Similar Questions

Explore conceptually related problems

Recommended Questions

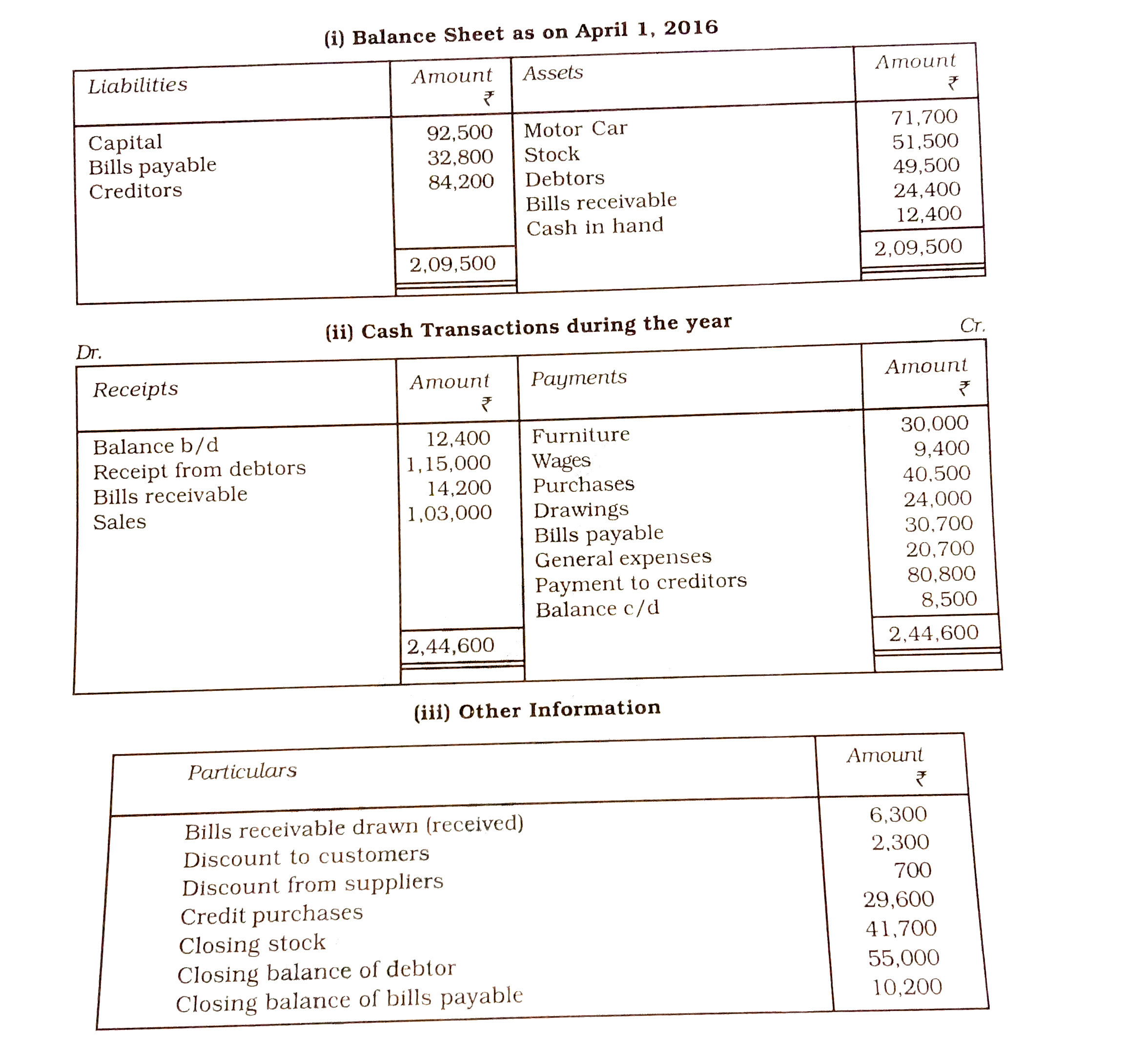

- Mr. Bahadur does not know how to keep books of account. From his vario...

Text Solution

|

- निम्नलिखित में से किसकी अभिक्रिया से फॉस्फोरस से फोस्फीन बनायी जाती है...

Text Solution

|

- एक धारामापी में 30 विभाजन हैं उसकी धारा संवेदिता 20 mu A प्रति विभाजन...

Text Solution

|

- एक राजमार्ग पर दो बिन्दु A और B एक दूसरे से 90 किमी की दूरी पर है। एक ...

Text Solution

|

- एक दूध-वाला 15 लीटर दूध में कुछ ₹ 12 प्रति लीटर तथा कुछ ₹ 14 प्रति लीट...

Text Solution

|

- वर्णिक 600 किमी घर तक की दूरी कुछ रेलगाड़ी और कुछ कार से तय करता है। य...

Text Solution

|

- समस्याओ में रेखिक समीकरणों के युग्म बनाइए और उनके हल (यदि उनका ...

Text Solution

|

- k के किस मान के लिये , निम्नलिखित समीकरण निकाय समपाती रेखाओ को प्...

Text Solution

|

- 25% और 40% के अम्लों को मिलाकर 30 % सान्द्रण का 60 लीटर अम्ल त...

Text Solution

|