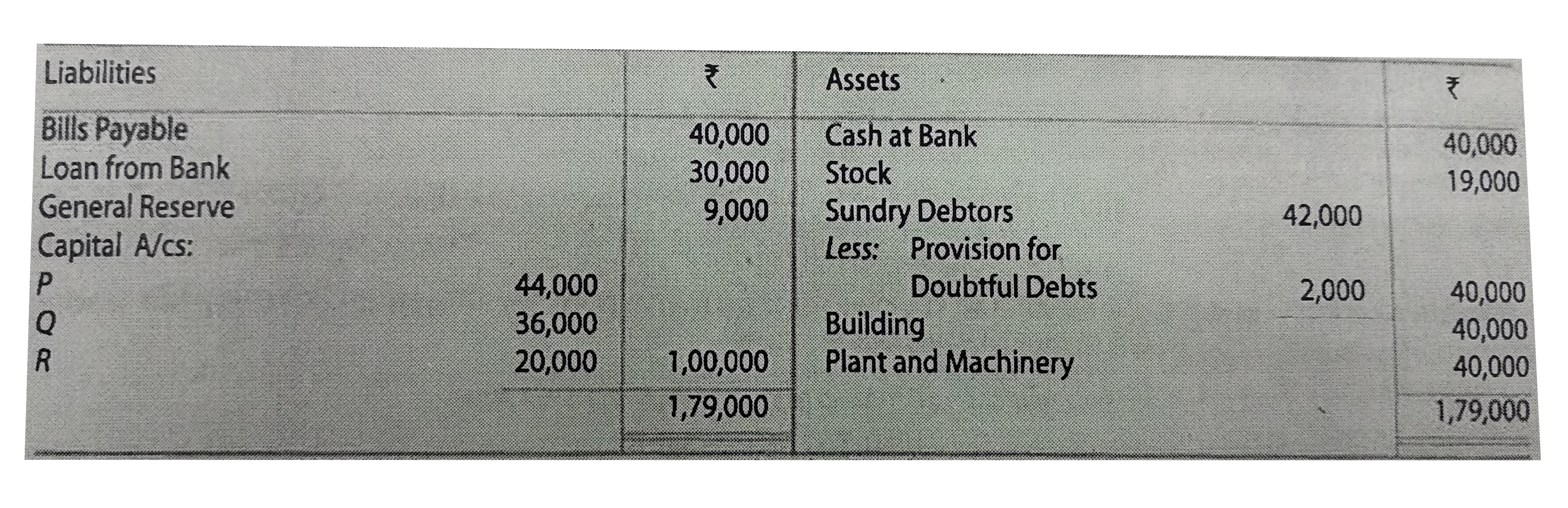

Balance Sheet of P , Q and R as at 31st March , 2019 , who were sharing profits in the ratio of `5 : 3 : 1` , was :

The partners dissolved the business . Assets realised - Stock ₹ 23, 400 , Debtors 50% , Fixed Assets 10% less than their book value . Bills Payable were settled for ₹ 32, 000 . There was an Outstanding Bill of Electricity ₹ 800 which was paid off . Realisation expenses ₹ 1,250 were also paid.

Prepare Realisation Account, Partner's Capital Accounts and Bank Account .

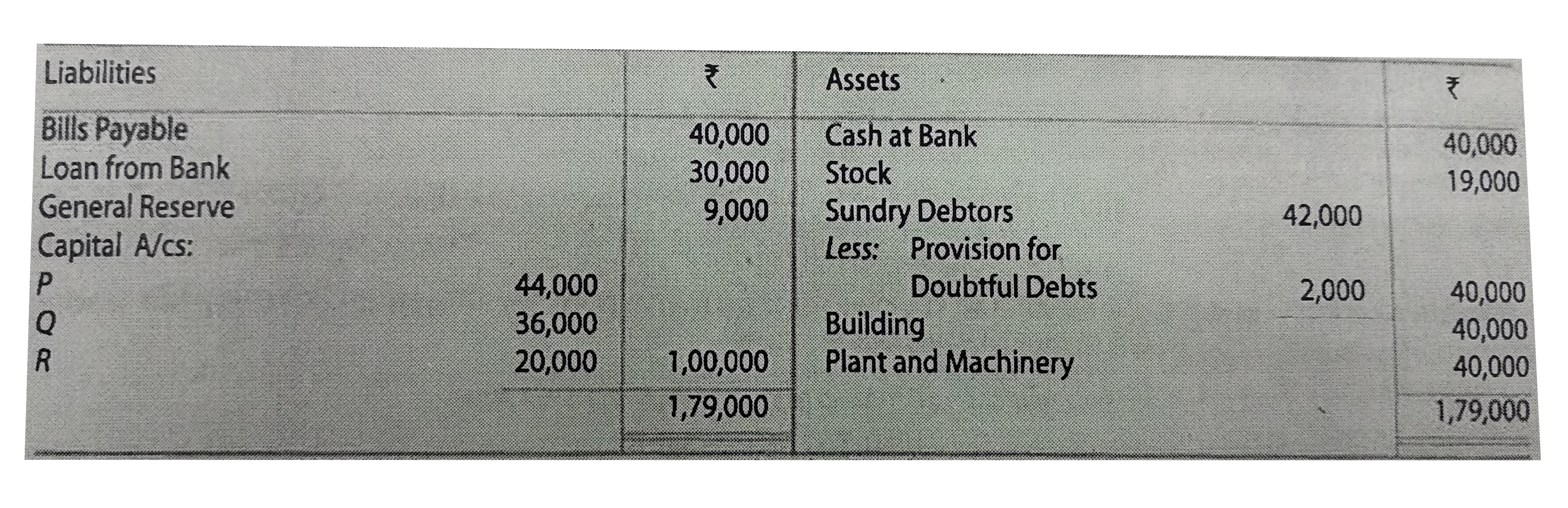

Balance Sheet of P , Q and R as at 31st March , 2019 , who were sharing profits in the ratio of `5 : 3 : 1` , was :

The partners dissolved the business . Assets realised - Stock ₹ 23, 400 , Debtors 50% , Fixed Assets 10% less than their book value . Bills Payable were settled for ₹ 32, 000 . There was an Outstanding Bill of Electricity ₹ 800 which was paid off . Realisation expenses ₹ 1,250 were also paid.

Prepare Realisation Account, Partner's Capital Accounts and Bank Account .

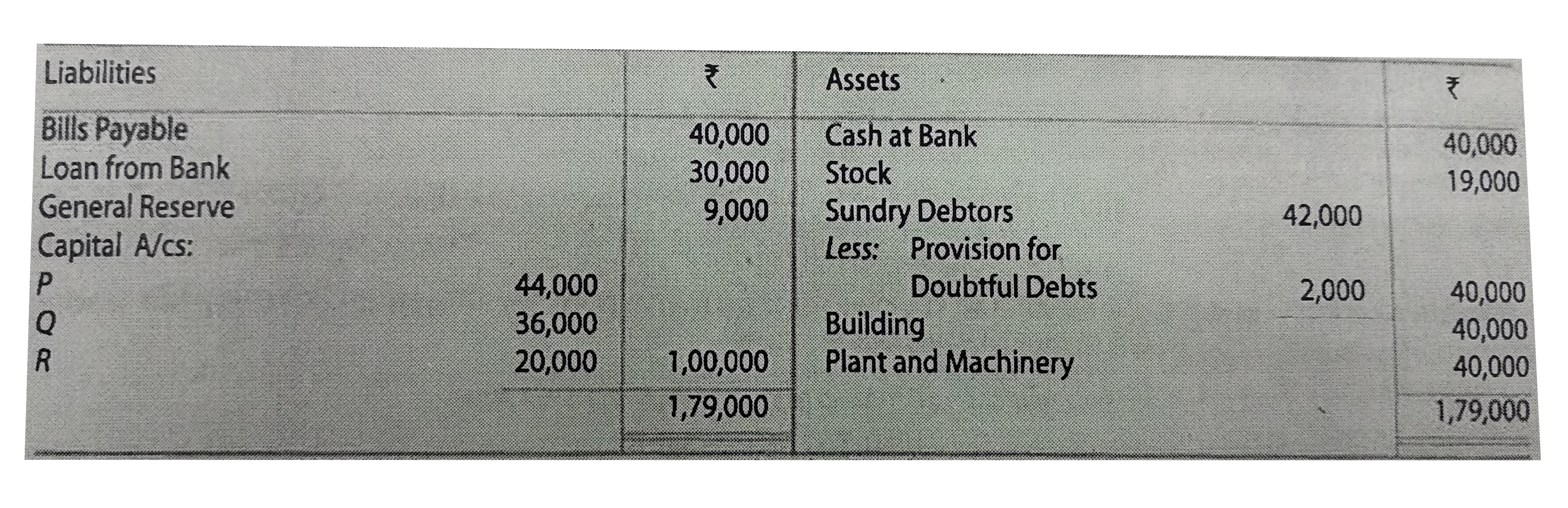

The partners dissolved the business . Assets realised - Stock ₹ 23, 400 , Debtors 50% , Fixed Assets 10% less than their book value . Bills Payable were settled for ₹ 32, 000 . There was an Outstanding Bill of Electricity ₹ 800 which was paid off . Realisation expenses ₹ 1,250 were also paid.

Prepare Realisation Account, Partner's Capital Accounts and Bank Account .

Similar Questions

Explore conceptually related problems

(Goodwill Appears in Balance Sheet) . A , B and C are partners in a firm sharing profits in the ratio of 2 : 1 : 1 . Their Balance Sheet as at 31st March , 2019 was as follows : The firm was dissolved on that date . Assets realised : Goodwill ₹ 20 , 000 , Land and Building ₹ 1, 00 , 000 , Plant and Machinery ₹ 50,000 , Car ₹ 28,000 and Debtors 50% of the book value . Realisation Expenses were ₹ 2, 000 . Prepare Realisation Account , Capital Accounts of Partners and Cash Account to close the books of the firm .

A and B are partners in a firm sharing profits and losses in the ratio of 3: 2 . On 31st March , 2019, their Balance Sheet was as follows : The firm was dissolved on 31st March , 2019 , and both the partners agreed to the following : (a) A took investments at an agreed value of ₹ 8,000 . He also agreed to settle Mrs. A's Loan. (b) Other assets realised as : Stock - ₹ 5,000 , Debtors - ₹ 18,500 , Furniture - ₹ 4, 500 , Plant - ₹ 25,000. (c) Expenses of realisation came to ₹ 1,600 . (d) Creditors agreed to accept ₹ 37,000 in full settlement of their claims . Prepare Realisation Account , Partner's Capital Accounts and Bank Account .

Shilpa , Meena and Nanda decided to dissolve their partnership on 31st March , 2019 . Their profit-sharing ratio was 3 : 2 : 1 and their Balance Sheet was as under : It is agreed as follows : The stock of value of ₹ 41, 660 are taken over by Shilpa for ₹ 35,000 and she agreed to discharge bank loan . The remaining stock was sold at ₹ 14,000 and debtors amounting to ₹ 10,000 realised ₹ 8,000 . Land is sold for ₹ 1,10,000 . The remaining debtors realised 50% at their book value . Cost of realisation amounted to ₹ 1,200 . There was a typewriter not recorded in the books worth of ₹ 6,000 which were taken over by one of the Creditors at this value . Prepare Realisation Account , Partner's Capital Accounts and Cash Account to Close the books of the firm .

A and B are partners in a firm sharing profits and losses in the ratio of 2 : 1 . On 31st March ,2019 , their Balance Sheet was : On that date , the partners decide to dissolve the firm . A took over Investments at an agreed valuation of ₹ 35,000 . Other assets were realised as follows : Sundry Debtors : Full amount . The firm could realise Stock at 15% less and Furniture at 20% less than the book value . Building was sold at ₹ 1,00,000 . Compensation to employees paid by the firm amounted to ₹ 10,000 . This liability was not provided for in the above Balance Sheet . You are required to close the books of the firm by preparing Realisation Account , Partner's Capital Accounts and Bank Account .

A and B were partners from 1st April , 2016 with capitals of ₹ 60,000 and ₹ 40,000 respectively . They shared profits in the ratio of 3 : 2 . They carried on business for two years . In the first year ended 31st March 2017 , they earned a profit of ₹ 50,000 but in the second year ended 31st March , 2018 , a loss of ₹ 20 , 000 was incurred . As the business was no longer profitable , they dissolved the firm on 31st March , 2018 . Creditors on that date were ₹ 20,000 . The partners withdrew for personal use ₹ 8,000 per partner per year . The assets realised ₹ 1,00,000 . The expenses of realisation were ₹ 3,000 . Prepare Realisation Account , Partner's Capital Accounts and Cash Account.

Parth and Shivika were partners in a firm sharing profits in the ratio of 3 : 2 . The Balance Sheet of the firm on 31st March , 2014 was as follows : On the above date , the firm was dissolved . The assets were realised and the liabilities were paid off as follows : (i) 50% of the furniture was taken over by Parth at 20% less than book value . The remaining furniture was sold for ₹ 1,05 , 000. (ii) Debtors realised ₹ 26,000 . (iii) Stock was taken over by Shivika for ₹ 29 , 000 . (iv) Shivika's sister's loan was paid off along with interest of ₹ 2,000 . (v) Expenses on realisation amounted to ₹ 5,000 . Prepare Realisation Account , Partner's Capital Accounts and Bank Account .

P , Q and R commenced business on 1st April , 2018 with capitals of : P - ₹ 2,00,000 , Q - ₹ 2,00,000 and R - ₹ 1,00,000 . Profits are shared in the ratio of 4 : 3 : 3 . Capital carried interest @ 5% p.a. During the year 2018-19 , the firm suffered a loss of ₹ 1,50,000 before allowing interest on capital. Drawings of each partner during the year were ₹ 20,000. On 31st March , 2019, the partners agreed to dissolve the firm as it was no longer profitable . The creditors on that date were ₹ 40,000 . The assets realised a net value of ₹ 3,20,000 and the expenses of realisation were ₹ 7,000 . Prepare Realisation Account , Partner's Capital Accounts and Cash Account along with necessary working to close the books of the firm .

Rita and Sobha are partners in a firm ,Fancy Garments Exports profits and losses equally . On 1st April , 2019 , the Balance Sheet of the firm was : The firm was dissolved on the date given above. The following transactions took place : (a) Rita took 25% of the Stock at a discount of 20% in settlement of her loan. (b) Book Debts realised ₹ 54,000 , balance of the Stock was sold at a profit of 30% on cost . (c) Sundry Creditors were paid out at a discount of 10% . Bills Payable were paid in full. (d) Plant and Machinery realised ₹ 75,000 . Land and Building ₹ 1,20,000. (e) Rita took the goodwill of the firm at a value of ₹ 30,000 . (f) An unrecorded asset of ₹ 6,900 was handed over to an unrecorded liability of ₹ 6,000 in full settlement . (g) Realisation expenses were ₹ 5,250 . Show Realisation Account , Partner's Capital Accounts and Bank Account in the books of the firm .

A , B and C were partners sharing profits in the ratio of 5 : 3 : 2 . On 31st March , 2019 , A's Capital and B's Capital were ₹ 30,000 and ₹ 20,000 respectively but C owed ₹ 5,000 to the firm . The liabilities were ₹ 20,000 . The assets of the firm realised ₹ 50,000 . Prepare Realisation Account , Partner's Capital Accounts and Bank Account.

The partnership between A and B was dissolved on 31st March , 2019 . On that date the respective credits to the capitals were A - ₹ 1,70,000 and B - ₹ 30,000 , ₹ 20,000 were owed by B to the firm , ₹ 1,00,000 were owed by the firm to A and ₹ 2,00,000 were due to the Trade Creditors . Profits and losses were shared in the proportions of 2/3 to A , 1/3 to B . The assets represented by the above stated net liabilities realised ₹ 4,50,000 exclusive of ₹ 20,000 owed by B . The liabilities were settled at book figure . Prepare Realisation Account , Partner's Capital Accounts and Cash Account showing the distribution to the partners .

Recommended Questions

- Balance Sheet of P , Q and R as at 31st March , 2019 , who were sharin...

Text Solution

|

- समान गतिज ऊर्जा वाले दो आवेशित कण समरूप चुम्बकीय क्षेत्र के लंबवत प्रव...

Text Solution

|

- एक छात्रावास के मासिक व्यय का एक भाग नियत है तथा शेष इस पर निर्भर करता...

Text Solution

|

- एक परीक्षा में पास होने वाले तथा पेल होने वालो का अनुपात 3 : 1 था। यदि...

Text Solution

|

- समस्याओ में रेखिक समीकरणों के युग्म बनाइए और उनके हल (यदि उनका ...

Text Solution

|

- समस्याओ में रैखिक समीकरणो के युग्म बनाइए और अनके हल ( यदि उनक...

Text Solution

|

- एक मित्र दूसरे से कहता है कि 'यदि मुझे एक सौ दे दो, तो मैं आपसे दो गुन...

Text Solution

|

- एक के विद्यार्थियों क्रो पंकितियों में खड़ा होना है। यदि पक्ति में...

Text Solution

|

- x और y के लिये हल कीजिए: px + qy = 1 और qx + py = ((p+q)^(2))/(p^(2)...

Text Solution

|