Similar Questions

Explore conceptually related problems

Recommended Questions

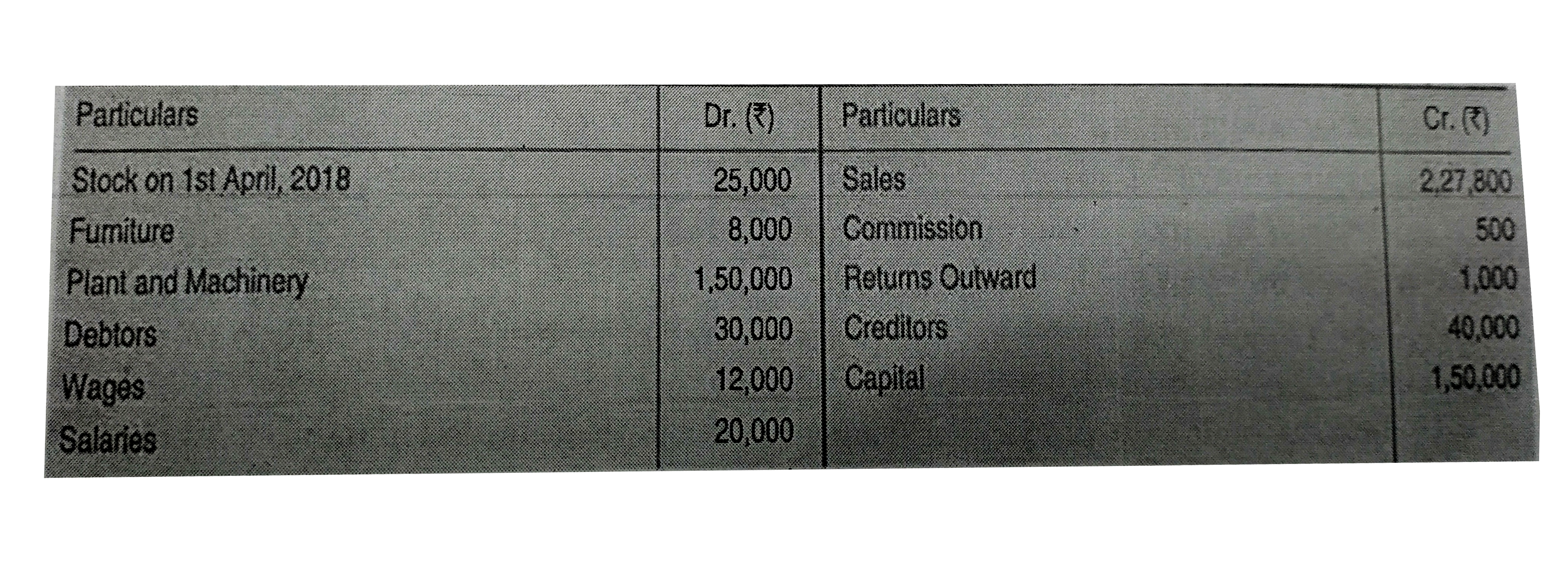

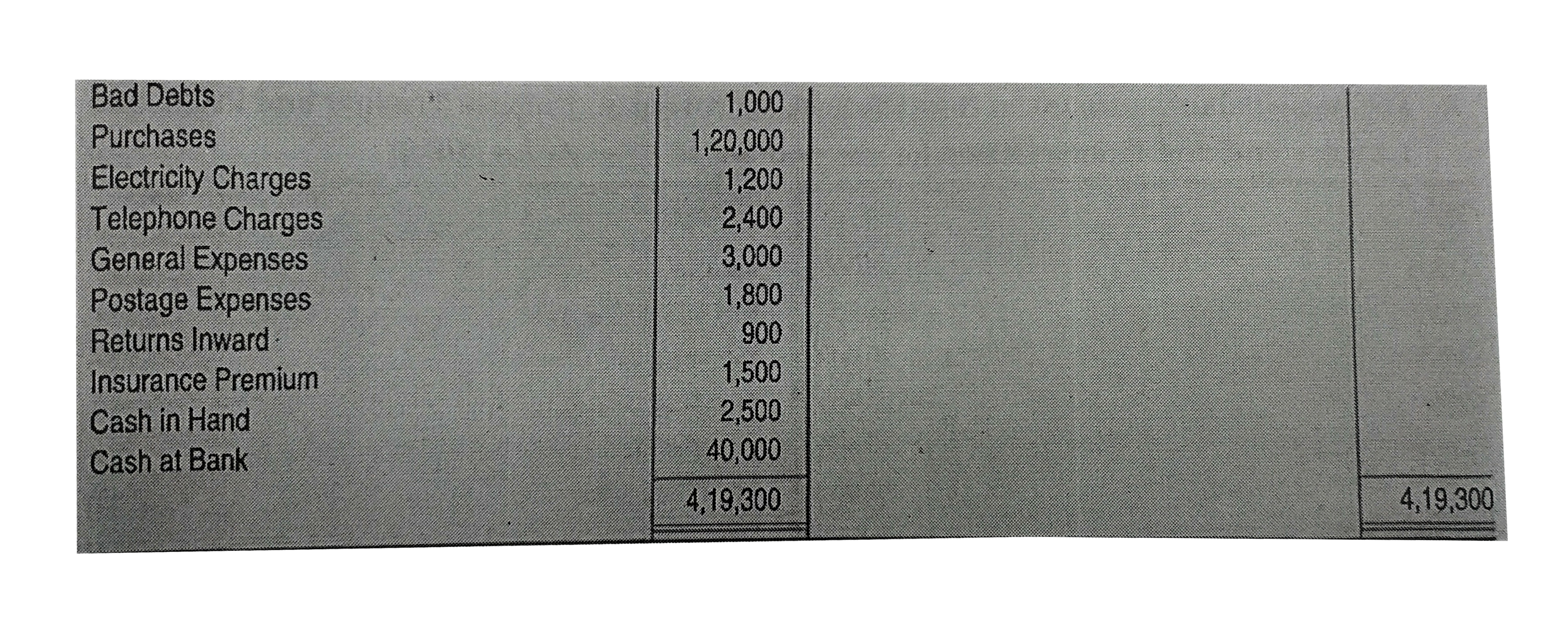

- Trial balance of a business as at 31st March, 2019 is given below: ...

Text Solution

|

- दिए गये विघुत परिपथ की सहायता से ज्ञात कीजिए - (i) परिपथ में धारा , ...

Text Solution

|

- दिये गये चित्र में एक LCR परिपथ दिखाया गया है एक प्रत्यावर्ती ...

Text Solution

|

- एक रेखिक समीकरण दी गई है । दो चरो में एक ऐसी और रेखिक समीकरण लिख...

Text Solution

|

- एक व्यापारी 4 थैले चावल और 10 थैले गेहूँ 3600 में खरीदता है । वह...

Text Solution

|

- LiCl की घनीय एकक कोष्ठिका (NaCl सदृश) की कोर का मान 5.14 Å है । ऋणायन-...

Text Solution

|

- एक यौगिक में तत्व A तथा B घनीय संरचना में क्रिस्टलीकृत होते हैं । परमा...

Text Solution

|

- एक आयनिक यौगिक की इकाई सेल में A आयन घन के शीर्षो पर हैं तथा B आयन घन ...

Text Solution

|

- एक यौगिक A तथा B तत्वों से मिलकर बना है । जब A परमाणु कोने पर तथा B पर...

Text Solution

|