Similar Questions

Explore conceptually related problems

Recommended Questions

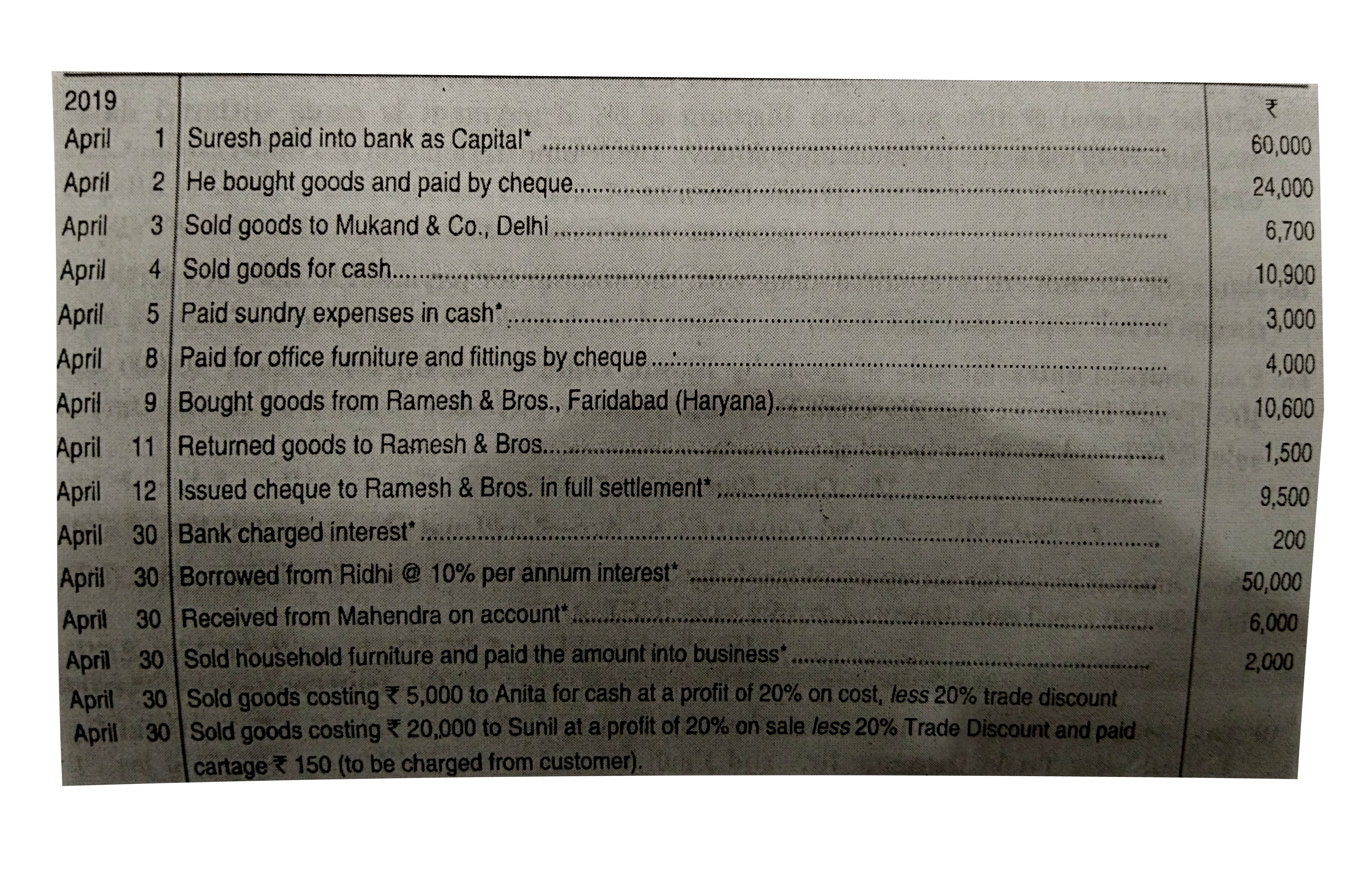

- Enter the following transactions in the Journal of Suresh, Delhi who t...

Text Solution

|

- संक्रमण धातु जो परिवर्ती ऑक्सीकरण अवस्था नहीं प्रदर्शित करती है, है-

Text Solution

|

- एक संक्रमण धातु की अधिकतम ऑक्सीकरण अवस्था प्राप्त करने में कौन-से इलेक...

Text Solution

|

- सवणारंक किसे कहते है? जिलेटिन व् गोंद के सवणारंक क्रमश: 0.005 व् 0.10 ...

Text Solution

|

- उद्विकास को परिभाषित कीजिए तथा जैव-विकास की मूल धारणा बताइए!

Text Solution

|

- जीवन की उत्पत्ति के समय स्वतंत्र अवस्था में नहीं पायी जाती थी-

Text Solution

|

- तीन प्रतिरोध तार हैं। प्रत्येक का प्रतिरोध 4 ओम हैं। इनमें सम्भ...

Text Solution

|

- प्रदत्त चित्र में दो लम्बे समान्तर धारावाही चालकों में 1 ऐम्पियर तथा ...

Text Solution

|

- एक परीक्षा में पास होने वाले तथा पेल होने वालो का अनुपात 3 : 1 था। यदि...

Text Solution

|