Similar Questions

Explore conceptually related problems

Recommended Questions

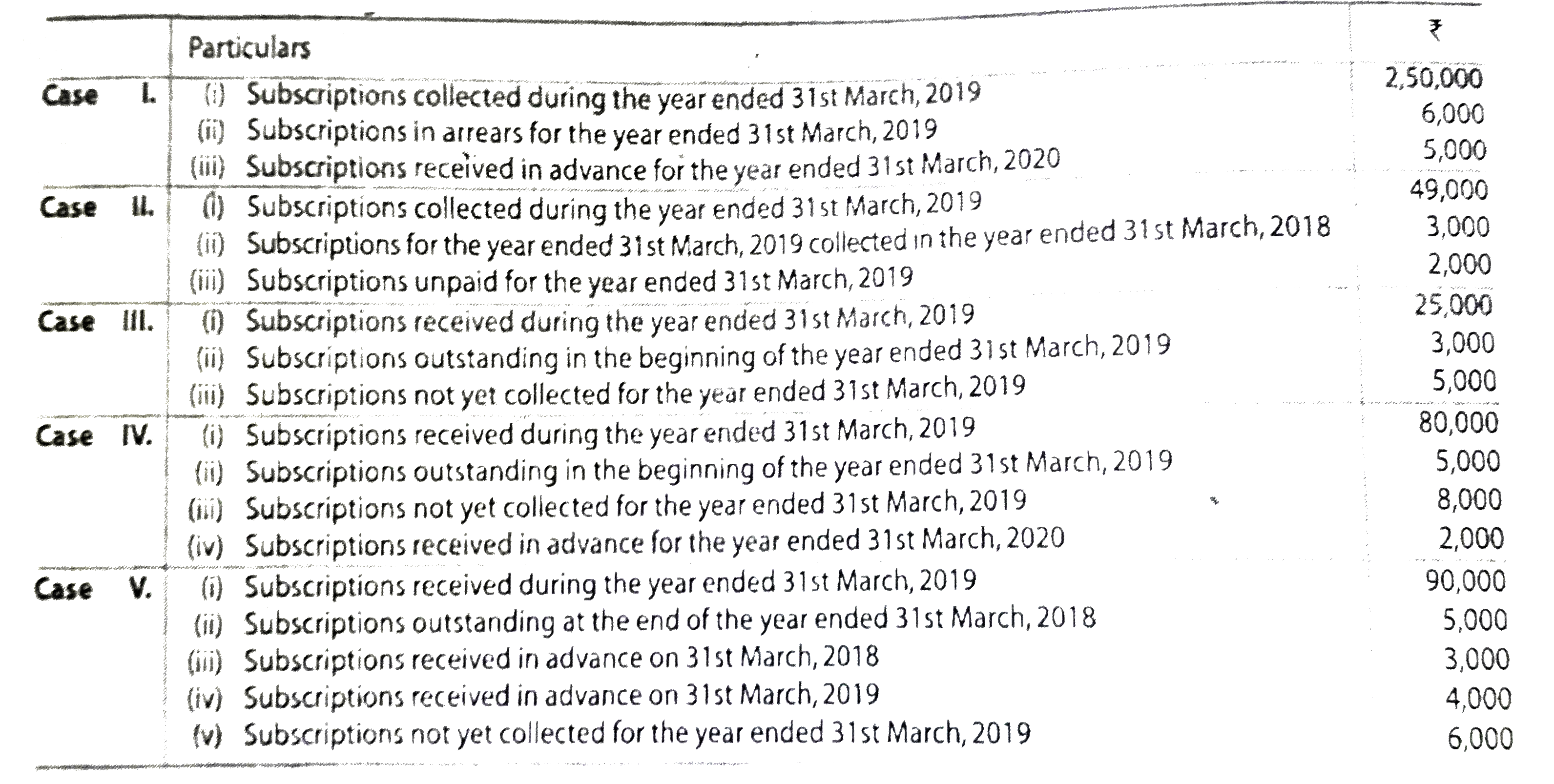

- Calculate amount of subscription which will be treated as income for ...

Text Solution

|

- रेडॉन की खोज किसने की थी ? इसका किस रोग के उपचार किया जाता है ?

Text Solution

|

- चुम्बकीय द्विध्रुव आघूर्ण सदिश राशि है या अदिश राशि? इसका मात्रक लिखि...

Text Solution

|

- किसी L -C -R श्रेणी परिपथ के लिए अनुनाद की स्थिति में धारा तथा...

Text Solution

|

- A और B की आय में 9:7 का अनुपात और उनके खच्चों का अनुपात 4:3 है। यदि इन...

Text Solution

|

- k के किस मान के लिए दो युगपत समीकरणो x + y = 2 और x - by = 1 का क...

Text Solution

|

- k के किस मान के लिये , निम्नलिखित समीकरण निकाय समपाती रेखाओ को प्...

Text Solution

|

- निम्नलिखित रिक्तियों में कौन-सी रिक्ति सबसे बड़ी होगी ?

Text Solution

|

- एक आयनिक क्रिस्टल A^(+) B^(-) के लिए उपसहसंयोजी संख्या 6 है । त्रिज्या...

Text Solution

|