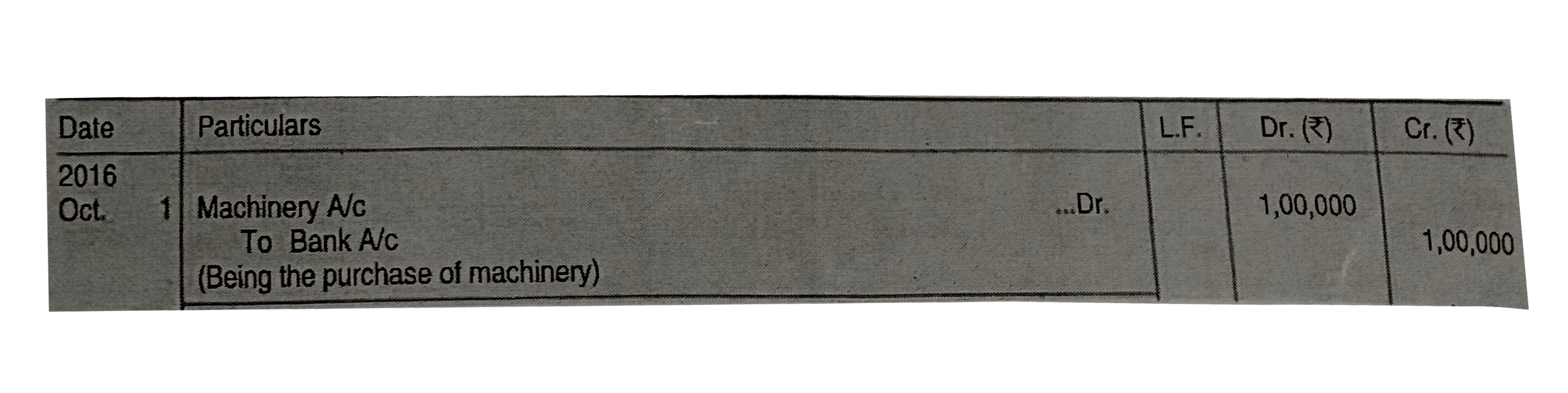

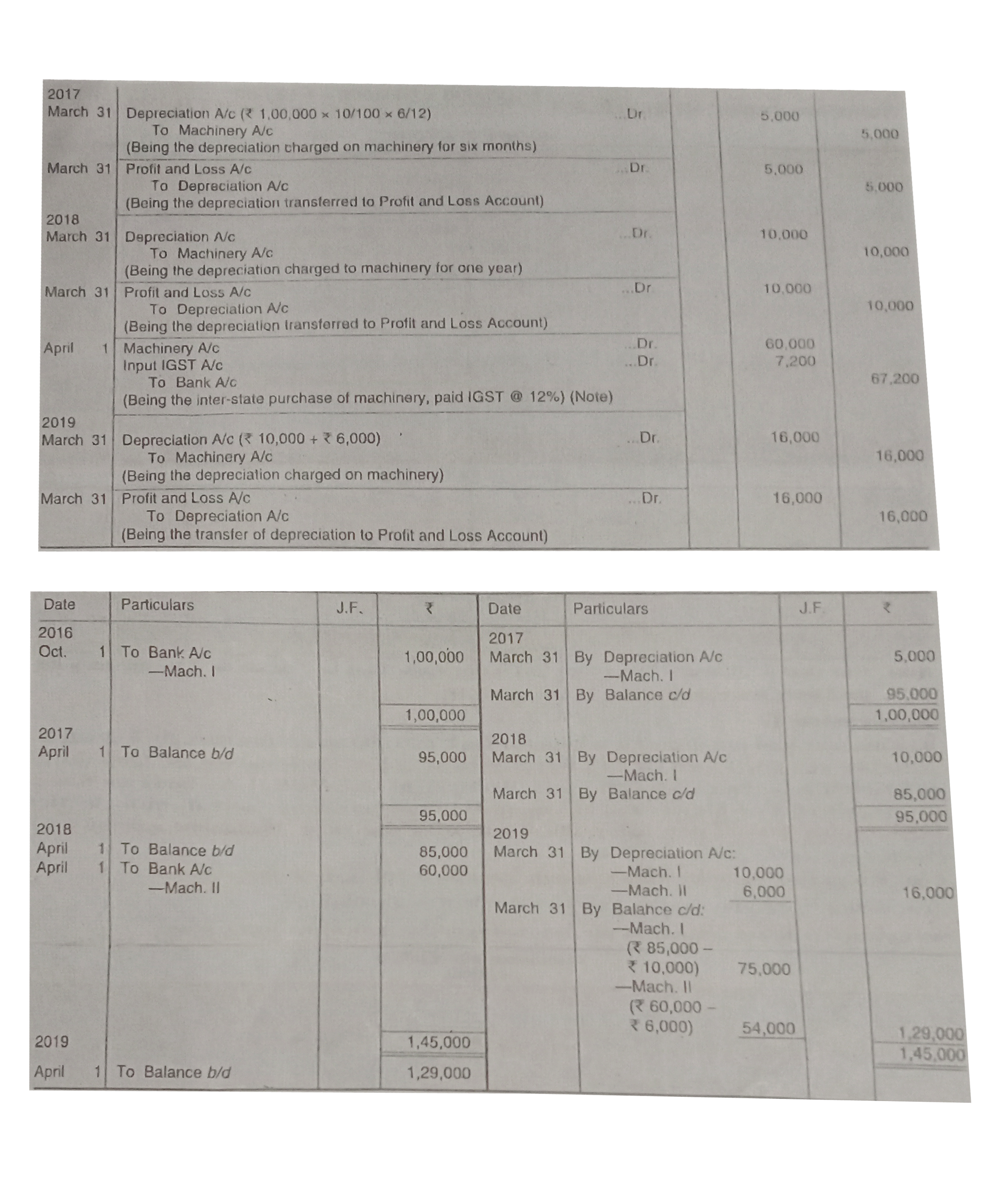

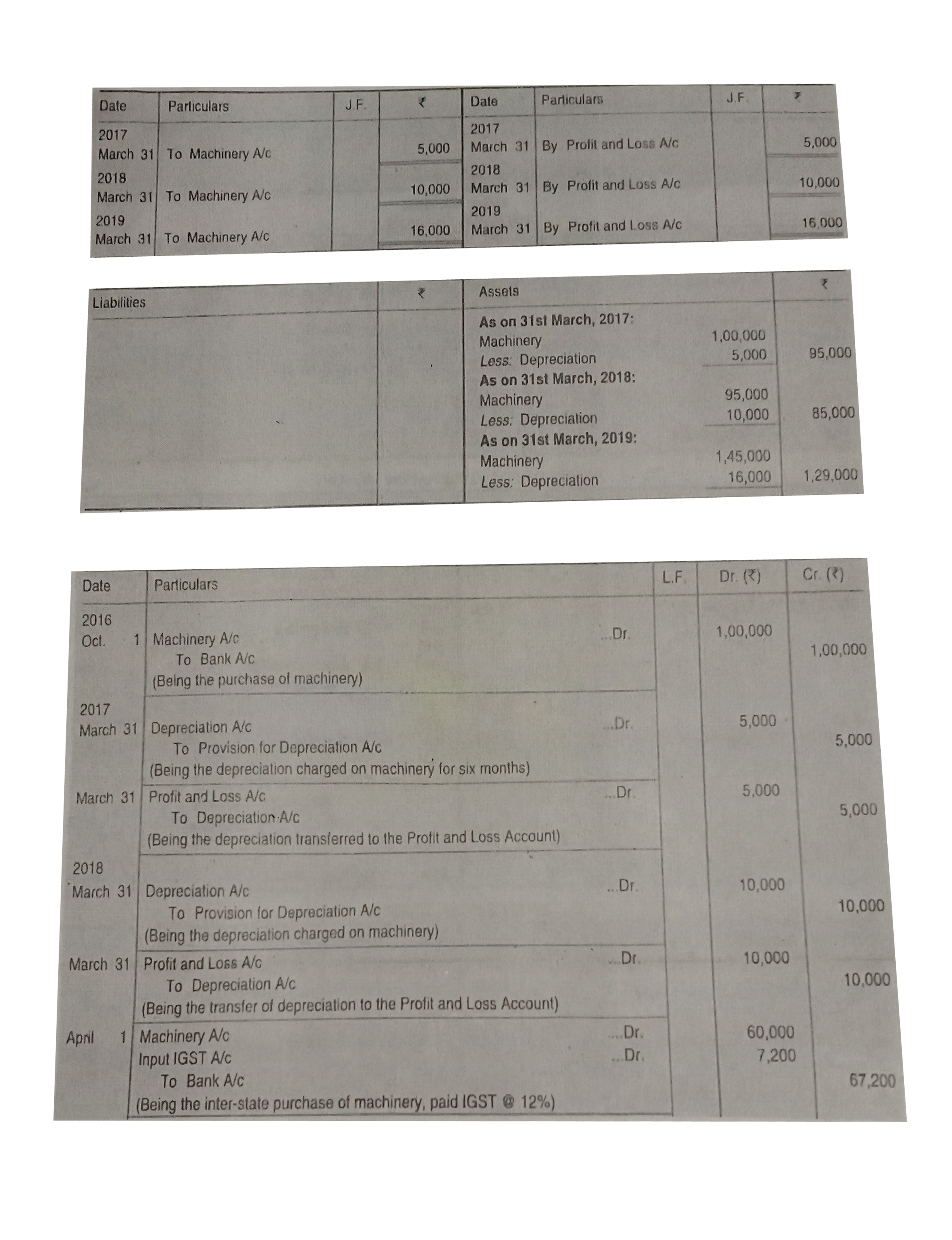

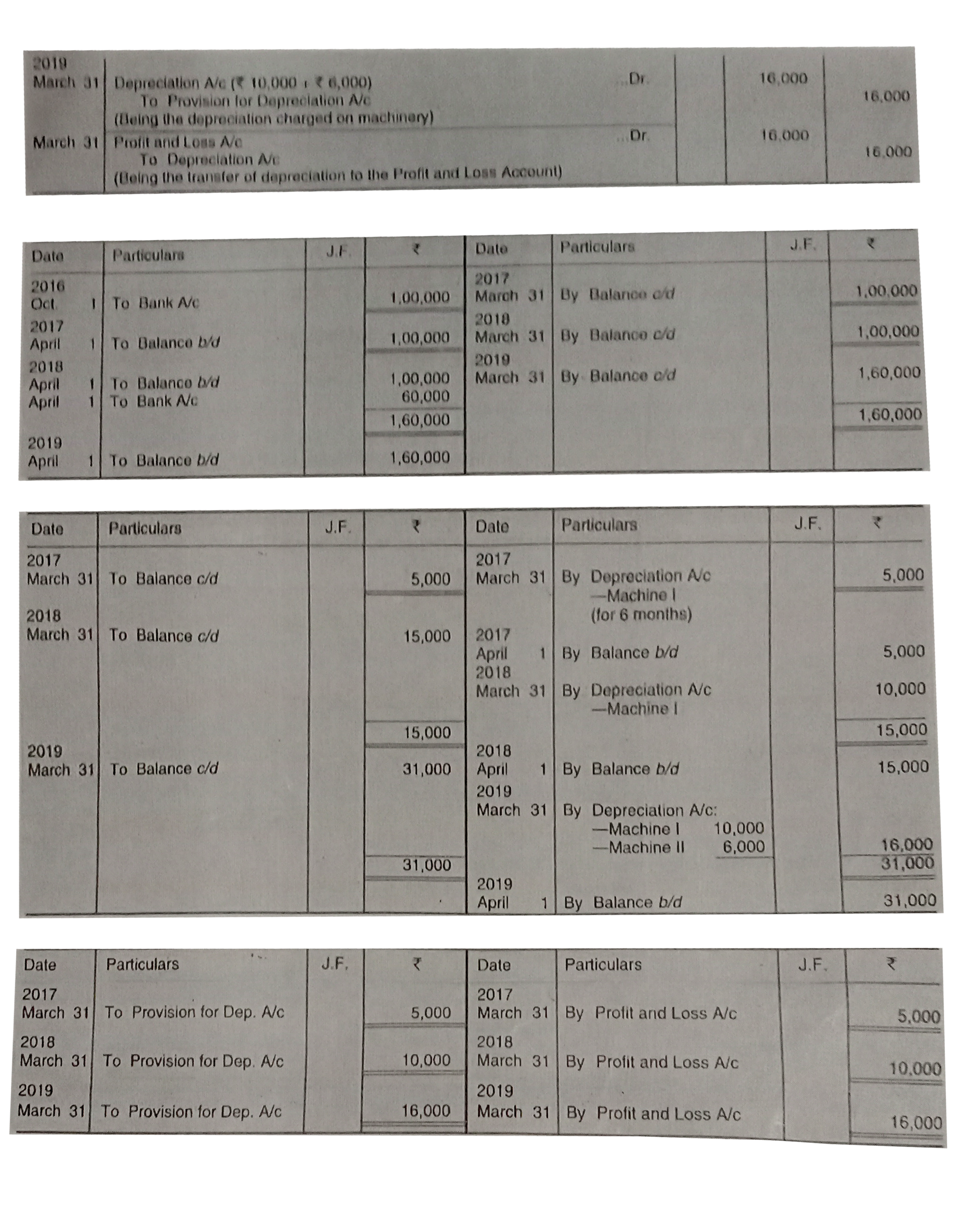

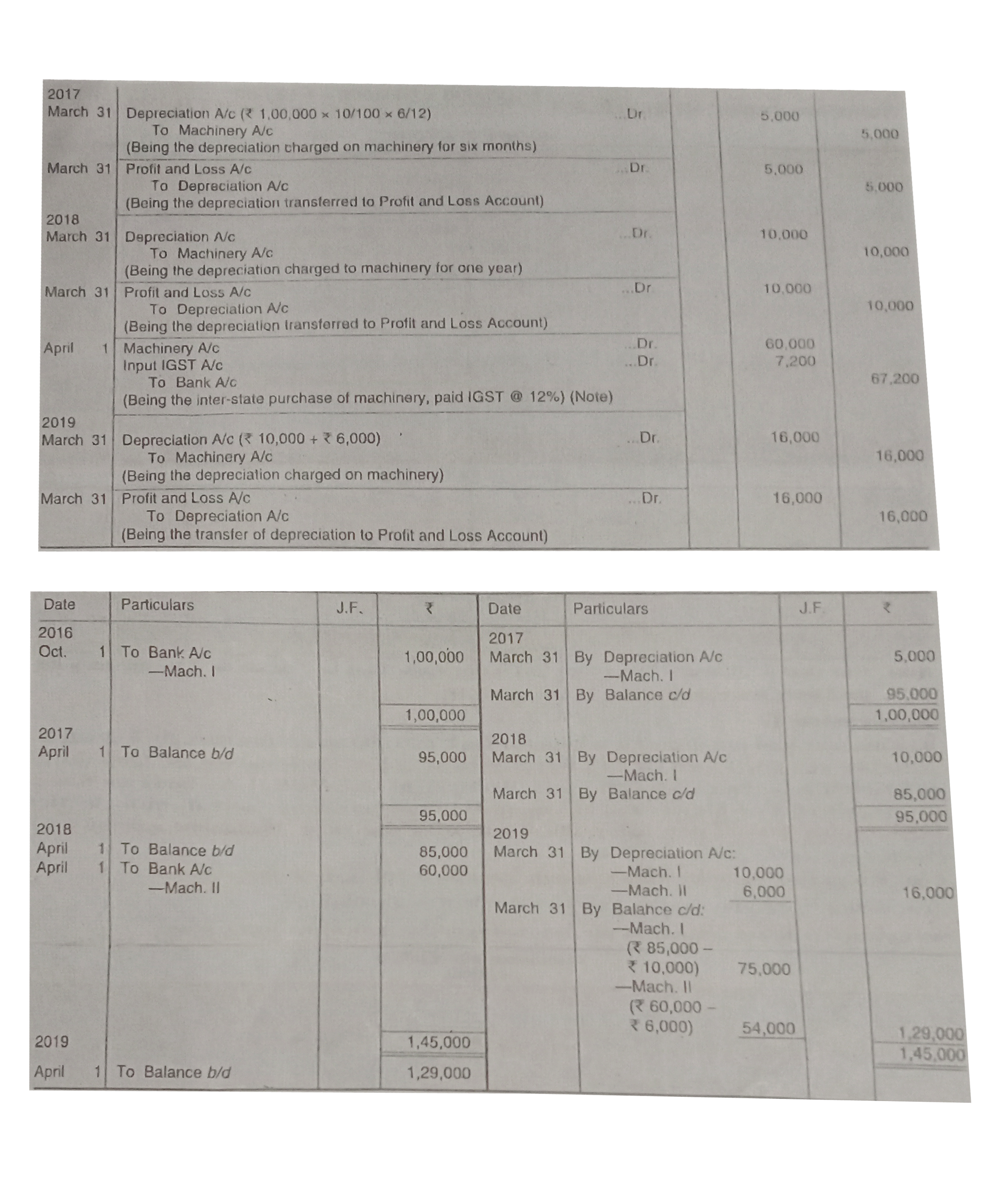

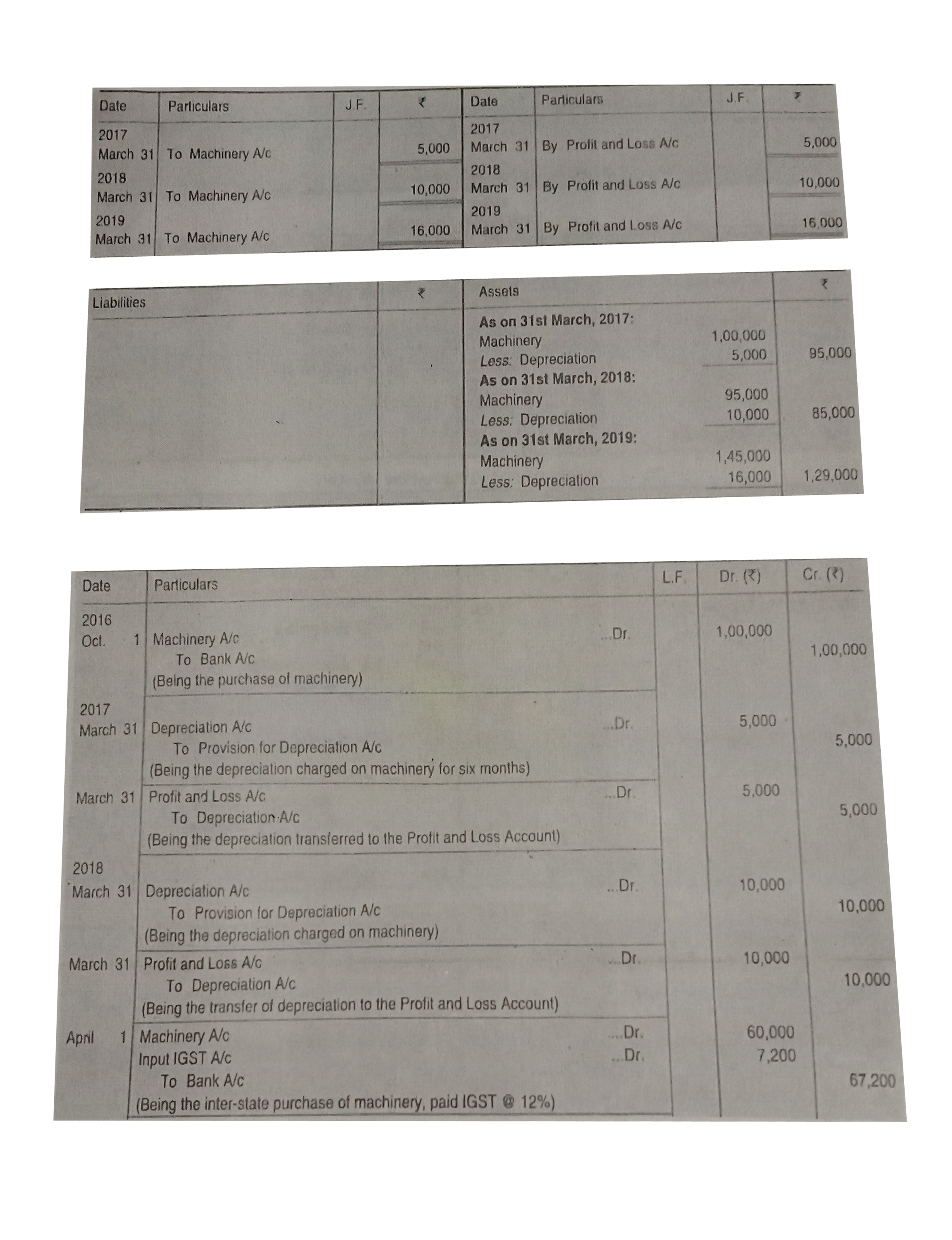

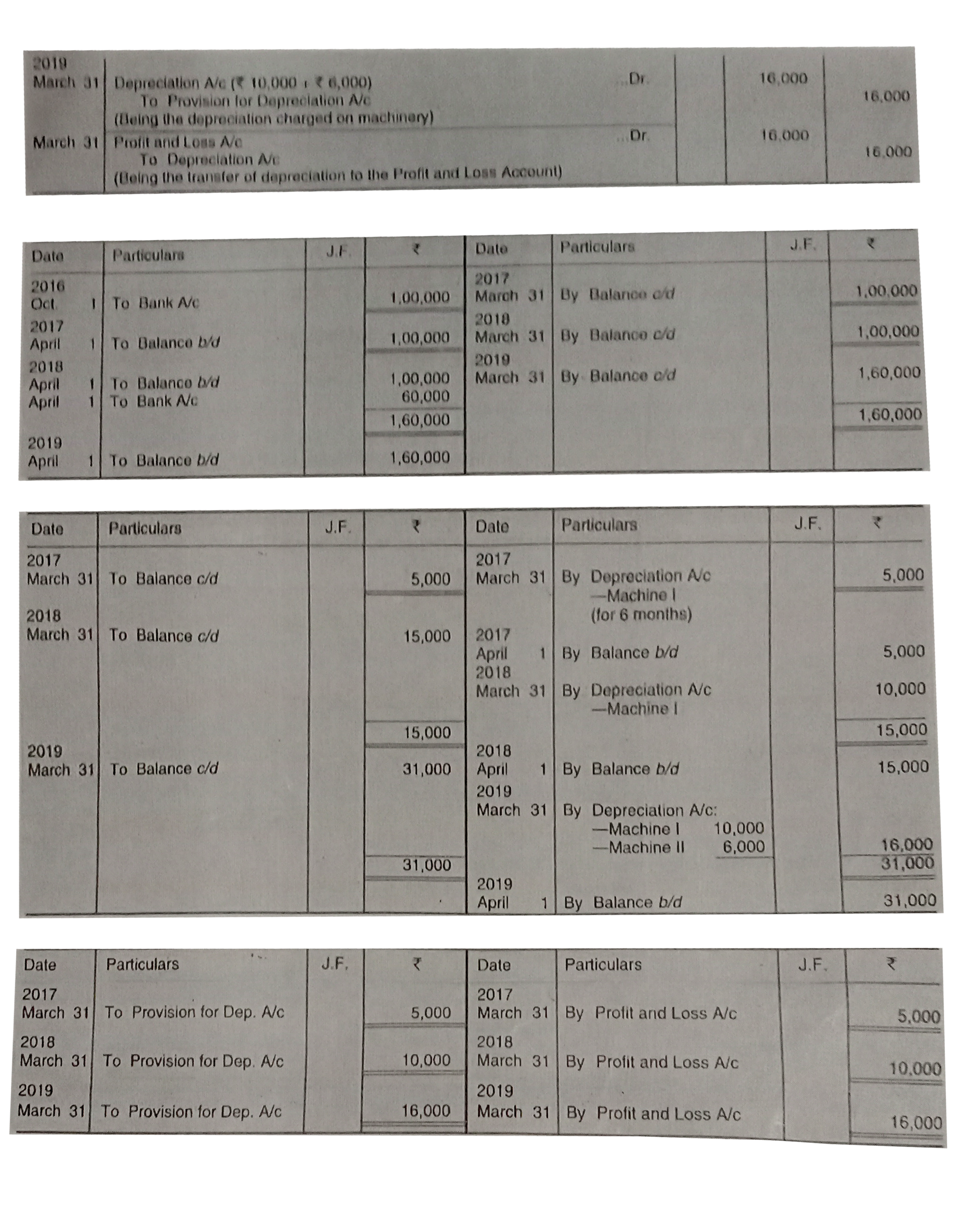

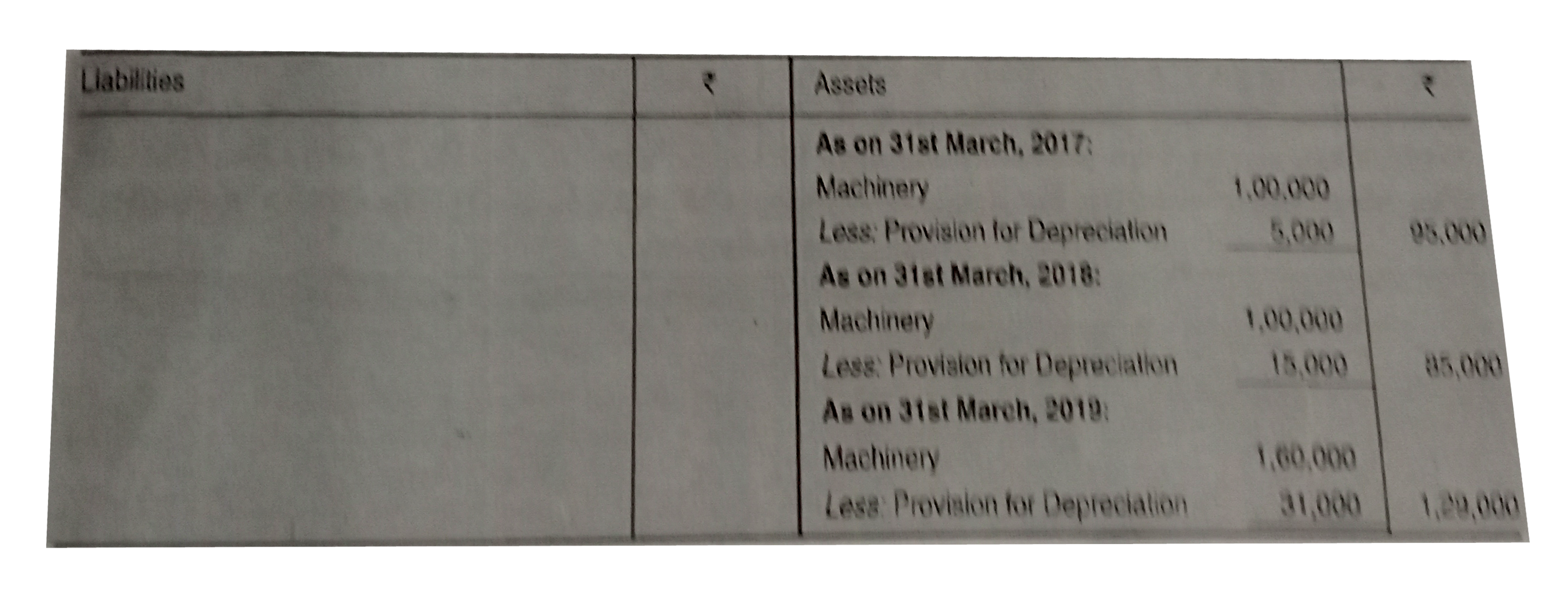

R. Kanitkar had purchased a machinery for rupee 1,00,000 on 1st October, 2016. Another machine was purchased for rupee 60,000 plus IGST `" @ "12 % ` by cheque on 1st April, 2018. Depreciation is charged `" @ "10%` p.a. by the Straight Line Method. Accounts are closed every year on 31 st March. You are required to pass necessary Journal entries for the years ended 31st March, 2017, 2018, and 2019 and show Machinery Account and Machinery in the Balance Sheet:

(i) When Provision for Depreciation Account is not maintained.

(ii) When Provision for Depreciation Account is maintained.

R. Kanitkar had purchased a machinery for rupee 1,00,000 on 1st October, 2016. Another machine was purchased for rupee 60,000 plus IGST `" @ "12 % ` by cheque on 1st April, 2018. Depreciation is charged `" @ "10%` p.a. by the Straight Line Method. Accounts are closed every year on 31 st March. You are required to pass necessary Journal entries for the years ended 31st March, 2017, 2018, and 2019 and show Machinery Account and Machinery in the Balance Sheet:

(i) When Provision for Depreciation Account is not maintained.

(ii) When Provision for Depreciation Account is maintained.

(i) When Provision for Depreciation Account is not maintained.

(ii) When Provision for Depreciation Account is maintained.

Text Solution

Verified by Experts

(i) When Provision for Depreciation Account is not maintained.

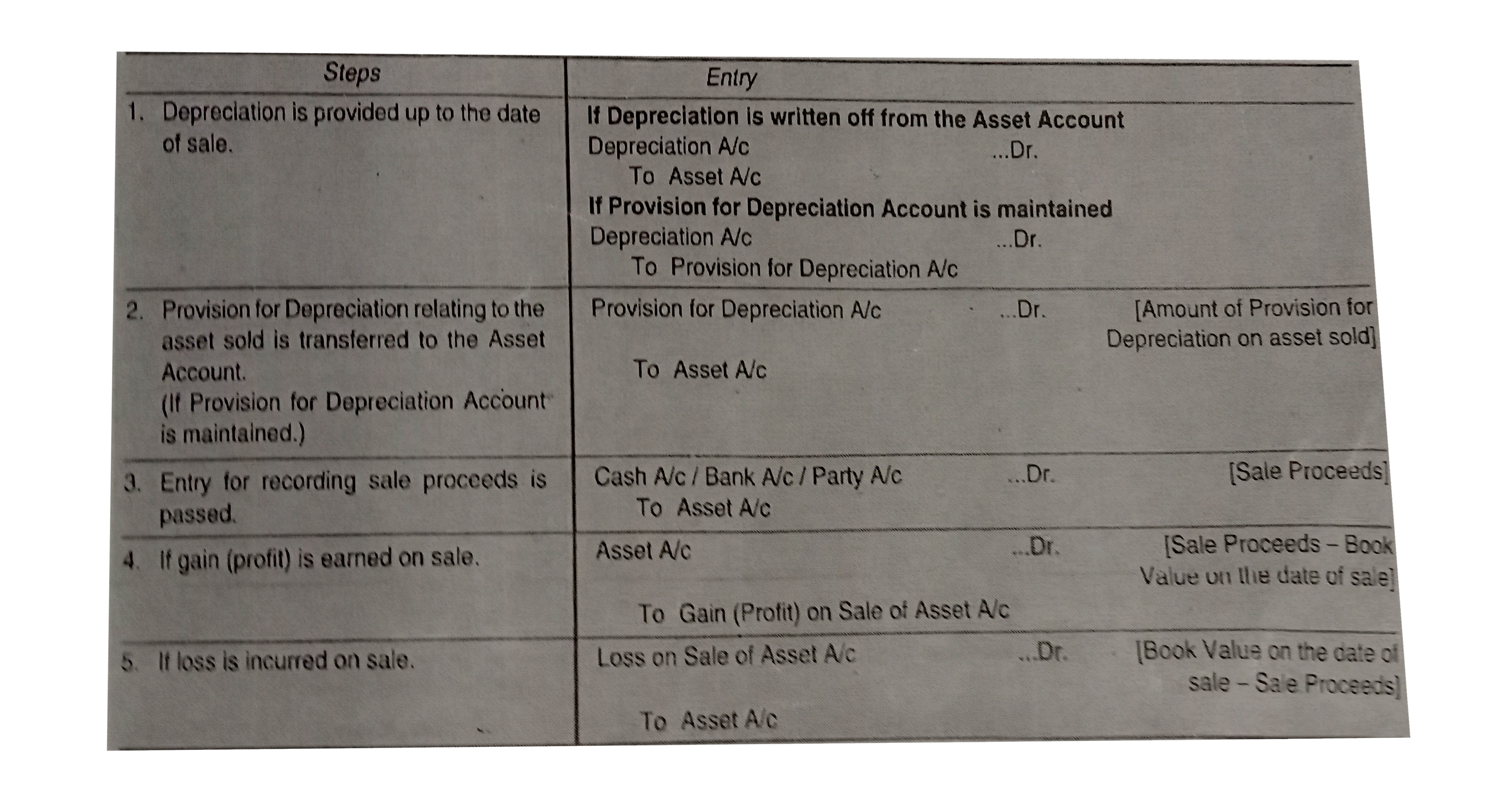

Sale or Disposal of an Asset: An asset may be sold before it is fully depreciated, i.e., before the end of its estimated useful life due to obsolescence, inadequacy or for any other reason. Depreciation in the year of sale is charged from the beginning of the year up to the date of sale. The sale proceeds, may not be equal to the written down value of the asset. If the sale proceeds is more than the written down value of the asset on the date of sale, it is a gain (profit) on sale of asset, i.e., Gain (profit)= Sale Value - Book Value on the date of sale. On the other hand, if the sale proceeds is less than the written down value of the asset on the date of sale, it is loss on sale of the asset, i.e., Loss= Book Value on the date of Sale - Sale Value. Gain (Profit) or loss on sale of asset is transferred to Profit and Loss Account.

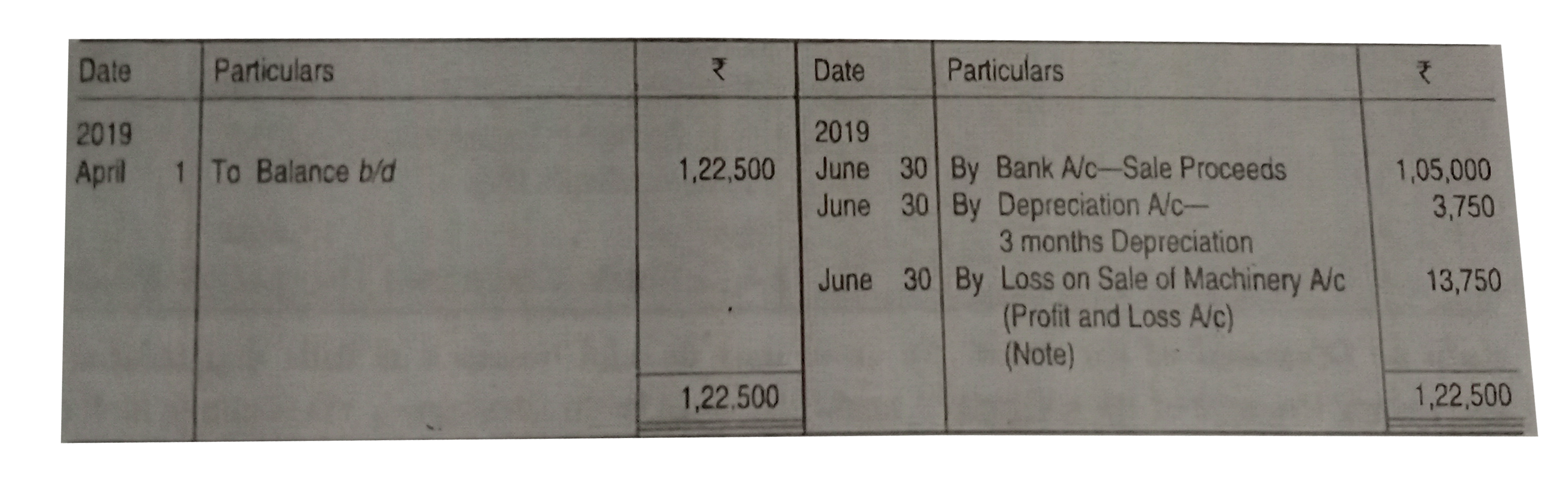

Note: Gain (Profit) on Sale of Asset is credited to Profit and Loss Account and Loss on Sale of Asset is debited to Profit and Loss Account. Continuing Illustration 3, suppose the machine is sold on 30th June, 2019 for Rs 1,05,000. The Depreciation for 3 months is Rs 3,750, i.e., 3/2 of Rs 15,000. This amount will be credited to the Machinery Account. Rs 1,05,000 will also be credited. A balance of Rs 13,750 remains. This is loss and should be transferred to the Profit and Loss Account. The Machinery Account for the year ending 31st March, 2020 will appear as under:

Note : Loss on Sale of Machinery = Book Value on the State-Sale Proceeds

`=(Rs 1,22,500-Rs 3,750)-Rs 1,05,000=Rs 13,750`.

Sale or Disposal of an Asset: An asset may be sold before it is fully depreciated, i.e., before the end of its estimated useful life due to obsolescence, inadequacy or for any other reason. Depreciation in the year of sale is charged from the beginning of the year up to the date of sale. The sale proceeds, may not be equal to the written down value of the asset. If the sale proceeds is more than the written down value of the asset on the date of sale, it is a gain (profit) on sale of asset, i.e., Gain (profit)= Sale Value - Book Value on the date of sale. On the other hand, if the sale proceeds is less than the written down value of the asset on the date of sale, it is loss on sale of the asset, i.e., Loss= Book Value on the date of Sale - Sale Value. Gain (Profit) or loss on sale of asset is transferred to Profit and Loss Account.

Note: Gain (Profit) on Sale of Asset is credited to Profit and Loss Account and Loss on Sale of Asset is debited to Profit and Loss Account. Continuing Illustration 3, suppose the machine is sold on 30th June, 2019 for Rs 1,05,000. The Depreciation for 3 months is Rs 3,750, i.e., 3/2 of Rs 15,000. This amount will be credited to the Machinery Account. Rs 1,05,000 will also be credited. A balance of Rs 13,750 remains. This is loss and should be transferred to the Profit and Loss Account. The Machinery Account for the year ending 31st March, 2020 will appear as under:

Note : Loss on Sale of Machinery = Book Value on the State-Sale Proceeds

`=(Rs 1,22,500-Rs 3,750)-Rs 1,05,000=Rs 13,750`.

Topper's Solved these Questions

DEPRECIATION

TS GREWAL|Exercise Higher Order Thinking Skills (HOTS) Questions|11 VideosDEPRECIATION

TS GREWAL|Exercise Very Short Answer Type Questions|21 VideosCOMPUTERS IN ACCOUNTING

TS GREWAL|Exercise Multiple choice Questions (MCQs)|3 VideosFINANCIAL STATEMENTS OF SOLE PROPRIETORSHIP

TS GREWAL|Exercise Illustration|50 Videos

Similar Questions

Explore conceptually related problems

A machine was purchased on 1st April, 2016 for Rs 2,50,000. On 1st October, 2016, another machine was purchased for Rs 1,50,000. Estimated scrap value was Rs 10,000 and Rs 5,000 respectively. Depreciation is to be provided "@ " 10% p.a. on the machines under the Reducing Balance System. (i) Show Machinery Account for the years ended 31st March, 2017 and 2018. (ii) Show how Machinery Account will appear in the Balance Sheet as at 31st March, 2018.

On 1st April, 2016, a machinery was purchased for Rs 20,000. On 1st October, 2017 another machine was purchased for Rs 10,000 and on 1st April, 2018, one more machine was purchased for Rs 5,000. The firm depreciates its machinery "@ "10% p.a. on the Diminishing Balance Method. What is the amount of Depreciation for the years ended 31st March, 2017, 2018 and 2019? What will be the balance in Machinery Account as on 31st March, 2019?

A company purchased a machinery for Rs 50,000 on 1st October, 2016. Another machinery costing Rs 10,000 was purchased on 1st December, 2017. On 31st March, 2019, the machinery purchased in 2016 was sold at a loss of Rs 5,000. The company charges depereciation "@ "15% p.a. on Diminishing Balance Method. Accounts are closed on 31st March every year. Prepare the Machinery Account for 3 years.

A company purchased machinery for Rs 2,00,000 on 1st April, 2016. The machinery is depreciated " @ "10% p.a. of cost. On 1st October, 2018, the machinery was sold for Rs 1,20,000. Draw the Machinery Account for the years ended 31st March 2017, 2018 and 2019.

Babu purchased on 1st April, 2017, a machine for Rs 6,000. On 1st October, 2017, he also purchased another machine for Rs 5,000. On 1st October, 2018, he sold the machine purchased on 1st April, 2017 for Rs 4,000. It was decided that Depreciation "@ "10% p.a. was to be written off every year under Diminishing Balance Method. Assuming the accounts were closed on 31st March every year, show the Machinery Account for the years ended 31st March, 2018 and 2019.

Modern Ltd. Purchased a machinery on 1st August, 2016 for Rs 60,000. On 1st October, 2017, it purchased another machine for Rs 20,000 plus CGST and SGST "@ "6% each. On 30th June, 2018, it sold the first machine purchased in 2016 for Rs 38,500 charging IGST "@ "12% . Depreciation is provided "@ " 20% p.a. on the original cost each year. Account are closed on 31st March every year. Prepare the Machinery Account for these years.

On 1st April, 2016, a firm purchased a machinery for Rs 12,00,000. On 1st October, 2018, a part of the machinery purchased on 1st April, 2016 for Rs 80,000 was sold for Rs 45,000 and a new machinery at a cost Rs 1,58,000 was purchased and installed on the same date. The Company has adopted the method of providing depreciation "@ "10% p.a. on the diminishing balance of the machinery. Show the necessary Ledger accounts assuming that: (i) 'Provision for Depreciation Account' is not maintained, (ii) 'Provision for Depreciation Account' is maintained.

M/s. P & Q purchased machinery for Rs 40,000 on 1st October, 2016. Depreciation is provided " @ "10% p.a. on the Diminishing Balance. On 31st January, 2019, one-fourth of the machinery was found unsuitable and disposed off for Rs 5,600. On the same date new machinery at a cost of Rs 15,000 was purchased. Write up the Machinery Account for the years ended 31st March, 2017, 2018 and 2019. Accounts are closed on 31st March each year.

Green Ltd. purchased a machinery on 1st August, 2015 for Rs 60,000. On 1st October, 2016, it purchased another machine for Rs 20,000. On 30th June, 2017, it sold the first 'machine for Rs 38,500 and on the same date purchased a new machinery for Rs 50,000. Depreciation is provided "@" 20% p.a. on cost each year. Accounts are closed each year on 31st March. Show the Machinery Account for three years.

TS GREWAL-DEPRECIATION-EVALUATION QUESTIONS: QUESTIONS WITH MISSING VALUES

- R. Kanitkar had purchased a machinery for rupee 1,00,000 on 1st Octobe...

Text Solution

|

- In the following Machinery Account, determine the missing values, if d...

Text Solution

|

- In the following Machinery Account, determine the missing values, if d...

Text Solution

|

- In the following Machinery Account. Determine the missing values, if d...

Text Solution

|