Text Solution

Verified by Experts

Topper's Solved these Questions

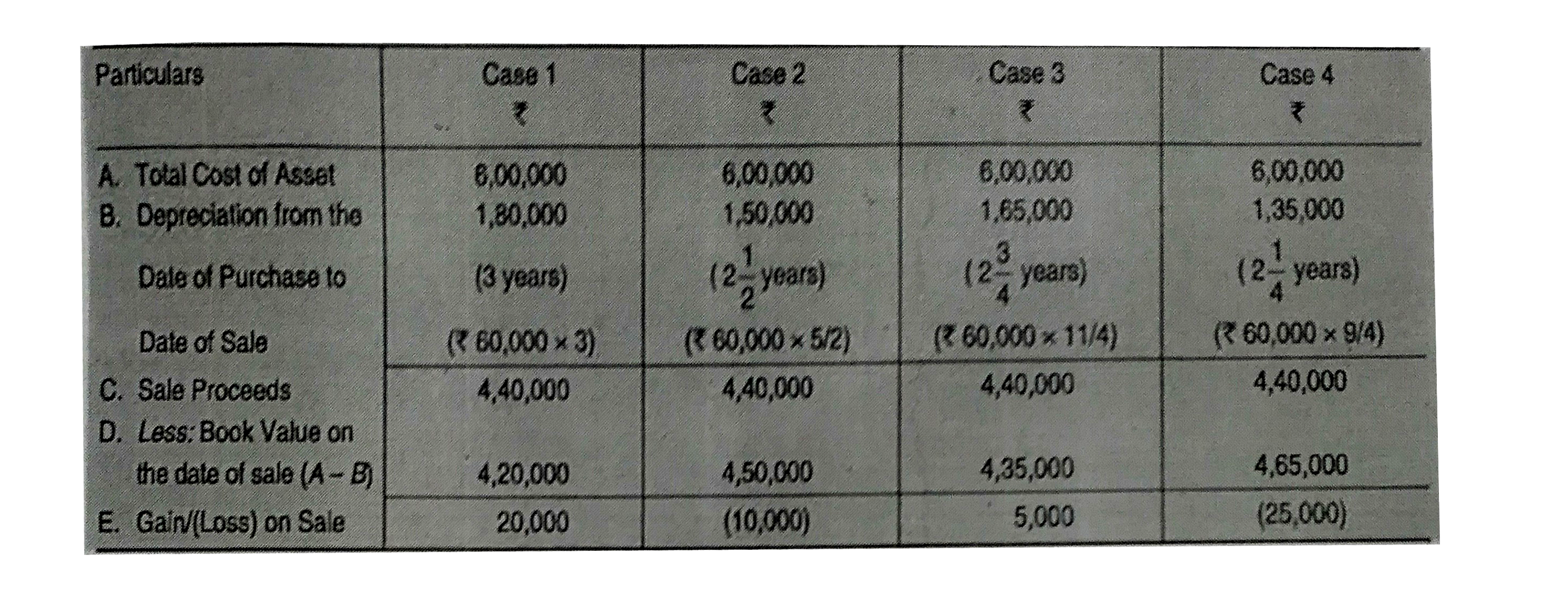

DEPRECIATION

TS GREWAL|Exercise Higher Order Thinking Skills (HOTS) Questions|11 VideosDEPRECIATION

TS GREWAL|Exercise Very Short Answer Type Questions|21 VideosCOMPUTERS IN ACCOUNTING

TS GREWAL|Exercise Multiple choice Questions (MCQs)|3 VideosFINANCIAL STATEMENTS OF SOLE PROPRIETORSHIP

TS GREWAL|Exercise Illustration|50 Videos

Similar Questions

Explore conceptually related problems

TS GREWAL-DEPRECIATION-EVALUATION QUESTIONS: QUESTIONS WITH MISSING VALUES

- Sunrise Ltd. purchased a second-hand machine for Rs 5,50,000 and spent...

Text Solution

|

- In the following Machinery Account, determine the missing values, if d...

Text Solution

|

- In the following Machinery Account, determine the missing values, if d...

Text Solution

|

- In the following Machinery Account. Determine the missing values, if d...

Text Solution

|