Similar Questions

Explore conceptually related problems

Recommended Questions

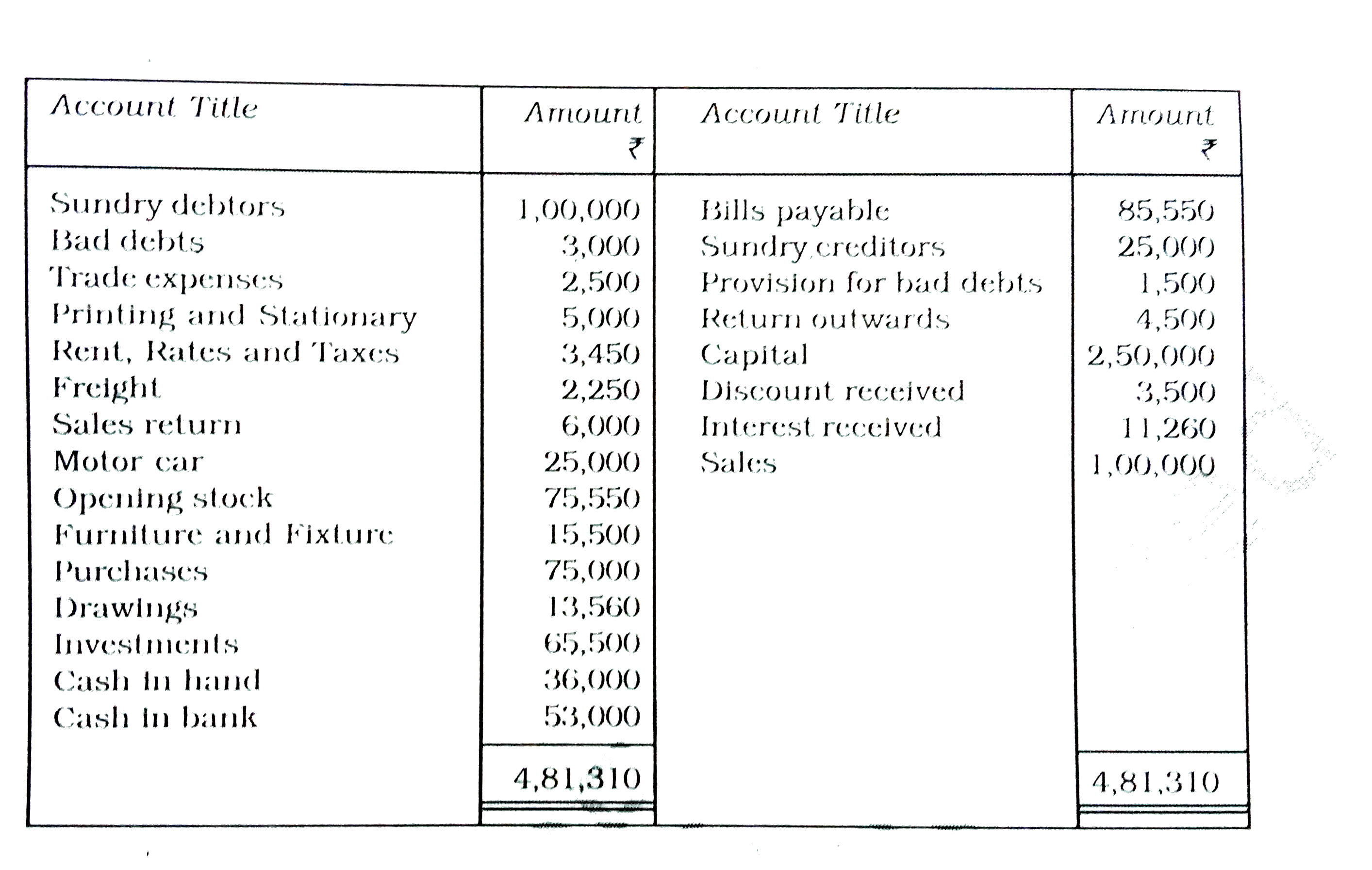

- Prepare the trading and profit and loss account and a balance sheet of...

Text Solution

|

- निम्नलिखित अभिक्रियाओं में योगिक [A] तथा [B] को पहचानिए तथा सम्बंधित...

Text Solution

|

- संजात और समवर्ती अंगो पर टिप्पणी कीजिए!

Text Solution

|

- प्रदत्त चित्र में दो लम्बे समान्तर धारावाही चालकों में 1 ऐम्पियर तथा ...

Text Solution

|

- एक स्कूटर का पहले 1 किमी का निश्चित किराया है तथा इसके बाद के प्रत्येक...

Text Solution

|

- a और b के लिये हल कौजिए : 2^(a) + 3^(b) = 17 और 2^(a+2) - 3^(b+1) =...

Text Solution

|

- समस्याओ में रैखिक समीकरणो के युग्म बनाइए और अनके हल ( यदि उनक...

Text Solution

|

- m और n के मान ज्ञात कीजिए जिनके लिये निम्नलिखित समीकरण निकाय ...

Text Solution

|

- 5 पेन और 6 पेसिलो का कुल मूल्य 9 तथा 3 पेन और 2 पेसिलो का ...

Text Solution

|