Similar Questions

Explore conceptually related problems

Recommended Questions

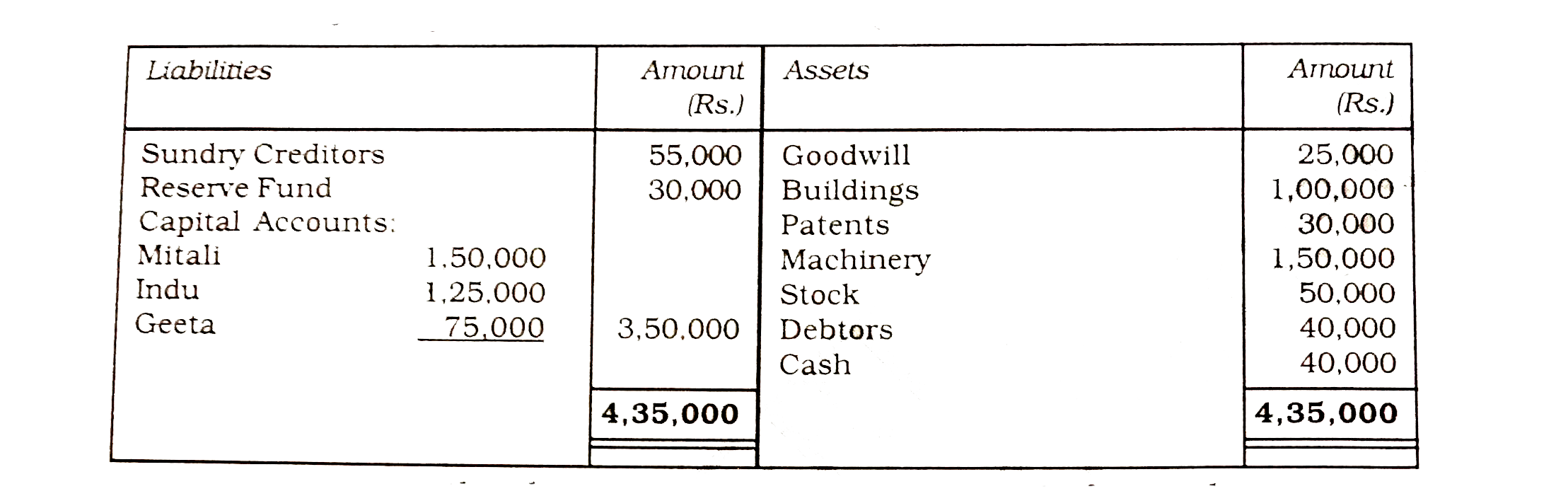

- Mitali, Indu and Geeta are partners sharing profits and losses in the ...

Text Solution

|

- जीवन की उत्पत्ति के समय स्वतंत्र अवस्था में नहीं पायी जाती थी-

Text Solution

|

- किसी स्थान पर पृथ्वी के चुम्बकीय क्षेत्र के क्षैतिज तथा ऊर्ध्वाधर घटक ...

Text Solution

|

- किसी स्थान पर पृथ्वी के चुम्बकीय क्षेत्र के क्षैतिज तथा ऊर्ध्वाधर घटक ...

Text Solution

|

- समस्याओ में रैखिक समीकरणो के युग्म बनाइए और अनके हल ( यदि उनक...

Text Solution

|

- Na तथा Mg क्रमश: bcc तथा fcc के रूप में क्रिस्ट्लित होते हैं तब Na तथा...

Text Solution

|

- एक आयनिक यौगिक की इकाई सेल में A आयन घन के शीर्षो पर हैं तथा B आयन घन ...

Text Solution

|

- प्रयोग के आधार पर एक धातु ऑक्साइड का सूत्र M(0.98)O पाया गया । यदि धात...

Text Solution

|

- NH(4)OH की 0.1,0.01 तथा 0.001M सांद्रताओं पर मोलर चालकताएँ क्रमशः 3.6,...

Text Solution

|