Similar Questions

Explore conceptually related problems

Recommended Questions

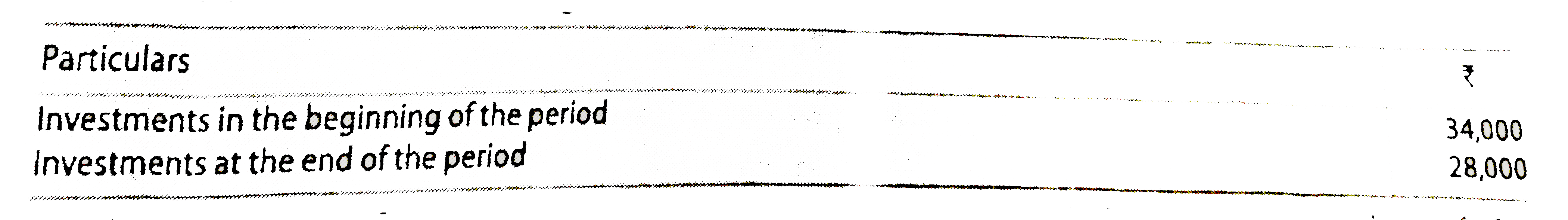

- Swan Ltd had the following balances : During the years the comp...

Text Solution

|

- किसी वृत्ताकार धारावाही लूप के केन्द्र पर उत्पन्न चुम्बकीय क्षेत्र का ...

Text Solution

|

- कारण सहित बताइए की धारामापी अपने वास्तविक रूप में धारा नापने के लिए क्...

Text Solution

|

- 25% और 40% सान्द्रण वाले अम्लों को मिलाकर 30% सान्द्रण का 60 लोटर अम्ल...

Text Solution

|

- एक कक्षा के छात्रों को पंक्ति में खड़ा किया जाता है। यदि प्रत्येक पंक्...

Text Solution

|

- A तथा B धातु युक्त द्विअंगी मिश्रधातु के इकाई सेल की ccp संरचना है जिस...

Text Solution

|

- 0.5 ऐम्पियर की धारा साम्थर्य 30 मिनट तक सिल्वर नाइट्रेट के जलीय विलयन ...

Text Solution

|

- एक धातु के तार में एक ऐम्पियर की धारा प्रवाहित हो रही है । बताइए एक से...

Text Solution

|

- निम्नलिखिए में से कौन-सा सल्फर का सर्वाधिक स्थायी अपरूप है

Text Solution

|