Text Solution

Verified by Experts

Topper's Solved these Questions

PROJECT WORK

ARIHANT PUBLICATION|Exercise Sample paper-2 Section : A|20 VideosPROJECT WORK

ARIHANT PUBLICATION|Exercise Sample paper-2 Section : B|6 VideosPROJECT WORK

ARIHANT PUBLICATION|Exercise SAMPLE(QUESTION PAPER-1): Section-D|5 VideosPRINCIPLES OF MANAGEMENT

ARIHANT PUBLICATION|Exercise CBSE EXAMINATIONS ARCHIVE ( LONG ANSWER)|11 VideosSTAFFING

ARIHANT PUBLICATION|Exercise CBSE Examinations Archive (Long Answer Type Questions)|11 Videos

ARIHANT PUBLICATION-PROJECT WORK -SAMPLE(QUESTION PAPER-1): Section-E

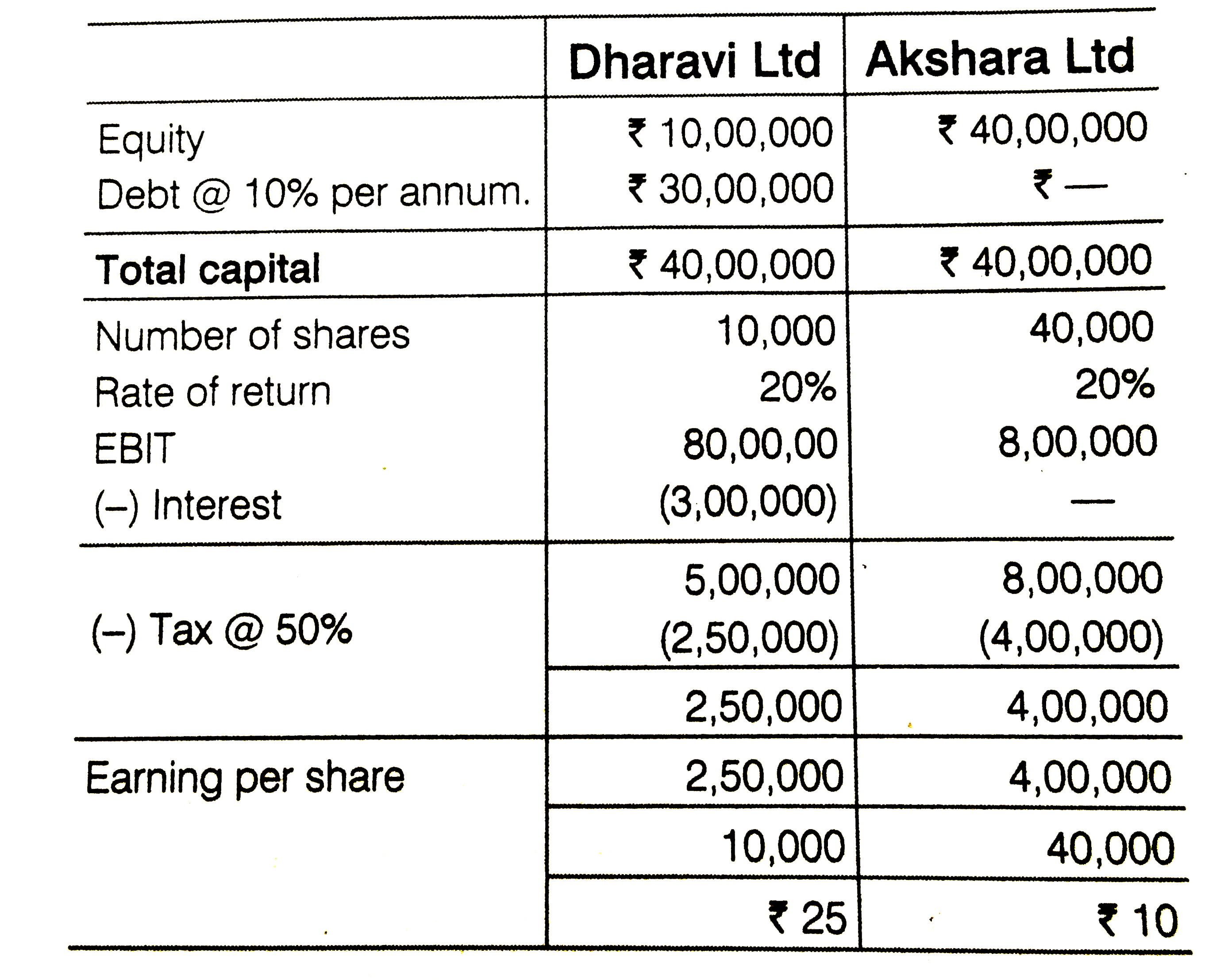

- There are two compaines B and D. Total contribution of capital is ₹40 ...

Text Solution

|

- Your are the finance maanger of a company your board of directors have...

Text Solution

|

- It is through motivation that managers can inspire their subordinates ...

Text Solution

|

- There are some barriers in communication which are concerned with enco...

Text Solution

|

- ABC is a leading publication company of the country. The company's obj...

Text Solution

|