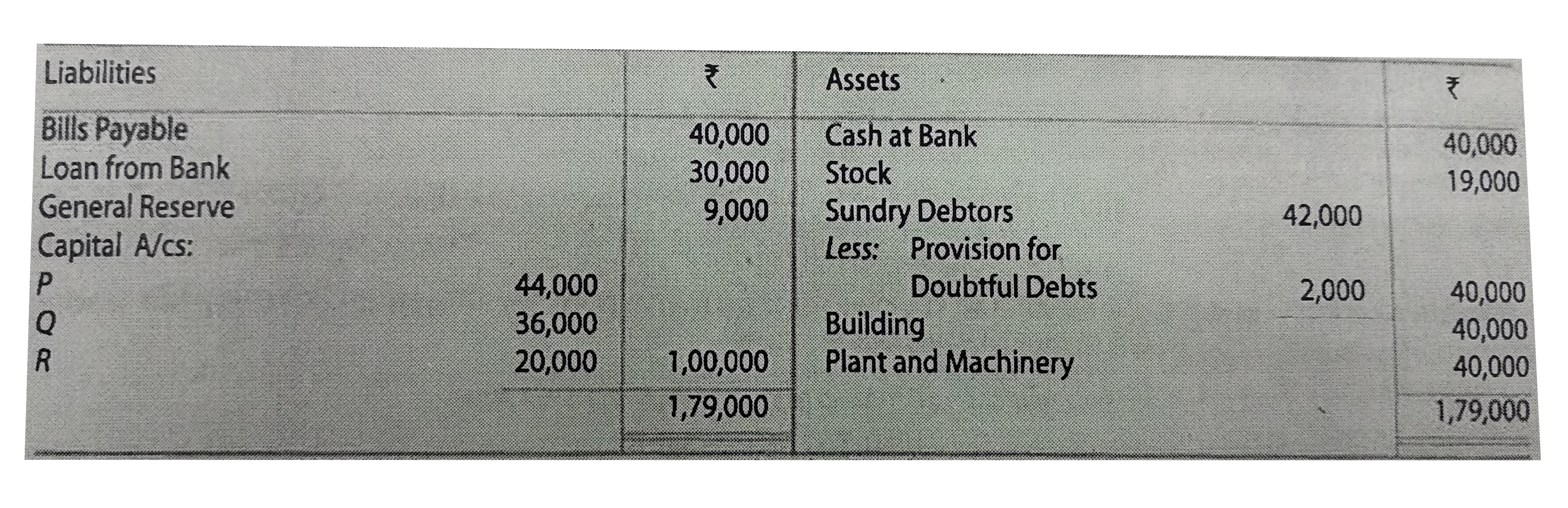

- Balance Sheet of P , Q and R as at 31st March , 2019 , who were sharin...

Text Solution

|

- Vinod , Vijay and Venkat are partners sharing profits and losses in t...

Text Solution

|

- P , Q and R were partners in a firm sharing profits and losses in the ...

Text Solution

|

- Ashu and Harish are partners sharing profits and losses as 3 : 2 . T...

Text Solution

|

- A , B and C were equal partners . On 31st March , 2019, their Balance ...

Text Solution

|

- Yogesh and Naresh were partners sharing profits equally . They dissolv...

Text Solution

|

- A , B and C are in partnership sharing profits and losses in the prop...

Text Solution

|

- A and B are partners in a firm sharing profits and losses in the ratio...

Text Solution

|

- Ashok , Babu and Chetan are in partnership sharing profit in the propo...

Text Solution

|

- X, Y and Z carrying on business as merchants and sharing profits and l...

Text Solution

|

- Rita and Sobha are partners in a firm ,Fancy Garments Exports profits ...

Text Solution

|

- Following is the Balance Sheet of Arvind and Balbir as at 31st March 2...

Text Solution

|

- Anju , Manju and Sanju were partners in a firm sharing profits in the ...

Text Solution

|

- A, B and C in partnership sharing profits in the ratio of 7 : 2 : 1 a...

Text Solution

|

- Srijan , Raman and Manan were partners in a firm sharing profits and l...

Text Solution

|

- A , B and C were partners sharing profits in the ratio of 2: 2 :1 . T...

Text Solution

|

- Krishna and Arjun are partners in a firm . They share profits in the r...

Text Solution

|