Similar Questions

Explore conceptually related problems

Recommended Questions

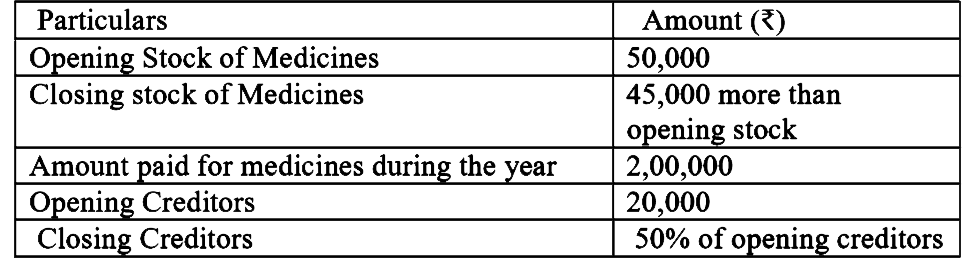

- a) Calculate the amount of medicines consumed during the year ended 31...

Text Solution

|

- 1 xx 10^(7) " मी"^(2) अनुप्रस्थ काट वाल तार में 3.6 ऐम्पियर की ...

Text Solution

|

- 1किलोवाट के विधुत बल्ब में 1 मिनट में कितनी ऊर्जा व्यय होगी ?

Text Solution

|

- किसी फिलामेन्ट का 100^(@)C पर प्रतिरोध 100 ओम तथा 400^(@)C पर 2...

Text Solution

|

- एक 220 वोल्ट- 100 वाट का बल्ब 110 वोल्ट के स्त्रोत से जुड़ा हैं।...

Text Solution

|

- दर्शाये गये परिपथ में a तथा b के मध्य विभवान्तर की गणना कीजिए ।

Text Solution

|

- चित्र में प्रदर्शित परिपथ की प्रत्येक शाखा में प्रवाहित धारा की गणना क...

Text Solution

|

- 12.5 xx 10^(18) इलेक्ट्रॉनों के आवेश की गणना कीजिए ।

Text Solution

|

- दिए गये विघुत परिपथ में तथा के मध्य विभवान्तर की गणना कीजिए ।

Text Solution

|