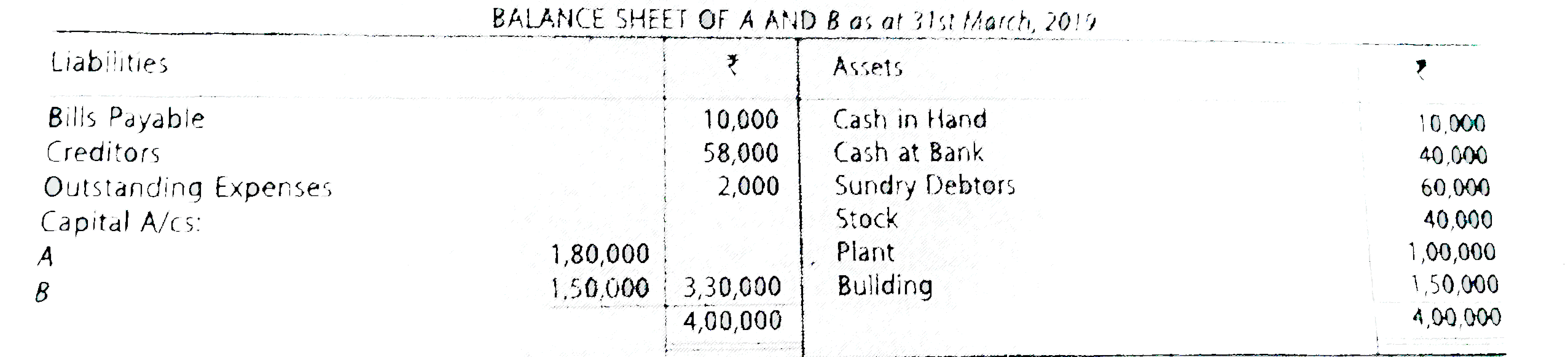

Given below is the Balance Sheet of A and B, who are carrying partnership business on 31st March, 2019. A and B share profit and losses in the ratio of 2 : 1.

C is admitted as a partner on 1st April, 2019 on the following terms:

(a) C will bring RS.1,00,000 as his capital and RS.60,000 as his share of goodwill for 1/4th share in the profits.

(b) Plant is to be appreciated to RS.1,20,000 and the value of building is to appreciated by 10%.

(c) Stock is found overvalued by RS.4,000.

(d) A provision for doubtful debts is to be created at 5% of sundry debtors.

(e) Creditors were unrecorded to the extent of RS.1,000.

Pass the necessary Journal entries, prepare the Revaluation Account and Partners' Capital Accounts and show the Balance Sheet after the admission of C.

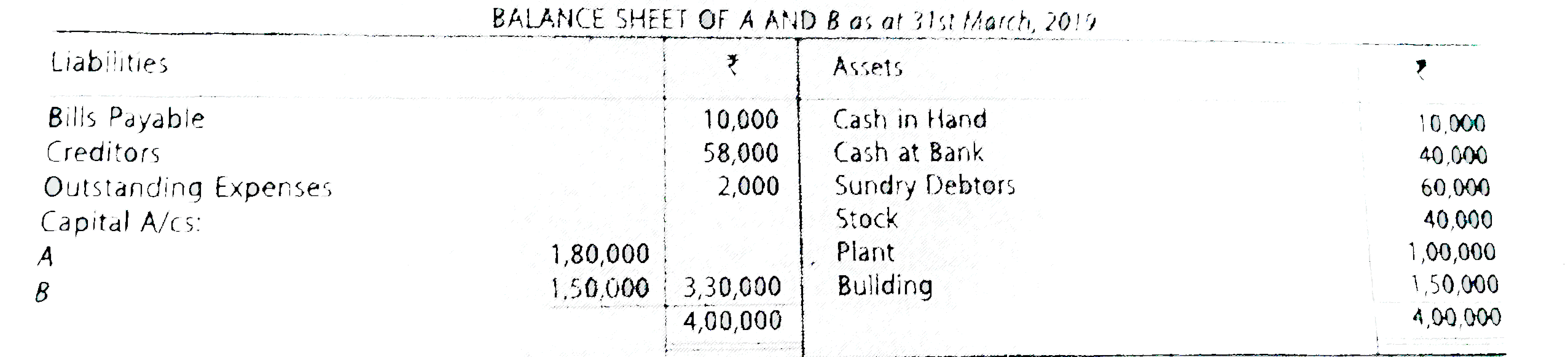

Given below is the Balance Sheet of A and B, who are carrying partnership business on 31st March, 2019. A and B share profit and losses in the ratio of 2 : 1.

C is admitted as a partner on 1st April, 2019 on the following terms:

(a) C will bring RS.1,00,000 as his capital and RS.60,000 as his share of goodwill for 1/4th share in the profits.

(b) Plant is to be appreciated to RS.1,20,000 and the value of building is to appreciated by 10%.

(c) Stock is found overvalued by RS.4,000.

(d) A provision for doubtful debts is to be created at 5% of sundry debtors.

(e) Creditors were unrecorded to the extent of RS.1,000.

Pass the necessary Journal entries, prepare the Revaluation Account and Partners' Capital Accounts and show the Balance Sheet after the admission of C.

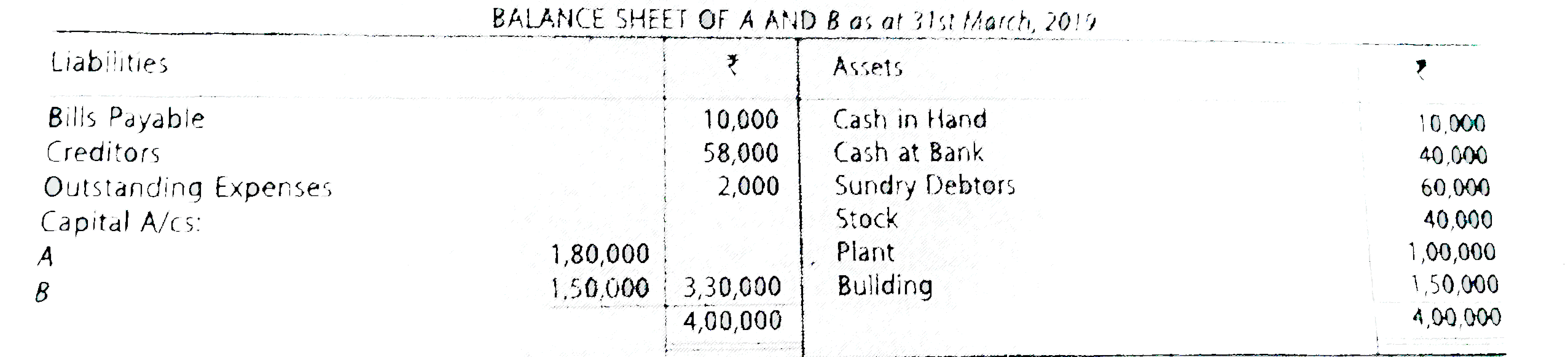

C is admitted as a partner on 1st April, 2019 on the following terms:

(a) C will bring RS.1,00,000 as his capital and RS.60,000 as his share of goodwill for 1/4th share in the profits.

(b) Plant is to be appreciated to RS.1,20,000 and the value of building is to appreciated by 10%.

(c) Stock is found overvalued by RS.4,000.

(d) A provision for doubtful debts is to be created at 5% of sundry debtors.

(e) Creditors were unrecorded to the extent of RS.1,000.

Pass the necessary Journal entries, prepare the Revaluation Account and Partners' Capital Accounts and show the Balance Sheet after the admission of C.

Similar Questions

Explore conceptually related problems

Given below is the Balance Sheet of A and B, who are carrying on partnership business on 31.12.2016. A and B share profits and losses in the ratio of 2:1. C is admitted as a partner on the date of the balance sheet on the following terms: (i) C will bring in Rs. 1,00,000 as his capital and Rs. 60,000 as his share of goodwill for 1/4 share in the profits. (ii) Plant is to be appreciated to Rs. 1,20,000 and the value of buildings is to be appreciated by 10%. (iii) Stock is found over valued by Rs. 4,000. (iv) A provision for bad and doubtful debts is to be created at 5% of debtors. (v) Creditors were unrecorded to the extent of Rs. 1,000. Pass the necessary journal entries, prepare the revaluation account and partners’ capital accounts, and show the Balance Sheet after the admission of C.

Given below is the Balance Sheet of A and B, who are carrying on partnership business as on March 31,2017. A and B share profits in the ratio of 2:1. C is admitted as a partner on the date of the balance sheet on the following terms: 1. C will bring in Rs 1,00,000 as his capital and Rs 60,000 as his share of goodwill for 1/4 share in profits. 2. Plant is to be appreciated to Rs 1,20,000 and the value of buildings is to be appreciated by 10%. 3. Stock is found overvalued by Rs 4,000. 4. A provision for doubtful debts is to be created at 5% of debtors. 5. Creditors were unrecorded to the extend of Rs 1,000. Record revaluation Account, partners’ capital accounts, and the Balance Sheet of the constituted firm after admission of the new partner.

A and B aer partners sharing profits and losses in the ratio of 3 : 2. On 31st March, 2019, their Balance Sheet was as follows: They admit C as a partnre with effect from 1st April, 2019, for 1/3rd share on the following terms: (i) C will bring in RS.5,00,000 as capital and RS.2,00,000 as his share of goodwill but he actually contributed only RS. 1,20,000 towards goodwill. (ii) Building and Machinery ot be depreciated by 5%. (iii) Stock to be revalued at RS. 4,00,000. (iv) There is an unrecorded asset worth RS.1,20,000. (v) One month salary of RS.30,000 is outstanding. Prepare Revaluation Account, Bank Account, Capital Accounts of Partners and the Balance Sheet after the admission of C.

Following was the Balance Sheet of A and B who were sharing profits in the ratio of 2 : 1 as at 31st March, 2019: They admit C into partnership on the following terms: (a) C was bring RS.7,500 as his capital and RS.3,000 as goodwill for 1/4th share in the firm. (b) Values of the Stock and Plant and Machinery were to be reduced by 5%. (c) A Provision for Doubtful Debts was to be created in respect of Sundry Debtors RS.375. (d) Building was to be appreciated by 10%. Pass necessary Journal entries to give effect to the arrangements. Prepare Profit and Loss Adjustment Account (or Revaluation Account), Partners' Capital Accounts and Balance Sheet of the new firm.

Following is the Balance Sheet of A and B, who had been sharing profits in proportion of 3/4th and 1/4th as at 31st March, 2019: They admit C into partnership on 1st April, 2019 on the following terms: (i) C pays RS.14,000 as his capital for 1/5th share in the future profits. (ii) Goodwill is valued at RS.20,000. C is unable to bring cash for his share of goodwill. (iii) Stock and Furniture be reduced by 10% and 5% Provision for Doubtful Debts be created on Debtors. (iv) Land and Building be appreciated by 20%. (v) Capital Accounts of the partreciated be readjusted on the basis of their profito-sharing arrangement and any excess or deficiency is to be transferre to their Currnet Accounts. Prepare Revaluation Account, Partners' Capital Accounts and the Balance Sheet of the new firm.

Balance Sheet of X and Y who share porfits and losses in the ratio of 3: 2 as at 31st March, 2019 was. They admit Z as a partner from 1st April, 2019 for 1/5th share in the profits of the firm. Z brings in RS 50,000 as his capital. Give Journal entry for the adjustment of goodwill.

A and B are partners sharing profits in the ratio of 3 : 2. Their books show goodwill at RS.2,000. C is admitted as parter for 1/4th share of profits nad brings in RS.10,000 as his capital but is not able to bring in cash for his share of goodwill RS.3,000. Draft Journal entries.

A and B are partners sharing profits and losses equally. Their Balance Sheet as at 31st March, 2019 is given below: C is abmitted as a partner for 1/4th share on 1st April, 2019, under the following terms: (i) C is to introduce RS.2,50,000 as capital. (ii) Goodwill is agreed to be nil. (iii) It is found that the creditors included a sum of RS.15,000 which was not to be paid. (iv) A liability of compensation to workmen amounting to RS.20,000. (v) Provision for doubtful debts is to be created @10% on debtors. (vi) It was decided to henceforth follow fluctuating capital method. (vii) Bills accepted worth RS.40,000 issued by creditors were not recorded in the books. (viii) A provides RS.1,00,000 loan to the business' Current Accounts, Partners' Capital Accounts and Balance Sheet of the new firm.

Recommended Questions

- Given below is the Balance Sheet of A and B, who are carrying partners...

Text Solution

|

- निम्न पर संक्षिप्त टिप्पणी लिखिए! (a) प्रायंस ! (b) इंटरफेरॉन (c) वा...

Text Solution

|

- a और b के लिये हल कौजिए : 2^(a) + 3^(b) = 17 और 2^(a+2) - 3^(b+1) =...

Text Solution

|

- अ के एक लाटरी में तीन शेयर हैं जिनमें 3 इनाम हैं तथा 6 रिक्त हैं। ब का...

Text Solution

|

- तीन तत्व A, B और C एक घनीय ठोस जलक में क्रिस्टलीकृत होते हैं । परमाणु ...

Text Solution

|

- प्रयोग के आधार पर एक धातु ऑक्साइड का सूत्र M(0.98)O पाया गया । यदि धात...

Text Solution

|

- समान चालकता सेल में लिए गए दो विलयनों A तथा B के प्रतिरोध क्रमशः 50 ओम...

Text Solution

|

- एक अभिक्रिया इस प्रकार से है - 2Ag^(+)+Cd to2Ag+Cd^(2+) अभिक्रिया ...

Text Solution

|

- नीचे कुछ अभिक्रियाएँ दी गयी है- (a) ACl(2)+BtoBCl(2)+A (b) B+DCl t...

Text Solution

|