Similar Questions

Explore conceptually related problems

Recommended Questions

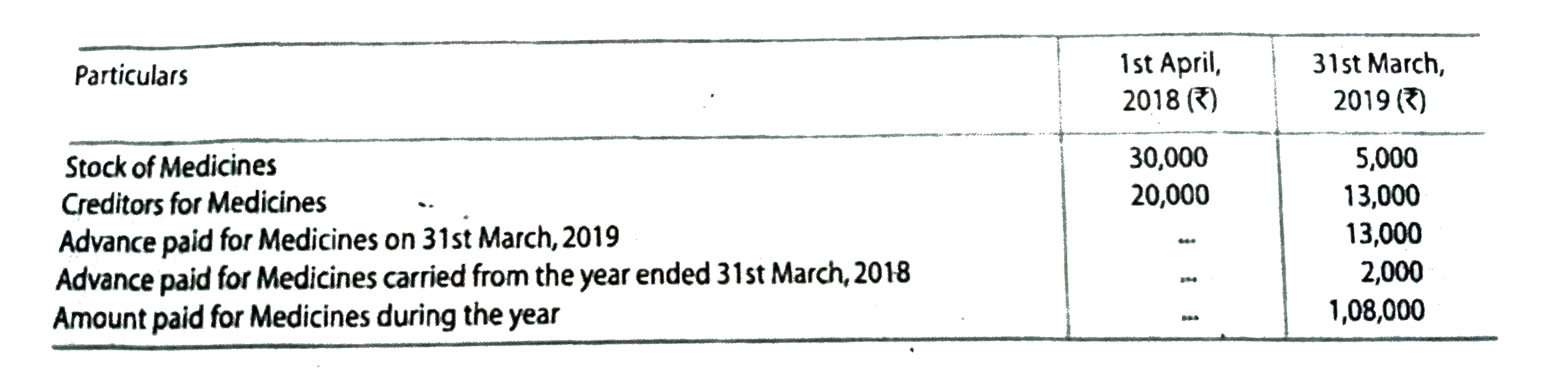

- Punya Trust runs a charitable hospital . How will be the following ite...

Text Solution

|

- SO(2) विरंजक के रूप में किस प्रकार कार्य करता है, समझाइए ।

Text Solution

|

- एक इलेक्ट्रॉन तथा एक प्रोटॉन जिनकी गतिज उर्जाएँ समान है, एकसमान चुम्बक...

Text Solution

|

- किसी स्थान पर पृथ्वी के चुम्बकीय क्षेत्र के क्षैतिज तथा ऊर्ध्वाधर घटक ...

Text Solution

|

- किसी स्थान पर पृथ्वी के चुम्बकीय क्षेत्र के क्षैतिज तथा ऊर्ध्वाधर घटक ...

Text Solution

|

- एक नाव 7 घण्टे तक चलती है। यदि यह 4 घण्टे घारा की दिशा में और 3 घण्टे ...

Text Solution

|

- एक छात्रावास के मासिक व्यय का एक भाग नियत है तथा शेष इस पर निर्भर करता...

Text Solution

|

- समस्याओ में रैखिक समीकरणो के युग्म बनाइए और अनके हल ( यदि उनक...

Text Solution

|

- k के किस मान के लिये , निम्नलिखित समीकरण निकाय समपाती रेखाओ को प्...

Text Solution

|