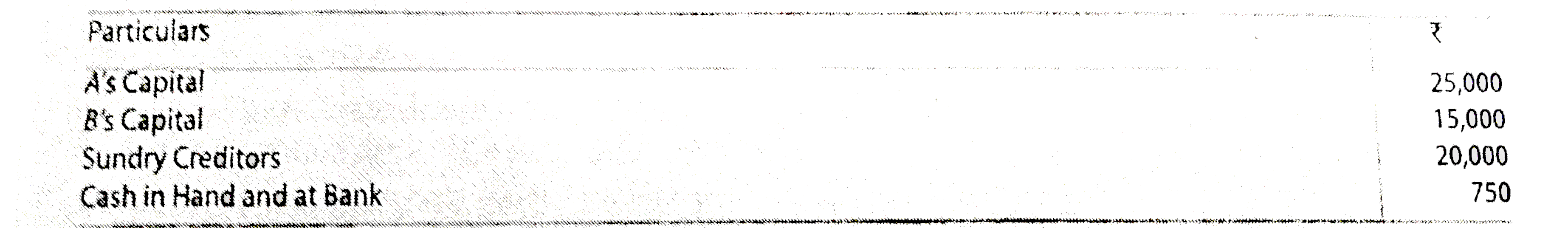

A and B dissolve their partnership . Their position as at 31st March , 2019 was :

The balance of A's Loan Account to the firm stood at ₹ 10,000 . The realisation expenses amounted to ₹ 350 . Stock realised ₹ 20,000 and Debtors ₹ 25,000 . B took a machine at the agreed valuation of ₹ 7,500 .

Other fixed assets realised ₹ 20,000 .

You are required to close the books of the firm .

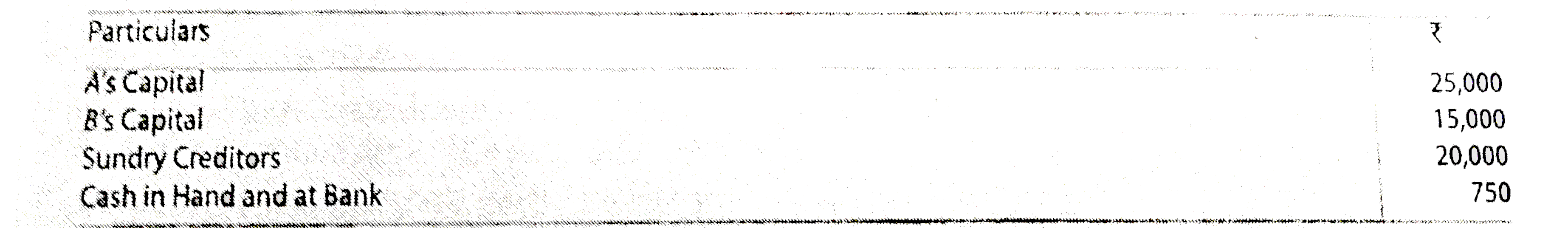

A and B dissolve their partnership . Their position as at 31st March , 2019 was :

The balance of A's Loan Account to the firm stood at ₹ 10,000 . The realisation expenses amounted to ₹ 350 . Stock realised ₹ 20,000 and Debtors ₹ 25,000 . B took a machine at the agreed valuation of ₹ 7,500 .

Other fixed assets realised ₹ 20,000 .

You are required to close the books of the firm .

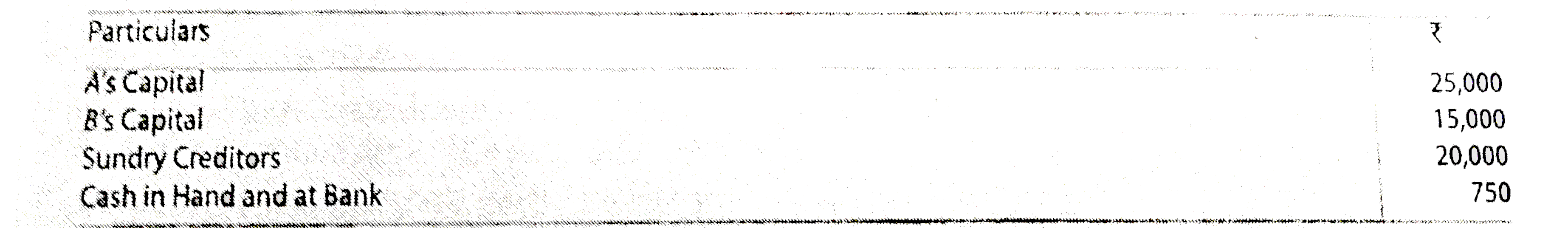

The balance of A's Loan Account to the firm stood at ₹ 10,000 . The realisation expenses amounted to ₹ 350 . Stock realised ₹ 20,000 and Debtors ₹ 25,000 . B took a machine at the agreed valuation of ₹ 7,500 .

Other fixed assets realised ₹ 20,000 .

You are required to close the books of the firm .

Similar Questions

Explore conceptually related problems

P , Q and R were partners in a firm sharing profits and losses in the ratio of 5 : 3 : 2 . They agreed to dissolve their partnership firm on 31st March , 2019 . P was deputed to realise the assets and pay the liabilities . He was paid ₹ 1,000 as commission for his services . The financial position of the firm was : P took over investments for ₹ 12,500. Stock and Debtors realised ₹ 11, 500 . Plant and Machinery were sold to Q for ₹ 22,500 for cash . Unrecorded assets realised ₹ 1,500 . Realisation expenses paid amounted to ₹ 900. Prepare necessary Ledger Accounts to close the books of the firm .

(Goodwill Appears in Balance Sheet) . A , B and C are partners in a firm sharing profits in the ratio of 2 : 1 : 1 . Their Balance Sheet as at 31st March , 2019 was as follows : The firm was dissolved on that date . Assets realised : Goodwill ₹ 20 , 000 , Land and Building ₹ 1, 00 , 000 , Plant and Machinery ₹ 50,000 , Car ₹ 28,000 and Debtors 50% of the book value . Realisation Expenses were ₹ 2, 000 . Prepare Realisation Account , Capital Accounts of Partners and Cash Account to close the books of the firm .

Ashok , Babu and Chetan are in partnership sharing profit in the proportion of 1/2 , 1/3 , 1/6 respectively . They dissolve the partnership of the 31st March , 2019 when the Balance Sheet of the firm as under : The Machinery was taken over by Babu for ₹ 45,000 , Ashok took over the investment for ₹ 40,000 and Freehold property took over by Chetan at ₹ 55,000 . The remaining Assets realised as follows : Sundry Debtors ₹ 56,500 and Stock ₹ 36, 500 . Sundry Creditors were settled at discount of 7% . A office computer , not shown in the books of accounts realised ₹ 9,000 . Realisation expenses amounted to ₹ 9,000 . Realisation expenses amounted to ₹ 3,000 . Prepare Realisation Account , Partner's Capital and Bank Account .

A , B and C were partners sharing profits in the ratio of 2: 2 :1 . They decided to dissolve their firm on 31st March , 2019 when the Balance Sheet was : Following transactions took place : (a) A took over Stock at ₹ 36,000 . He also took over his wife's loan . (b) B took over half of Debtors at ₹ 28,000. (c) C took over investments at ₹ 54,000 and half of Creditors at their book value. (d) Remaining Debtors realised 60% of their book value. Furniture sold for ₹ 30,000 , Machinery ₹ 82,000 and Land ₹ 1,20,000. (e) An unrecorded asset was sold for ₹ 22,000 . (f) Realisation expenses amounted to ₹ 4,000 . Prepare necessary Ledger Accounts to close the books of the firm.

Bale and Yale are equal partners of a firm . They decide to dissolve their partnership on 31st March , 2019 at which date their Balance Sheet stood as : (a) The assets realised were : Stock ₹ 22,000 , Debtors ₹ 7,500 , Machinery ₹ 16,000 , Building ₹ 35,000 . (b) Yale took over the Furniture at ₹ 9,000. (c) Bale agreed to accept ₹2,500 in full settlement of his Loan Account . (d) Dissolution Expenses amounted to ₹ 2,500. Prepare the : (i) Realisation Account " " (ii) Capital Accounts of Partners , (iii) Bale's Loan Account , " " (iv) Bank Account .

A and B are partners in a firm sharing profits and losses in the ratio of 2 : 1 . On 31st March ,2019 , their Balance Sheet was : On that date , the partners decide to dissolve the firm . A took over Investments at an agreed valuation of ₹ 35,000 . Other assets were realised as follows : Sundry Debtors : Full amount . The firm could realise Stock at 15% less and Furniture at 20% less than the book value . Building was sold at ₹ 1,00,000 . Compensation to employees paid by the firm amounted to ₹ 10,000 . This liability was not provided for in the above Balance Sheet . You are required to close the books of the firm by preparing Realisation Account , Partner's Capital Accounts and Bank Account .

Balance Sheet of a firm as at 31st March , 2019 was : The firm was dissolved on the above date . X took the Investments at a value of ₹ 1, 90 , 000 . Cash realised was : Freehold Property ₹ 9 , 00 , 000 , Sundry Debtors ₹ 90, 000 and Stock ₹ 1, 40 , 000 . Creditors were paid at a discount of 5% . Realisation Expenses were ₹ 20 , 000 . Pass Journal entries and prepare necessary Ledger Accounts to close the books .

X and Y were partners sharing profits and losses in the ratio of 3 : 2 . They decided to dissolve the firm on 31st March , 2019 . On that date , their Capitals were X - ₹ 40,000 and Y - ₹ 30,000 . Creditors amounted to ₹ 24,000 . Assets were realised for ₹ 88,500 . Creditors of ₹ 16,000 were taken over by X at ₹ 14,000 . Remaining Creditors were paid at ₹ 7,500 . The cost of realisation came to ₹ 500 . Prepare necessary accounts .

X and Y , who were sharing profits and losses in the ratio of 3 : 1 respectively , decided to dissolve the firm on 31st March , 2019 at which date some of the balances were : X's Capital -₹ 1,00,000 , Y's Capital - ₹ 10 ,000 (Debit Balance) , Profit and Loss A/c - ₹ 8,000 (Debit Balance) , Trade Creditors - ₹ 30,000 , Loan from Mrs .X - ₹ 10,000 , Cash at Bank - ₹ 2,000 . Assets (other than cash at bank) realised ₹ 1,10,000 and liabilities were paid at 5 % discount . Realisation expenses amounted to ₹ 1,000. Prepare Realisation Account , Capital Accounts of the Partners and Bank Account assuming that both the partners are solvent .

Recommended Questions

- A and B dissolve their partnership . Their position as at 31st March ,...

Text Solution

|

- Aoverset(HNO(2))toC(2)H(5)OHoverset([O])toB में A तथा B को पहचान-कर उन...

Text Solution

|

- प्रदत्त चित्र में दो लम्बे समान्तर धारावाही चालकों में 1 ऐम्पियर तथा ...

Text Solution

|

- एक चुम्बक की अक्षीय स्थिति में 10 सेमी दूरी पर चुम्बकीय क्षेत्र की तीव...

Text Solution

|

- किसी स्थान पर पृथ्वी के चुम्बकीय क्षेत्र का क्षैतिज तथा ऊर्ध्वाधर घटक ...

Text Solution

|

- पाच वर्ष पूर्व, A की आयु B से तीन गुनी थी तथा दस वर्ष बाद A की आयु B स...

Text Solution

|

- एक राजमार्ग पर दो बिन्दु A और B एक दूसरे से 90 किमी की दूरी पर है। एक ...

Text Solution

|

- एक छात्रावास के मासिक व्यय का एक भाग नियत है तथा शेष इस पर निर्भर करता...

Text Solution

|

- A और B एक पाँसे को 1100 रु. के इनाम पर फेंकते हैं जो उस खिलाड़ी द्वारा...

Text Solution

|