Similar Questions

Explore conceptually related problems

Recommended Questions

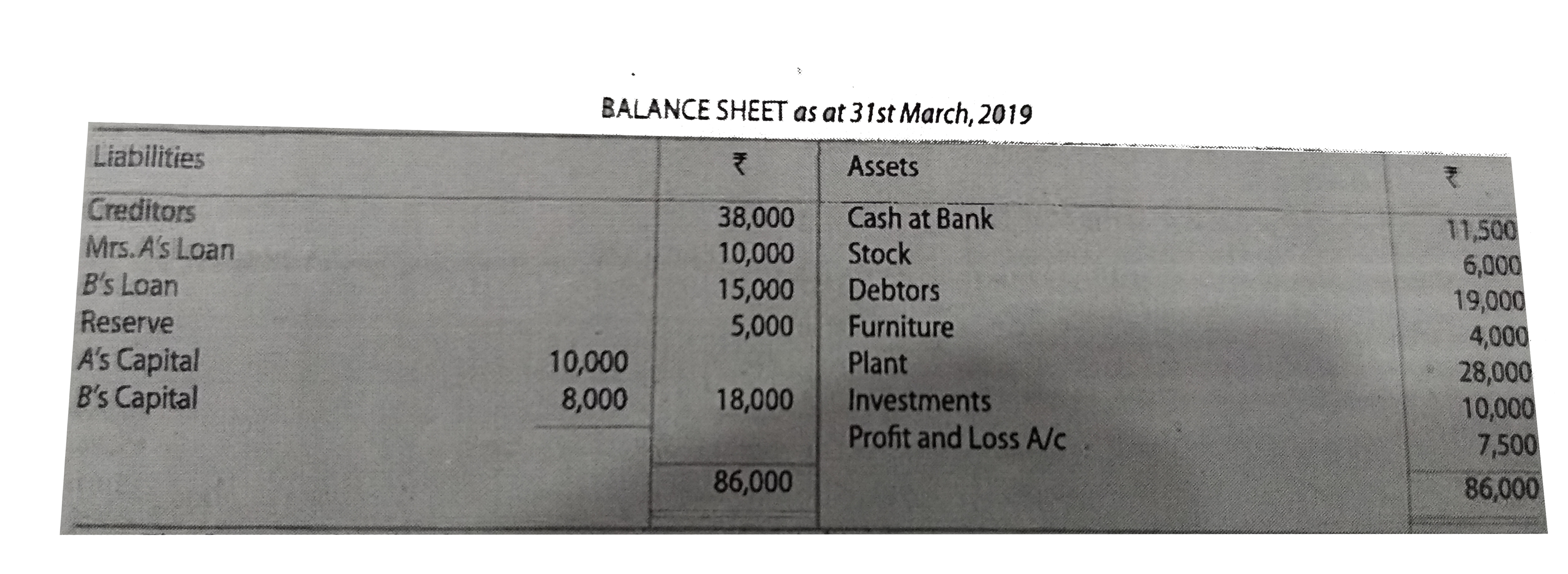

- A and B are partners in a firm sharing profits and losses in the ratio...

Text Solution

|

- Aoverset(HNO(2))toC(2)H(5)OHoverset([O])toB में A तथा B को पहचान-कर उन...

Text Solution

|

- निम्नलिखित अभिक्रियाओं में योगिक [A] तथा [B] को पहचानिए तथा सम्बंधित...

Text Solution

|

- प्रदत्त चित्र में दो लम्बे समान्तर धारावाही चालकों में 1 ऐम्पियर तथा ...

Text Solution

|

- एक राजमार्ग पर दो बिन्दु A और B एक दूसरे से 90 किमी की दूरी पर है। एक ...

Text Solution

|

- एक व्यक्ति ₹ 1000 का नोट लेकर बैंक जाता है। वह कैशियर से बदले में केवल...

Text Solution

|

- 40 बच्चों की एक कक्षा में लड़कियों और लड़कों का अनुपात 2 : 3 हैं। 5 नव...

Text Solution

|

- a और b के लिये हल कौजिए : 2^(a) + 3^(b) = 17 और 2^(a+2) - 3^(b+1) =...

Text Solution

|

- समस्याओ में रैखिक समीकरणो के युग्म बनाइए और अनके हल ( यदि उनक...

Text Solution

|