Text Solution

Verified by Experts

Topper's Solved these Questions

ACCOUNTING RATIOS

TS GREWAL|Exercise Evaluation Questions|13 VideosACCOUNTING RATIOS

TS GREWAL|Exercise Exercise|147 VideosACCOUNTING FOR PARTNERSHIP FIRMS-FUNDAMENTALS

TS GREWAL|Exercise EVALUATION QUESTION :QUESTIONSWITHMISSINGVALUES|3 VideosAdmission of a Partner

TS GREWAL|Exercise EXERCISE|107 Videos

Similar Questions

Explore conceptually related problems

TS GREWAL-ACCOUNTING RATIOS -Exercise

- Current ratio of a company is 3:1 state giving reasons ,which of the f...

Text Solution

|

- From the following compute curent ratio:

Text Solution

|

- calculate current ratio from the following information:

Text Solution

|

- Current ratio is 2.5 working capital is Rs 150000. calculate the amoun...

Text Solution

|

- Working capital is Rs 900000, Trade payables Rs 90000, and other curre...

Text Solution

|

- Working capital Rs 180000, total debts Rs 390000, long term debts Rs 3...

Text Solution

|

- Current assets are Rs 750000 and working capital is Rs 250000. calcula...

Text Solution

|

- Trade payables rs 50000 working capital Rs 900000, current liabilities...

Text Solution

|

- A company had current assets of Rs 450000 and current liabilites of Rs...

Text Solution

|

- Current liabilites of a company were Rs 175000 and its current ratio w...

Text Solution

|

- Ratio of current assets (Rs 300000) to current liabilities (Rs 200000)...

Text Solution

|

- Ratio of currents assets (Rs 275000) to curent liabilites (Rs 350000) ...

Text Solution

|

- A firm had curent assets of Rs 500000.It paid current liabilities of R...

Text Solution

|

- state giving reason whether the current ratio will improve or decline ...

Text Solution

|

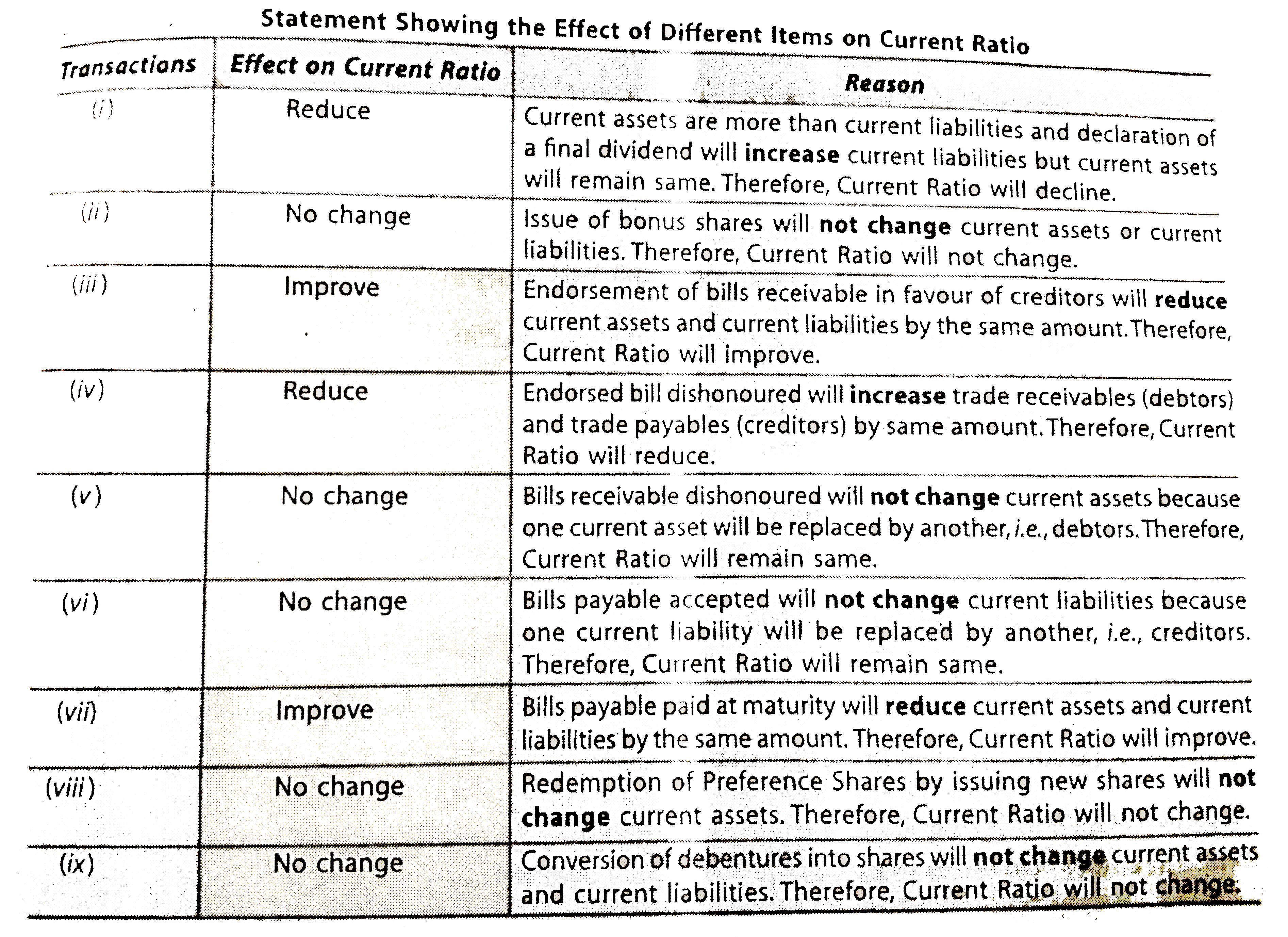

- state giving reasons which of the following transactions would improve...

Text Solution

|

- From the following information calcualte liquid ratio:

Text Solution

|

- Quick assets Rs 150000, inventroy (stock) Rs 40000, prepaid Expaneses ...

Text Solution

|

- Current assets Rs 300000, inventories Rs 600000, working capital Rs 25...

Text Solution

|

- Woking capital Rs 360000, total debts Rs 780000, long term debts s 600...

Text Solution

|

- Current liablities of a company are Rs 600000. Its current ratio is 3:...

Text Solution

|

- X ltd has a current ratio fo 3.5 :1 and quick ratio of 2:1 if the inve...

Text Solution

|